- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

VDIGX- Vanguard Dividend Growth Fund

Posted on 12/27/22 at 7:33 pm

Posted on 12/27/22 at 7:33 pm

Anybody else have this fund in their roth IRA? with the new year coming up i'm getting ready to add money. Would this be a good add? Currently my roth only holds about 20 stocks. All dividend stocks currently. I know it cost a minimum of 3000 to buy in. Is it worth it to add? to my 20 stocks ? Just looking for sugguestions for the new year.

Posted on 12/27/22 at 7:46 pm to FLObserver

It’s pretty hard to go wrong with a portfolio of companies with a strong track record of growing their dividend.

Posted on 12/27/22 at 10:23 pm to FLObserver

Pardon my ignorance, but why wouldn't someone just go with VYM (Vanguard High Dividend Yield)?

VYM has only a .06% net expense ratio, no minimum initial investment, and an annual (quarterly) dividend/yield of $4.19/3.87%.

VDIGX has a .27% gross expense ratio, and $3k minimum (0.0 if in IRA).

Both have 5 star Morningstar ratings, below average risk, and above average returns.

VYM has only a .06% net expense ratio, no minimum initial investment, and an annual (quarterly) dividend/yield of $4.19/3.87%.

VDIGX has a .27% gross expense ratio, and $3k minimum (0.0 if in IRA).

Both have 5 star Morningstar ratings, below average risk, and above average returns.

Posted on 12/28/22 at 7:18 am to Ballstein32

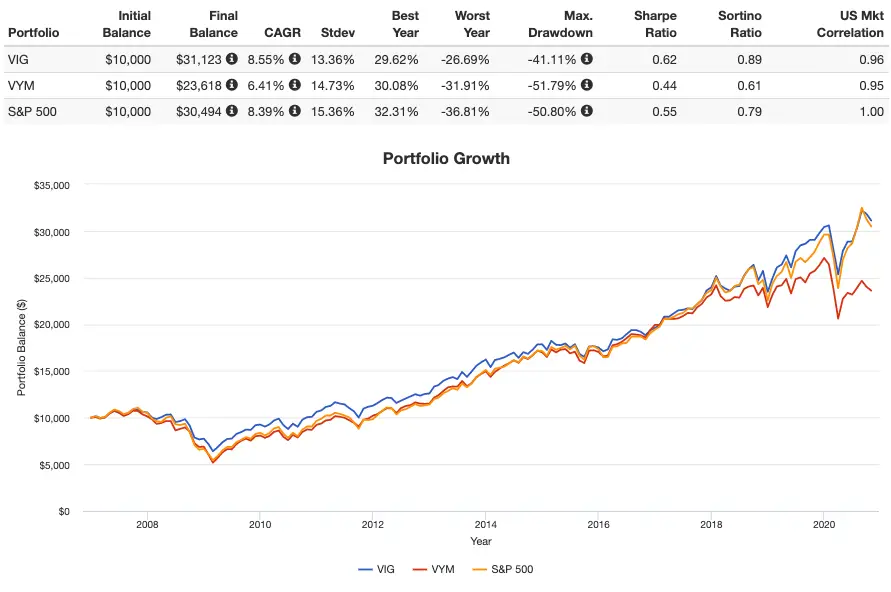

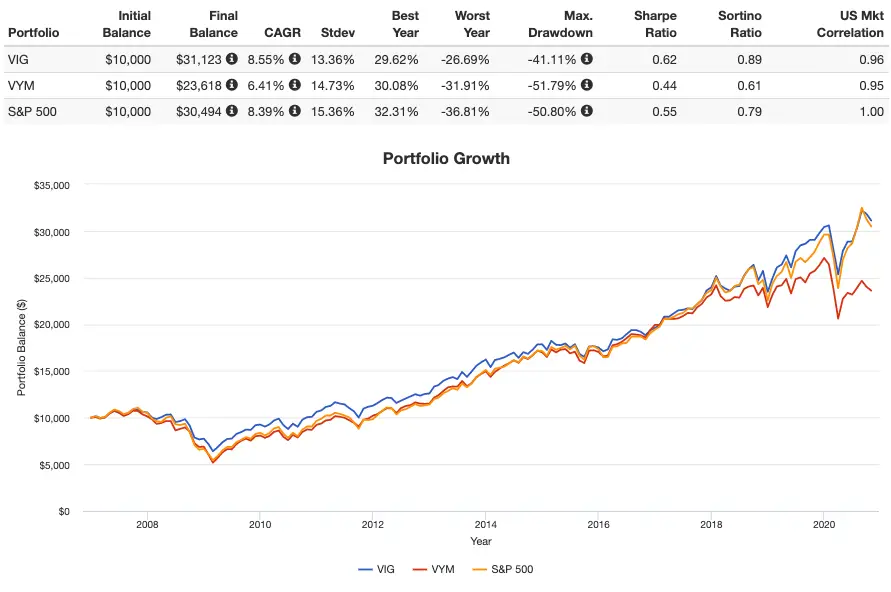

Since their inception in 2006, VIG has handily beaten VYM on every notable metric.

This post was edited on 12/28/22 at 7:24 am

Popular

Back to top

2

2