- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 5/17/24 at 12:30 pm to ev247

Posted on 5/17/24 at 12:30 pm to ev247

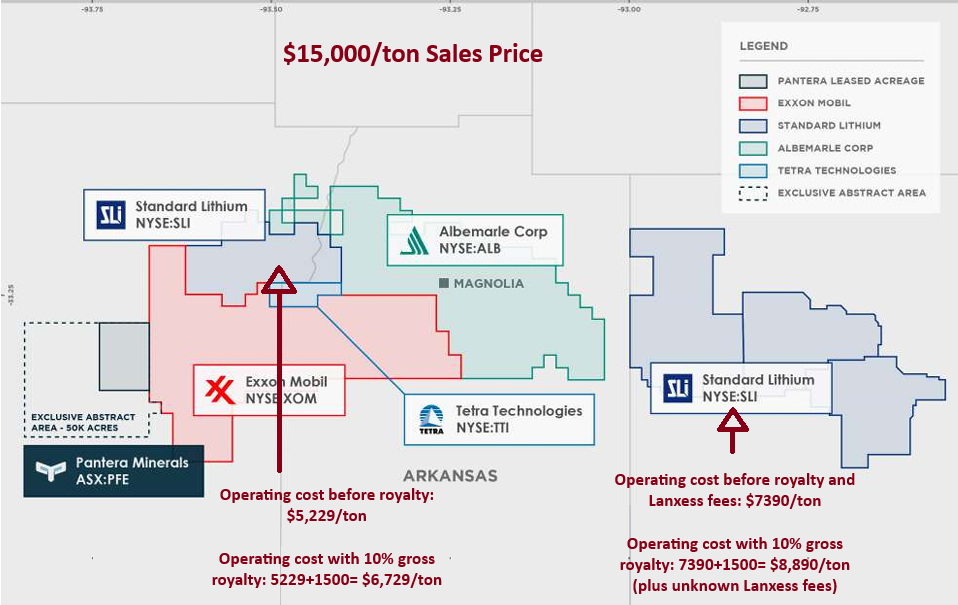

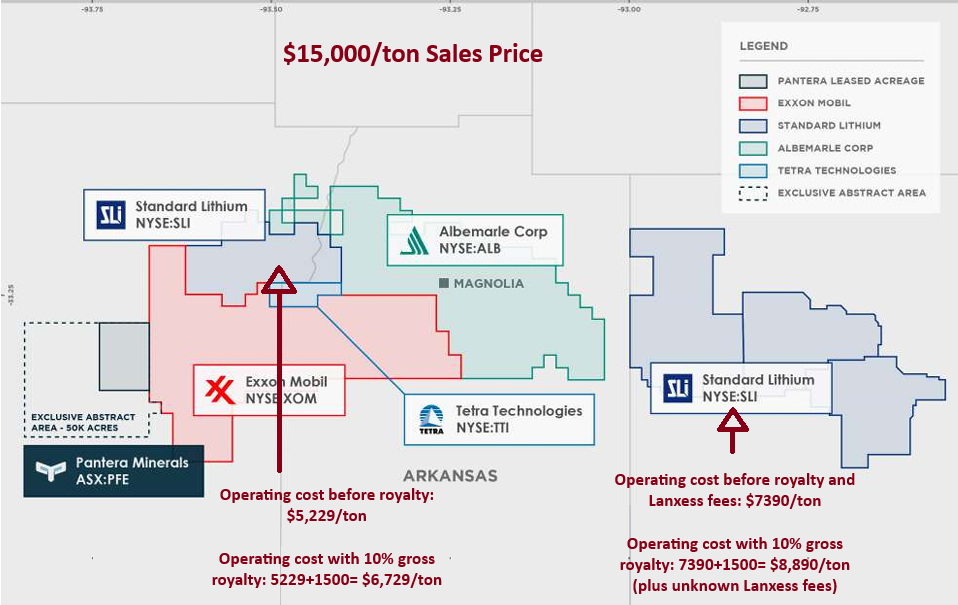

I edited an Arkansas brine territories map to show how a 10% royalty would affect the operating costs of 1A and SWA, using their DFS and PFS. Notice just how much stronger SWA is than 1A. $15,000/ton seems to be the neighborhood where lithium spot prices have been for the past several months.

Posted on 5/17/24 at 1:04 pm to ev247

Would love to see a ruling from AO&G that since Exxon suggested it, they can operate for the next 5 years with a 10% royalty and everyone else at 3.5% and then have the issue revisited.

Posted on 5/28/24 at 10:13 pm to ev247

Exxon isn't offering a true 10% gross royalty. It's 10% less expenses related to transport, refining, marketing, etc. Who knows what that works out to with corporate accounting. But an interesting point is that Lithium only accounts for ~10% of the marketable value of the minerals in the brine. Ex: Na, Mg and Ca ions are worth considerably more if isolated via electrolysis/distillation given their concentration x spot of industrial grades in Shanghai. The E&P's maintain they're only interested in Lithium, potassium and bromine, but I have my doubts

Also that 10% assumes Exxon, or whoever markets the sourced minerals, sells them in an arms-length deal. I wouldn't be surprised if it's something like this: There are 2 operators partnered on the unit, one which might extract the bromine. The tail-end brine then gets traded like-kind with Albemarle or Dow for chemicals/products equivs needed for ops + a deal for a backend royalty carved out from the revenue generated when they chem cos market the end products, or selling crude brine at discount wellhead rates with an end-profit sharing deal in place

Oh and the lithium doesn't go for $15k/mt, Lithium Carbonate and Lithium Hydroxide are ~$13-15k/mt, but lithium is a small component in those compounds by mass, with the anion considered to contribute no value. Correcting for purity and stoichiometric coefficients, the lithium is actually ~$80,000/ton at current spot

Also that 10% assumes Exxon, or whoever markets the sourced minerals, sells them in an arms-length deal. I wouldn't be surprised if it's something like this: There are 2 operators partnered on the unit, one which might extract the bromine. The tail-end brine then gets traded like-kind with Albemarle or Dow for chemicals/products equivs needed for ops + a deal for a backend royalty carved out from the revenue generated when they chem cos market the end products, or selling crude brine at discount wellhead rates with an end-profit sharing deal in place

Oh and the lithium doesn't go for $15k/mt, Lithium Carbonate and Lithium Hydroxide are ~$13-15k/mt, but lithium is a small component in those compounds by mass, with the anion considered to contribute no value. Correcting for purity and stoichiometric coefficients, the lithium is actually ~$80,000/ton at current spot

This post was edited on 5/29/24 at 11:54 pm

Popular

Back to top

2

2