- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Pay Extra on Student Loan vs Invest?

Posted on 2/13/24 at 11:41 am to TorchtheFlyingTiger

Posted on 2/13/24 at 11:41 am to TorchtheFlyingTiger

Fully maxing both Roths this year, have some going to an HSA + company contribution into HSA (I just started putting towards this past open enrollment) and I've been getting company match + some, totaling 10% into 1 401k account for the last 4-ish years.

This post was edited on 2/13/24 at 11:42 am

Posted on 2/13/24 at 12:53 pm to Roux57

Great job with your finances. Good advice in this thread. We don't know if you have car payments and such. The 4.3 one is very borderline depending on what else you would do with that amount instead. But the feeling of getting them paid off is very rewarding.

Posted on 2/13/24 at 8:41 pm to Roux57

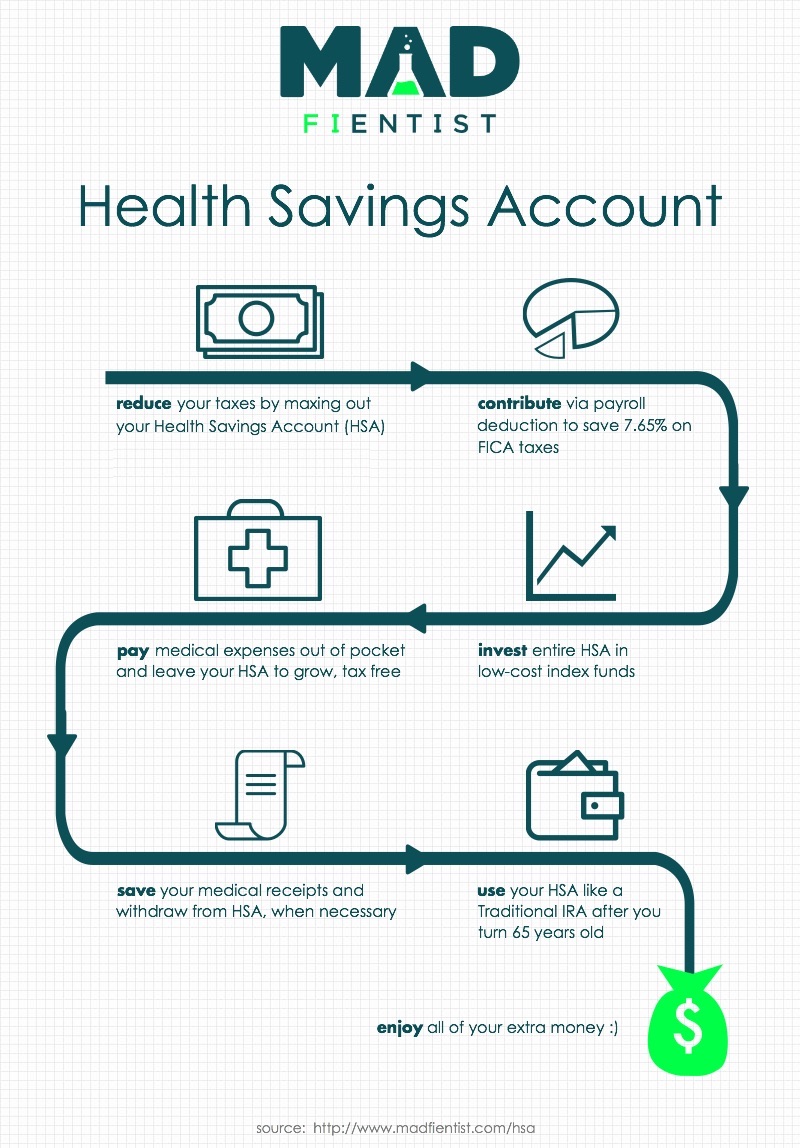

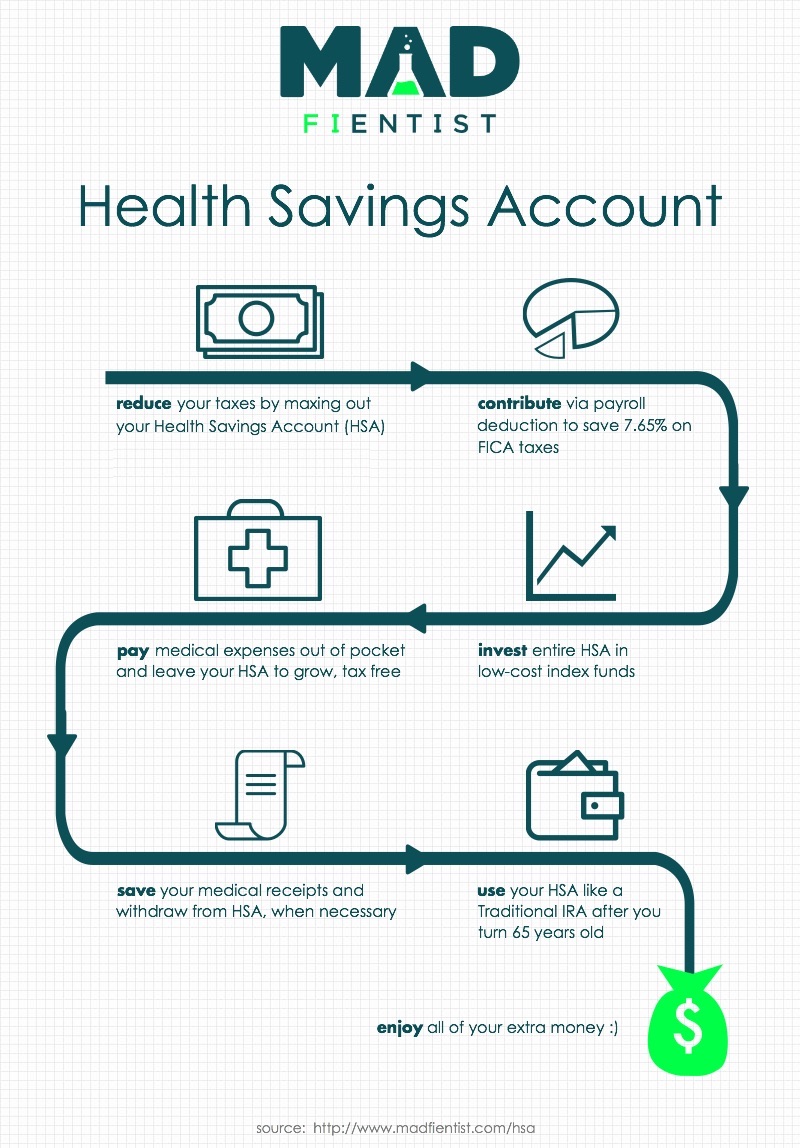

Max that HSA while eligible. It is triple tax advantaged and you can invest it, pay health expenses out of pocket , save reciepts and withdraw without tax or penalty later.

This post was edited on 2/13/24 at 8:49 pm

Popular

Back to top

2

2