- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Louisiana Sales Tax - Special Events - Paging Poodlebrain; LSUFanHouston

Posted on 4/10/16 at 9:02 am

Posted on 4/10/16 at 9:02 am

So, I volunteered to help a friends family at a booth at Strawberry festival in Ponchatoula this week. This particular booth is extremely successful and incurs a high volume of transactions over the three day period. A Louisiana Department of Revenue agent, badge and all, made his way around the entire festival presenting those operating a booth with a notice saying the LDR will have a booth and asked the vendors to show up and remit payment for sales tax on Sunday between 10AM - 4PM. I've had little sales tax experience but naturally the person running the booth came to me and asked about it. I told her I had NEVER heard of remitting sales tax a day after the sale had occurred much less advancing sales tax for Sundays sales. Does Poodlebrain or Houston have any experience with this?

I told them to make the revenue agent show them a revised statute stating the timetable for remitting payments in conjunction with a special event. Any advice here? I've sort of struck out with some minor research.

I told them to make the revenue agent show them a revised statute stating the timetable for remitting payments in conjunction with a special event. Any advice here? I've sort of struck out with some minor research.

This post was edited on 4/10/16 at 9:11 am

Posted on 4/10/16 at 9:14 am to Jabstep

OMG.

This has got to be a direct result of all the crap the legislature passed in the special session.

Have you or the person running the booth discussed this with the festival organizers?

In no way would I write anyone from LDR a check today from 10 am to 4 pm. If you owe money, you can pay it next month.

EDIT: What I mean to say is that I believe someone will owe sales tax on these booth sales, as all the various exemptions for festivals have been eliminated. But I think this is something the festival itself should be involved in or at least aware of. I'm guessing there is some sort of contract between the booth and the festival and that contract may stipulate who is responsible for what. It may even be that the booth is not even technically the seller, it may just be selling on behalf of the festival.

All this is meant to say, it's complex, you need to discuss it with the festival (along with all the other vendors) and you definitely do not need to, or should, give LDR anything today.

EDIT 2: Sales tax reports and payments are due to the state the 20th of the following month. There is no special rule for festivals or anything like that. The LDR person may be telling people he'll accept their money now "as a convenience" so you don't have to worry about doing after the fact.

I sure hope this is a rouge who thinks if he can show up Monday morning with some checks that he'll get thanks from his superiors, and not an official LDR decision to go shake down and scare vendors to get money today because the state is in such poor cash flow situation.

This has got to be a direct result of all the crap the legislature passed in the special session.

Have you or the person running the booth discussed this with the festival organizers?

In no way would I write anyone from LDR a check today from 10 am to 4 pm. If you owe money, you can pay it next month.

EDIT: What I mean to say is that I believe someone will owe sales tax on these booth sales, as all the various exemptions for festivals have been eliminated. But I think this is something the festival itself should be involved in or at least aware of. I'm guessing there is some sort of contract between the booth and the festival and that contract may stipulate who is responsible for what. It may even be that the booth is not even technically the seller, it may just be selling on behalf of the festival.

All this is meant to say, it's complex, you need to discuss it with the festival (along with all the other vendors) and you definitely do not need to, or should, give LDR anything today.

EDIT 2: Sales tax reports and payments are due to the state the 20th of the following month. There is no special rule for festivals or anything like that. The LDR person may be telling people he'll accept their money now "as a convenience" so you don't have to worry about doing after the fact.

I sure hope this is a rouge who thinks if he can show up Monday morning with some checks that he'll get thanks from his superiors, and not an official LDR decision to go shake down and scare vendors to get money today because the state is in such poor cash flow situation.

This post was edited on 4/10/16 at 9:32 am

Posted on 4/10/16 at 10:30 am to Jabstep

Typical Louisiana cluster frick. Why would a vendor at a festival who was exempt from sales tax under prior law have a sales tax account with the LDR? Have you applied for a sales tax account since the laws were changed effective April 1, 2016? How would you have any confidence that deposits/payments would be properly credited to a non-existent account?

This is an attempt to grab as much cash as possible as fast as possible by the state. I wonder how much the state collected versus how much it spent since the spending will include overtime pay for the agents who worked weekends.

This is an attempt to grab as much cash as possible as fast as possible by the state. I wonder how much the state collected versus how much it spent since the spending will include overtime pay for the agents who worked weekends.

Posted on 4/10/16 at 11:07 am to Poodlebrain

So both of your instincts say don't pay it and just wait until they're legall required to file sales tax? That is unless the festival has some agreement with the LDR.

That was my initial recommendation.

That was my initial recommendation.

Posted on 4/10/16 at 11:28 am to LSUFanHouston

Great points man. I couldn't find anything about payments being so prompt either. Poodle makes a great point about account numbers. The funniest thing about the notice said they would take cash payments....can you imagine the processing nightmare that would be.

I'm going to tell them to either show us an agreement between the festival and LDR that requires vendor payment on Sunday or a law that says I have to make payment before the festival is over otherwise you will get my sales tax on the normal deadline to file a sales tax return.

I'm going to tell them to either show us an agreement between the festival and LDR that requires vendor payment on Sunday or a law that says I have to make payment before the festival is over otherwise you will get my sales tax on the normal deadline to file a sales tax return.

Posted on 4/10/16 at 11:32 am to Jabstep

quote:

The funniest thing about the notice said they would take cash payments....

Is there any chance that this is a really sophisticated scammer here? Just a thought. I mean, it's totally believable that a scammer would try this. It's also totally believable that LDR is stupid enough to try something like this.

quote:

I'm going to tell them to either show us an agreement between the festival and LDR that requires vendor payment on Sunday or a law that says I have to make payment before the festival is over otherwise you will get my sales tax on the normal deadline to file a sales tax return.

I wouldn't even go that far. what are they going to do, put y'all in jail? I would tell them quite simply that after the festival is over, we will reconcile our taxable sales and if a payment is required we will forward said payment with a sales tax return by the deadline.

Posted on 4/10/16 at 11:37 am to Poodlebrain

Poodle, you mean every nontaxable entity that is now subject to sales tax, didn't jump online at 12:01 am on April 1st and apply for a sales tax account????

I'd laugh my rear off if this costs them more money than whatever they can shake down from the vendors.

In other news, I had a discussion with a guy in our office yesterday about what the projected noncompliance rate is going to be with these new sales tax laws. In other words, how many of these entities, especially the nonprofit ones, are going to actually remit sales tax, since the state has no idea who they are, especially the smaller ones? I imagine it's going to be very high.

I'd laugh my rear off if this costs them more money than whatever they can shake down from the vendors.

In other news, I had a discussion with a guy in our office yesterday about what the projected noncompliance rate is going to be with these new sales tax laws. In other words, how many of these entities, especially the nonprofit ones, are going to actually remit sales tax, since the state has no idea who they are, especially the smaller ones? I imagine it's going to be very high.

Posted on 4/10/16 at 11:37 am to LSUFanHouston

Exactly what I just told her. Thanks for the recommendations.

I thought it could be a scam too but the guy had a badge and it was on LDR letterhead. Plus the fact that they are out in public collecting sales tax makes me think its legit. My mind was blown after reading the letter. Some people have already put the letter on social media if you want to look at it.

I thought it could be a scam too but the guy had a badge and it was on LDR letterhead. Plus the fact that they are out in public collecting sales tax makes me think its legit. My mind was blown after reading the letter. Some people have already put the letter on social media if you want to look at it.

Posted on 4/10/16 at 11:44 am to Jabstep

quote:

So both of your instincts say don't pay it and just wait until they're legall required to file sales tax?

What's going to suck about this is that I can promise you, up until the agent went trolling yesterday, many of these vendors may have had no idea about this new liability that took effect just 10 days ago after a short period. Meaning, they probably did not price their items for this.

So in the end, since they didn't price for it nor collect it as an add-on, it's going to come out of their profits. Of course it's going to hit the smaller vendors the worst.

Posted on 4/10/16 at 11:49 am to LSUFanHouston

quote:

What's going to suck about this is that I can promise you, up until the agent went trolling yesterday, many of these vendors may have had no idea about this new liability that took effect just 10 days ago after a short period. Meaning, they probably did not price their items for this.

This is the biggest thing. They're selling thinking no sales tax. Little do they know their margins just got trimmed by 5%.

Posted on 4/10/16 at 11:50 am to Jabstep

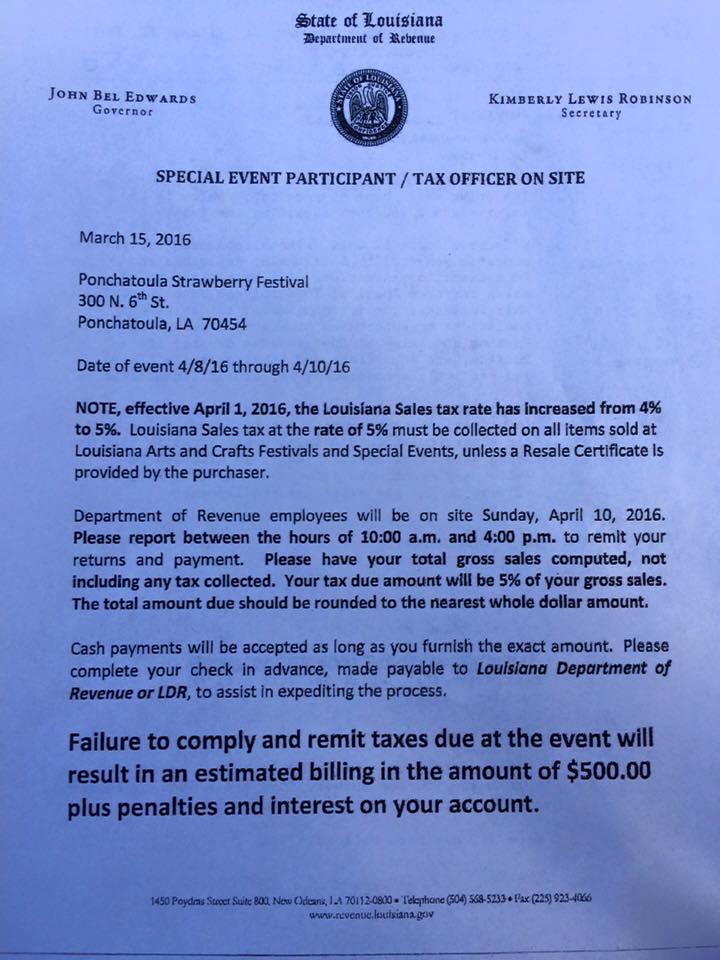

I just found a copy of it on facebook.

Holy cow.

The letter is addressed to the Festival, which is interesting, and it's dated March 15, so I wonder if there was some advance notice about this.

It says at the bottom "faulure to comply and remit taxes due at the event will result in an estimated billing in the amount of $500.00 plus penalties and interest on your account".

This is straight Gestapo tactics.

But, like Poodle said, many of them probably don't have an account. How is LDR going to estimate bill a non-existing account????

Letter

Holy cow.

The letter is addressed to the Festival, which is interesting, and it's dated March 15, so I wonder if there was some advance notice about this.

It says at the bottom "faulure to comply and remit taxes due at the event will result in an estimated billing in the amount of $500.00 plus penalties and interest on your account".

This is straight Gestapo tactics.

But, like Poodle said, many of them probably don't have an account. How is LDR going to estimate bill a non-existing account????

Letter

Posted on 4/10/16 at 11:57 am to Jabstep

I did find this on LDR website, I have not seen it there before.

LINK

So basically they are demanding that event coordinators provide them with a vendor list, I wonder if they are crosschecking this against their database ahead of time and automatically issuing account numbers to those who don't have one?

This is insane. But it does not change my advice to not pay anything until you have had a time to calculate your sales after the event.

LINK

So basically they are demanding that event coordinators provide them with a vendor list, I wonder if they are crosschecking this against their database ahead of time and automatically issuing account numbers to those who don't have one?

This is insane. But it does not change my advice to not pay anything until you have had a time to calculate your sales after the event.

Posted on 4/10/16 at 12:22 pm to LSUFanHouston

I saw that on the LDR as well. Typical bulletin that very vague. I agree, the $500 penalty is just something out of thin air. I've seen no law that substantiates it

Posted on 4/10/16 at 4:42 pm to Jabstep

I do a lot of festivals and have never seen this myself. I usually take our sales and ring it in through our computer at work. Sales tax gets taken care of that way for us at least.

Posted on 4/10/16 at 5:29 pm to Jabstep

Funny that the state is demanding money instantly while I've been waiting for them to pay me for months...

Posted on 4/10/16 at 5:36 pm to Jabstep

quote:The $500 isn't a penalty. It is the LDR's "estimate" of how much tax someone should owe, so it is a proposed assessment of tax. It is like the $100 estimate of franchise tax the LDR assesses when it doesn't receive a franchise tax return from entities who are exempt from the franchise tax. You have to prove to them that you don't owe the tax, or that you owe less.

I agree, the $500 penalty is just something out of thin air. I've seen no law that substantiates it

Posted on 4/10/16 at 5:46 pm to Poodlebrain

How unbelievable is that letter?

Sometimes I just want to move one state over. Just wait until they raise income taxes during the next legislative session. People are going to lose their minds.

Sometimes I just want to move one state over. Just wait until they raise income taxes during the next legislative session. People are going to lose their minds.

Posted on 4/10/16 at 7:53 pm to Poodlebrain

quote:

The $500 isn't a penalty. It is the LDR's "estimate" of how much tax someone should owe,

So they think every vendor had $10K in sales? What a bunch of horse shite. If I could I would move out of this state.

Posted on 4/10/16 at 8:34 pm to offshoretrash

Time for the people to just elect the odd man out in an election. It will send a message. This is good info though. I've never had to bring my Resale Cert so I guess I should carry it now.

Popular

Back to top

6

6