- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Real Estate Investing for a Novice

Posted on 5/24/23 at 12:26 pm

Posted on 5/24/23 at 12:26 pm

Which direction should I go?I do not want to fix & flip. I am looking at something more passive.

Posted on 5/24/23 at 12:30 pm to Scientific73

Traditional buy and hold

Posted on 5/24/23 at 12:46 pm to Scientific73

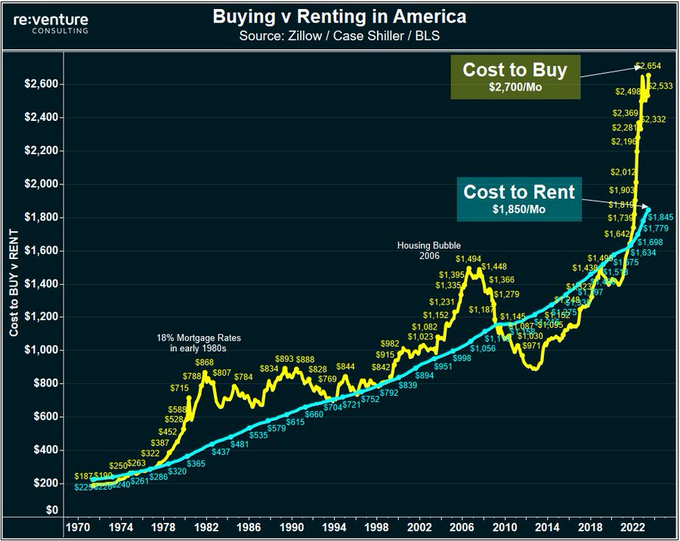

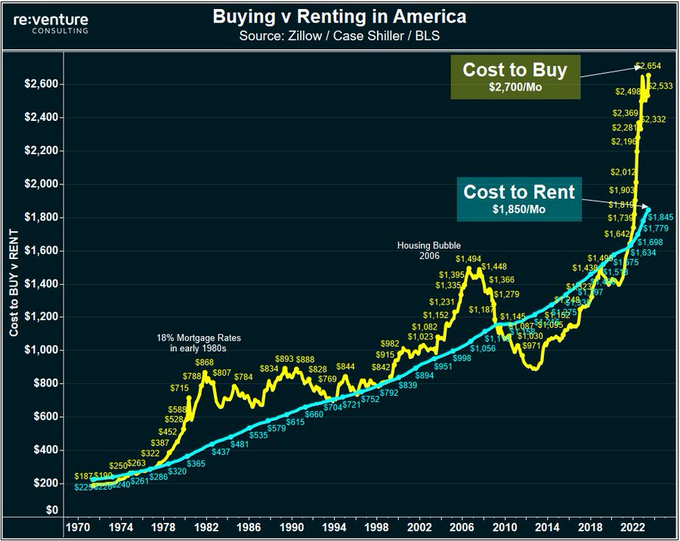

It's cheaper to rent right now than buy. I would not be entering this market as an investor at the moment.

Wait for the numbers to make more sense.

Wait for the numbers to make more sense.

Posted on 5/24/23 at 12:47 pm to Scientific73

quote:Here's the only advice that matters for a novice: PRICE MATTERS

Real Estate Investing for a Novice

Which direction should I go?I do not want to fix & flip. I am looking at something more passive.

Posted on 5/24/23 at 12:53 pm to I Love Bama

@ I love Bama, got a question for you. What is your email?

Posted on 5/25/23 at 7:26 pm to Scientific73

Wouldn’t that increase the demand for rental properties?

Asking bc I agree and I’m intrigued.

Asking bc I agree and I’m intrigued.

Posted on 5/25/23 at 7:44 pm to good_2_geaux

25 year banker - I would not enter the market right now either. I’d stockpile some cash and wait until 3rd or 4th quarter

Posted on 5/26/23 at 2:28 pm to Scientific73

Cap rates are still way too low to enter the CRE or residential rental markets.

Posted on 5/26/23 at 2:31 pm to Scientific73

quote:

I am looking at something more passive.

Real estate isn't passive.

Posted on 5/26/23 at 2:55 pm to Im4datigers

quote:You'd wait a whole 6 weeks, huh?

. I’d stockpile some cash and wait until 3rd or 4th quarter

Posted on 5/26/23 at 4:27 pm to Big Scrub TX

quote:

You'd wait a whole 6 weeks, huh?

shite these days 6 weeks is like 6 years as fluid as everything is.

Meant to say END of 3rd quarter. Jackass hahahaha

Posted on 5/26/23 at 4:44 pm to Im4datigers

quote:Just fricking with you in good fun, although in all seriousness, still seems a little aggressive.

shite these days 6 weeks is like 6 years as fluid as everything is.

Meant to say END of 3rd quarter. Jackass hahahaha

I think we should all learn to fight the "do something" bias after so many years of there being nothing to do. Won't be smart to jump at the first batch of things that look pretty good. I think the real potential distress is a ways away (and might not actually be worth doing when it gets here).

Posted on 5/26/23 at 7:05 pm to good_2_geaux

quote:

Wouldn’t that increase the demand for rental properties? Asking bc I agree and I’m intrigued.

I believe that the reasoning is that real property is likely slightly over valued and the interest rates are high. If there is any kind of housing crash that is a situation where you can really lose your arse because you lose all equity and still have a high rate note.

If you have the cash to buy outright then it doesn’t really make sense either because there is better things you can do with that money that would yield better ROI.

Posted on 5/26/23 at 8:05 pm to Scientific73

you should try to buy low and sell high imho

Posted on 5/26/23 at 10:27 pm to BigBinBR

(no message)

This post was edited on 7/16/23 at 12:27 pm

Posted on 5/27/23 at 7:41 am to lsuconnman

The problem right is is cash flow. Unless you can put down 30% percent, there’s just no way to cash flows deal right now with rates way up and rents stabilizing. Tack on increasing insurance for the souther states and it’s hard to find the diamond in the rough. The returns just aren’t there especially on most 1-4 families.

Posted on 5/27/23 at 10:46 am to I Love Bama

quote:

I would not be entering this market as an investor at the moment.

Wait for the numbers to make more sense.

Yep. For sale signs are just starting to stay out longer. Give it some time, and you’ll start seeing deals. Right now, folks who bought in high are having a hard time grasping the actual value of their properties, and they may not be in a position to lower their price to fair market value anyway. I would be hard pressed to think this is anything but buy high and sell low at the present time.

Posted on 5/27/23 at 11:02 am to Scientific73

Numbers are still pretty wacky. This will calm down over the next year or so, but unless you find a gem you're minimizing gains.

Posted on 5/28/23 at 9:25 am to Billy Blanks

Incorrect. Most is passive. All real estate income is a broad statement and some is active. If one is purely investing and not actively working in the projects, then it is generally passive.

Posted on 5/30/23 at 8:05 am to Im4datigers

Don't think you can make this broad statement without more details and facts. Depends on the OPs situation, the market he lives in, and the type of real estate investment he gets into.

The rental market where I live is so tight that there are still plenty of good opportunities. Tight in the sense that rental occupancy rates are above 95%. True that the rapid interest rate increases have had impact, but actual rent increases have outpaced rate increases where I live. I am slowing down in life and selling rentals instead of adding, but agree with the other poster that basically said too many sit on the sideline for too long over getting in the game. Rentals are normally a fairly long term investment, so lots of details determine success, but OP should stay open minded.

Another route that worked really well for me in real estate, is new residential construction. Buy a lot (preferably in a good neighborhood or area), hire a builder, get construction loan, build and sell the house for a profit, repeat. This is a relatively short process for each project, typically about 9-18 months.

I oversimplified into a few words, but this model works in a lot of environments. Details matter, but this is worth investigating for the OP.

The rental market where I live is so tight that there are still plenty of good opportunities. Tight in the sense that rental occupancy rates are above 95%. True that the rapid interest rate increases have had impact, but actual rent increases have outpaced rate increases where I live. I am slowing down in life and selling rentals instead of adding, but agree with the other poster that basically said too many sit on the sideline for too long over getting in the game. Rentals are normally a fairly long term investment, so lots of details determine success, but OP should stay open minded.

Another route that worked really well for me in real estate, is new residential construction. Buy a lot (preferably in a good neighborhood or area), hire a builder, get construction loan, build and sell the house for a profit, repeat. This is a relatively short process for each project, typically about 9-18 months.

I oversimplified into a few words, but this model works in a lot of environments. Details matter, but this is worth investigating for the OP.

Popular

Back to top

8

8