- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Implications of fiscal dominance in the US and likely options going forward.

Posted on 8/28/23 at 12:43 pm to Captain Crackysack

Posted on 8/28/23 at 12:43 pm to Captain Crackysack

quote:

Right but the SPR doesn’t store refined products. It stores crude oil.

I certainly didn't mean to suggest otherwise, but the SPR crude can be made immediately available to refiners to maintain stocks in the short run for either military contracts or to supply emergency demands.

The assumption (valid in this case) is that any mid/major conflict will disrupt the global petroleum market.

Posted on 8/28/23 at 12:46 pm to Art Blakey

Great first post!

Current budgets would need to be cut by ~22% ( LINK) across the board just to balance (much less have a surplus with which to pay down the debt). I could probably count the amount of members of Congress who would vote for something like that with just the fingers of one hand and have fingers left over.

I get the idea of effectively shrinking debt through inflation, but without spending controls (limiting creation of new debt) it seems like it's nothing more than obfuscation with a hope that someone, somewhere in the future will come up with some way to fix things beyond accounting aesthetics. The big problem here is something I refer to as "no one goes to DC to serve only one term". What I mean by that is the cuts to spending needed just to balance the budget (much less have a surplus) would guarantee that almost anyone voting for it would lose their next election (and possibly any other election after that).

To my way of thinking, trying this in the fiscally irresponsible environment we've had in DC for over 20 years now (and for the foreseeable future) is a bit like an addict doing ever-more stronger drugs in an attempt to re-capture that feeling of their first high. It's an inevitable death spiral as the more debt we create, the more inflation is needed to effectively shrink it, causing higher servicing amounts, meaning we create more debt so that we can service it while not making cuts which would cause politicians to not get re-elected, which means more inflation is needed to effectively shrink it, etc. We're currently looking at estimated $1.3T+ annual deficits with annual debt servicing quickly approaching $1T.

Debt servicing for FY2022 was $852B, total deficit for FY2022 was $1.357T, meaning we borrowed money, largely, in order to pay the interest on borrowed money. This has been the norm since FY2008 and is expected to continue into the foreseeable future. As long as we're borrowing more than it takes to service our debt, we're essentially borrowing more in order to pay for borrowing more (read: death spiral). There's no path forward where this ends well, it's just a matter of "how" and "when" this all comes to a head.

Current budgets would need to be cut by ~22% ( LINK) across the board just to balance (much less have a surplus with which to pay down the debt). I could probably count the amount of members of Congress who would vote for something like that with just the fingers of one hand and have fingers left over.

I get the idea of effectively shrinking debt through inflation, but without spending controls (limiting creation of new debt) it seems like it's nothing more than obfuscation with a hope that someone, somewhere in the future will come up with some way to fix things beyond accounting aesthetics. The big problem here is something I refer to as "no one goes to DC to serve only one term". What I mean by that is the cuts to spending needed just to balance the budget (much less have a surplus) would guarantee that almost anyone voting for it would lose their next election (and possibly any other election after that).

To my way of thinking, trying this in the fiscally irresponsible environment we've had in DC for over 20 years now (and for the foreseeable future) is a bit like an addict doing ever-more stronger drugs in an attempt to re-capture that feeling of their first high. It's an inevitable death spiral as the more debt we create, the more inflation is needed to effectively shrink it, causing higher servicing amounts, meaning we create more debt so that we can service it while not making cuts which would cause politicians to not get re-elected, which means more inflation is needed to effectively shrink it, etc. We're currently looking at estimated $1.3T+ annual deficits with annual debt servicing quickly approaching $1T.

Debt servicing for FY2022 was $852B, total deficit for FY2022 was $1.357T, meaning we borrowed money, largely, in order to pay the interest on borrowed money. This has been the norm since FY2008 and is expected to continue into the foreseeable future. As long as we're borrowing more than it takes to service our debt, we're essentially borrowing more in order to pay for borrowing more (read: death spiral). There's no path forward where this ends well, it's just a matter of "how" and "when" this all comes to a head.

This post was edited on 8/28/23 at 12:52 pm

Posted on 8/28/23 at 3:02 pm to Art Blakey

The funny part about your post is you didn’t mention unfunded pension liabilities we owe to boomers. The CARES Act and our response to Covid was the most reckless action we’ve taken in my lifetime. We should all be praying for a productivity miracle with our aging and shrinking population growth.

Awesome first post baw

Awesome first post baw

Posted on 8/28/23 at 3:06 pm to Art Blakey

quote:

I don't think he'll QE again until he sees a treasury auction fail or near fail.

The reason they started QE in 2020 was because treasuries went 0 bid in SE Asian trading.

Posted on 8/28/23 at 4:09 pm to wutangfinancial

quote:

The funny part about your post is you didn’t mention unfunded pension liabilities we owe to boomers.

That's only another 200T, mostly denominated in health care goods and services, which, last I checked, can not be printed by the Fed. Boomers vote so those are not getting cut either.

This post was edited on 8/28/23 at 4:10 pm

Posted on 8/28/23 at 5:02 pm to Bard

quote:

Great first post!

Current budgets would need to be cut by ~22% ( LINK) across the board just to balance (much less have a surplus with which to pay down the debt). I could probably count the amount of members of Congress who would vote for something like that with just the fingers of one hand and have fingers left over.

I get the idea of effectively shrinking debt through inflation, but without spending controls (limiting creation of new debt) it seems like it's nothing more than obfuscation with a hope that someone, somewhere in the future will come up with some way to fix things beyond accounting aesthetics. The big problem here is something I refer to as "no one goes to DC to serve only one term". What I mean by that is the cuts to spending needed just to balance the budget (much less have a surplus) would guarantee that almost anyone voting for it would lose their next election (and possibly any other election after that).

To my way of thinking, trying this in the fiscally irresponsible environment we've had in DC for over 20 years now (and for the foreseeable future) is a bit like an addict doing ever-more stronger drugs in an attempt to re-capture that feeling of their first high. It's an inevitable death spiral as the more debt we create, the more inflation is needed to effectively shrink it, causing higher servicing amounts, meaning we create more debt so that we can service it while not making cuts which would cause politicians to not get re-elected, which means more inflation is needed to effectively shrink it, etc. We're currently looking at estimated $1.3T+ annual deficits with annual debt servicing quickly approaching $1T.

Debt servicing for FY2022 was $852B, total deficit for FY2022 was $1.357T, meaning we borrowed money, largely, in order to pay the interest on borrowed money. This has been the norm since FY2008 and is expected to continue into the foreseeable future. As long as we're borrowing more than it takes to service our debt, we're essentially borrowing more in order to pay for borrowing more (read: death spiral). There's no path forward where this ends well, it's just a matter of "how" and "when" this all comes to a head.

Have you read Dalio's latest book? It was helpful to me to understand the cyclical nature of debt cycles. We're at the end of the one that began just after WW2. The cliffnotes are about once every four generations, or about the same time as one long human life, debt accumulates to unsustainable levels and the entire system gets a complete reboot, a debt jubilee of sorts.

That's the 50k foot view anyway. As I said earlier, I think Powell understands this, the Triffin Dilemma and the ramifications of what these rates will eventually do to an economy with debt levels this high. But I think he knows everyone else is in worse shape and by crushing everyone else, especially Europe and Japan, that that might drive capital our way to eat some of the obscene amount of issuance Yellen will be churning out over the next few years.

But like you pointed out, it's a short term play. Without massive fiscal reform that dooms every sitting member of Congress the math morphs into a debt death spiral. I still think he'll cut and print to kick the can one more time when the treasury market gets illiquid which of course lights inflation on fire.

Posted on 8/28/23 at 6:07 pm to wutangfinancial

quote:

The funny part about your post is you didn’t mention unfunded pension liabilities we owe to boomers.

I think they're hoping boomers die off before that gets too costly. I wouldn't be too surprised to see some sort of "direct payment" program shenanigans where Social Security payments are credited to Medicare once some criteria is met, then Medicare just drags its feet in billing Social Security, thus "extending solvency" (or likely "creating solvency equity" or some other flowery phrase).

Posted on 8/28/23 at 6:56 pm to Bard

quote:

I think they're hoping boomers die off before that gets too costly.

Inb4 vaxxed

Posted on 8/28/23 at 10:02 pm to Ace Midnight

quote:

quote:

we had a surplus for a couple years despite profligate govt spending.

I hate this myth. The budget was in near balance for a single yearly cycle, but since the actual debt actually went up (slightly) I continue to argue that it was no surplus at all and perverts the very nature of the word.

Regardless, it was, as you say, more the result of timing than any policy pushed by either party at the time.

I'm with Ace on this, but some things worth pointing out:

The economy of the 1990's was the enabler for this to happen every bit as much as anything the DC crowd on either side did. We had a triple witching hour of the PC revolution, the advent of the web, and Y2K forcing massive IT reinvestment and updates that all drove record productivity increases, which also pushed the economy's growth. That all came about from investments made in the 1980s (SEMATech, the MicroComputer Consortium, combined with tax laws) that pushed innovation. Growing GDP yielded growing tax revenues.

Now we have a similar opportunity with AI, if we manage it correctly. The last couple of waves of tech advances since the 1990's generated a lot of wealth - social media, etc - but did little for productivity and arguably hurt it. AI could be the next big jump in productivity that would push GDP growth again, which would amount to more kicking the can further down the road unless government finally does something about spending.

Everytime I think we're in really bad shape economically, I take a closer look at demographically doomed China and Russia, or the inept, doddering EU, or near-underwater Japan. If the US craters economically, it will set off a global collapse like 1929, perhaps even worse. There will inevitably be war out of that. But if we can control the risk with AI and leverage its potential for productivity improvements, we can remain a major economic engine for the world, and just maybe keep our heads above water.

Posted on 8/28/23 at 10:08 pm to Art Blakey

quote:

Have you read Dalio's latest book? It was helpful to me to understand the cyclical nature of debt cycles. We're at the end of the one that began just after WW2. The cliffnotes are about once every four generations, or about the same time as one long human life, debt accumulates to unsustainable levels and the entire system gets a complete reboot, a debt jubilee of sorts.

That's the 50k foot view anyway. As I said earlier, I think Powell understands this, the Triffin Dilemma and the ramifications of what these rates will eventually do to an economy with debt levels this high. But I think he knows everyone else is in worse shape and by crushing everyone else, especially Europe and Japan, that that might drive capital our way to eat some of the obscene amount of issuance Yellen will be churning out over the next few years.

But like you pointed out, it's a short term play. Without massive fiscal reform that dooms every sitting member of Congress the math morphs into a debt death spiral. I still think he'll cut and print to kick the can one more time when the treasury market gets illiquid which of course lights inflation on fire.

I think the common flaw with an economics-only approach to analyzing the problem is that it has to assume everything else is just a linear projection on the supply side - GDP, etc. As I noted above, technology advances can alter the inputs IF they are fundamental enough. The 1990's was not the first time we've seen it happen. It happened before in the industrial revolution and then again in the transportation revolution (cars and airplanes both became mature enough to start affecting the economy at about the same time).

If all else fails, I fall back on Churchill's wartime quote, roughly: "As for me, I am an optimist. There doesn't seem to be much use in being anything else."

Posted on 8/30/23 at 1:34 pm to TigerHornII

quote:

I think the common flaw with an economics-only approach to analyzing the problem is that it has to assume everything else is just a linear projection on the supply side - GDP, etc. As I noted above, technology advances can alter the inputs IF they are fundamental enough. The 1990's was not the first time we've seen it happen. It happened before in the industrial revolution and then again in the transportation revolution (cars and airplanes both became mature enough to start affecting the economy at about the same time).

If all else fails, I fall back on Churchill's wartime quote, roughly: "As for me, I am an optimist. There doesn't seem to be much use in being anything else."

I assume you're referencing potential productivity gains from AI or similar? Imo the issue there, AI specifically, is it is just another labor arbitrage situation, not unlike bringing China into the WTO. It will be incredibly deflationary and deflation is incompatible with a debt based fiat monetary system that is already leveraged to the extreme. Deflation increases debt burdens in real terms. They will have to print even more to prevent the system from buckling.

Imo, the only tech advance with a prayer of helping gdp outrun the debt balloon is a revolution in energy production. A fusion breakthrough would probably do it. Current tech fission might have done it if we hadn't put the brakes on it in the 80s.

Posted on 8/30/23 at 5:50 pm to Art Blakey

quote:

I assume you're referencing potential productivity gains from AI or similar? Imo the issue there, AI specifically, is it is just another labor arbitrage situation, not unlike bringing China into the WTO. It will be incredibly deflationary and deflation is incompatible with a debt based fiat monetary system that is already leveraged to the extreme. Deflation increases debt burdens in real terms. They will have to print even more to prevent the system from buckling.

Imo, the only tech advance with a prayer of helping gdp outrun the debt balloon is a revolution in energy production. A fusion breakthrough would probably do it. Current tech fission might have done it if we hadn't put the brakes on it in the 80s.

Not sure I agree with your first paragraph Art, but I do with the second for sure. Remember the 1980's and '90's when everyone thought the computer revolution would kill jobs? Well, it did kill off encyclopedia salesmen, typing pools, and a bunch of other stuff, but it enabled far more jobs that were in general higher paying. That's why I don't think AI will be a labor arbitrage.

Couple of ways this could play out:

1. AI helps the US wage base become more competitive, which would not be deflationary. Productivity improvements will be core to this. For one, it would make US programmers competitive with their Indian counterparts, reducing outflows of cash from the US and keeping it circulating here.

2. AI accelerates convergence technologies (biomedical, robotics - especially assistive cobotics, energy storage R&D) which could all drive technological revolutions, again, not deflationary, and creates a lot of new wealth.

The last two rounds of IT advances - "web 2.0 and 3.0", really just created a lot of rent takers, while doing nothing for the broader industrial base. I think AI can break that trend.

Posted on 8/31/23 at 8:08 am to Civildawg

quote:

One thing I've started to notice is the diminishing power of the dollar around the world. Went to Mexico a few months ago and the exchange rate kind of shocked me.

Exchange rates are determined by interest rates I'd have thought.

Mexico's interest rate has risen pretty rapidly while US interest rates are plateauing increasing the demand for the peso against the dollar.

Since 2003, the peso has actually depreciated so it's a very short-term view of things to say that the power of the dollar has diminished I'd argue.

They said the same thing about the euro reducing the power of the dollar and that was pretty short-lived when it turned out that a single unit currency for disparate countries doesn't work very well...

I disagree with the premise of this post. The US is in a pretty damn good position compared with 'peer' countries.

This post was edited on 8/31/23 at 8:13 am

Posted on 9/2/23 at 7:58 am to TigerHornII

quote:

Not sure I agree with your first paragraph Art, but I do with the second for sure. Remember the 1980's and '90's when everyone thought the computer revolution would kill jobs? Well, it did kill off encyclopedia salesmen, typing pools, and a bunch of other stuff, but it enabled far more jobs that were in general higher paying. That's why I don't think AI will be a labor arbitrage.

Couple of ways this could play out:

1. AI helps the US wage base become more competitive, which would not be deflationary. Productivity improvements will be core to this. For one, it would make US programmers competitive with their Indian counterparts, reducing outflows of cash from the US and keeping it circulating here.

2. AI accelerates convergence technologies (biomedical, robotics - especially assistive cobotics, energy storage R&D) which could all drive technological revolutions, again, not deflationary, and creates a lot of new wealth.

The last two rounds of IT advances - "web 2.0 and 3.0", really just created a lot of rent takers, while doing nothing for the broader industrial base. I think AI can break that trend.

We shall see. You might be right. However, my pessimism about AI becoming another labor arbitrage is rooted in recent history. From NAFTA through China joining the WTO every deal had the same sucker at the card table, the US middle class. A tech advance is clearly in a different category than a trade deal but AI has the ability to offer a labor arbitrage result. We should probably pay close attention to any AI regulation bills that come out of Washington. Anything that centralizes the the tech is a red flag imo.

You would hope that the political class has learned from the events of the last 7-8 years that we've reached the limit with labor arbitrage. The return of populism to the forefront of US politics beginning in the 2016 cycle should have been a sufficient warning. People forget that it overtook both ends of the spectrum (Sanders).

It all comes down to the distribution of AI's productivity imo. If the benefits accrue throughout the country, great, if they pool up on Wall St and in DC it could have a net negative result imo.

Posted on 9/3/23 at 3:41 pm to Art Blakey

So I read through this whole thing last night then pickup up Freakenomics. My question is where does the immigration population figure into the US unemployment situation, it’s indicators and the overall economy going forward.

Posted on 9/4/23 at 5:27 pm to TJack

quote:

So I read through this whole thing last night then pickup up Freakenomics. My question is where does the immigration population figure into the US unemployment situation, it’s indicators and the overall economy going forward.

I'm no expert but my understanding is illegal immigrants basically don't count in most official numbers. We don't know how many there are, where they are or where they work. A lot of the people that come for the menial jobs get paid cash and the only tax they pay are sales taxes and the Western Union tax when they send it home. This varies from state to state. Are they influencing the numbers? Yes, but it's nearly impossible to quantify.

FWIW all govt numbers are cooked imo. The BLS labor data is a joke. There have been massive divergences between the household survey and the business survey since last July. With the business survey they add what's called the birth/death model. That's an estimate of how many jobs were created or destroyed by new business formations or closings and it's based on how many actual openings and closings happened that month in the previous year. It's arguably a stupid metric during normal economic times, post covid, post Godzilla stimulus you can imagine what an unreliable metric it is, completely devoid of any basis in statistical reality. No surprise that labor data has been revised downward 7 months in a row now. Then there's the participation rate which is another big can of worms.

Has labor remained tight thus far through this tightening cycle? Yes. Are the official numbers cooked? Yes. Labor always rolls over last.

Posted on 9/4/23 at 6:14 pm to Art Blakey

I appreciate the response. Thank you!

Posted on 9/7/23 at 7:27 am to Shepherd88

quote:The USD remaining as the world's primary reserve currency enables a higher debt-to-GDP ratio. But we're getting there.

I think “kicking the can down the road” continues until there is a viable candidate to replace the USD though.

Prior to fiscal dominance (aka GDP>Debt), higher interest rates (current Fed Policy) result in curtailed bank credit, which combats inflation.

On the other hand, those same higher rates obviously increase costs of servicing the debt. When GDP significantly exceeds Debt, the cost-of-carry is less impactful.

Given our 120% Debt:GDP though, those costs are considerable. They noticeably contribute to a rise in government deficits all by themselves. e.g., The 2.2% annual debt service difference between 1.8% & 4% rates is $726B. $726B nearly equates to the entire DOD budget, or Medicare.

The problem at those levels is the debt service costs trigger needs for further inflationary “printing.” So if the source of inflation is more deficit-driven, higher interest rates are ineffective.

Posted on 9/7/23 at 10:18 am to NC_Tigah

quote:

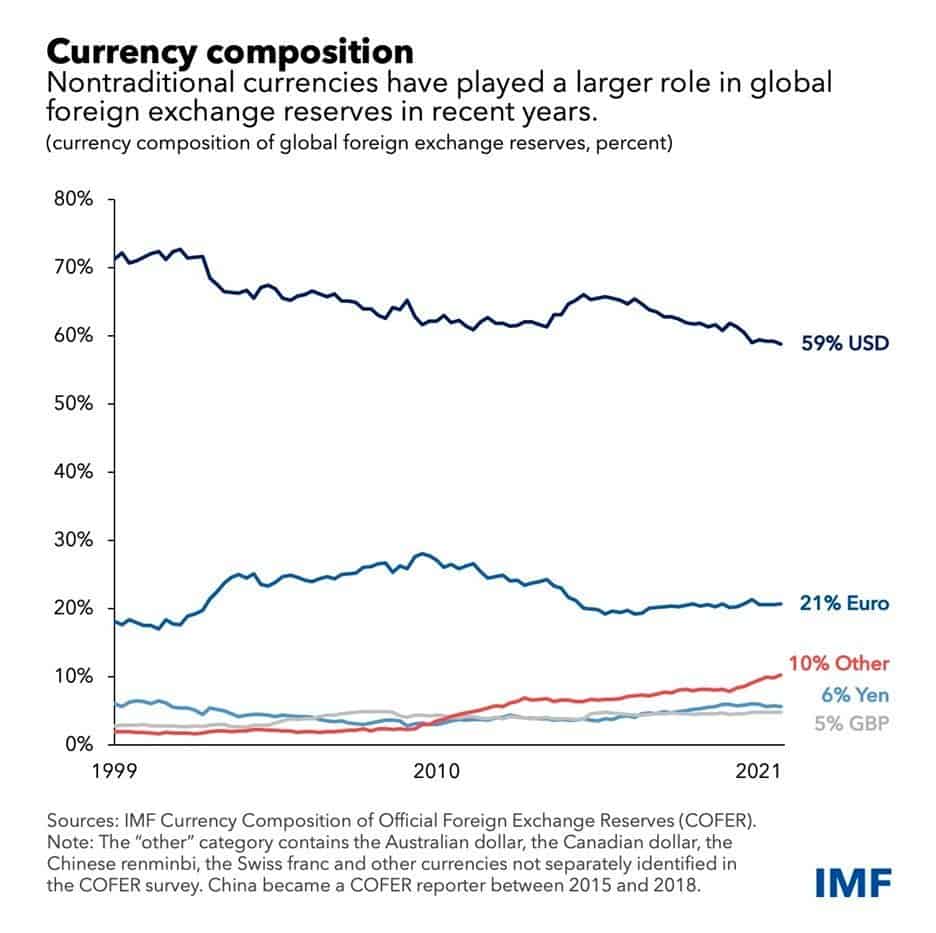

The USD remaining as the world's primary reserve currency

How long do we remain there?

As I mentioned in an earlier post, we've essentially been borrowing to service debt since 2008. In an environment where interest on new borrowing is more than double what it was during the majority of the time back to 2008, that means we're building debt at an ever-increasing pace.

With the USD being a fiat currency, eventually that debt burden is going to scare away potential investors. Along with that, one of the big supporters of the USD being the primary world currency is its function as the petrodollar. This is why Saudi and UAE joining BRICS has me concerned.

If BRICS is successful in getting its member nations to trade oil only in their currency -even if it's just among themselves- we're suddenly looking at lot of excess petrodollars sitting in the market. BRICS represents the majority of world oil production (80%), a sizeable amount of total oil exports (~40% if all of the currently applying countries were to be approved) and a nearly equal amount of oil imports (BRICS countries account for ~33% of all oil imports).

We've already been seeing a slow but definite pattern of the world moving from the USD internationally.

This is why I am starting to take BRICS a bit more seriously. Granted, there's still a wide gulf between proposing a new currency and having it be successful once instituted, but waiting until that's the situation before acting would be economic suicide.

Posted on 9/7/23 at 11:00 am to Art Blakey

quote:

Both Clinton and Gingrich took credit for it, pretending like they were budgetary savants but the truth was that was just a brief window of favorable demographics, boomers were in their prime earning years, there were a lot of them, and the WW2 generation who were drawing on entitlements were a smaller demographic. Now boomers are retiring, there are still a lot of them, and gen X and millennials aren't making nearly enough for their taxes to support boomer retirements. The math on the New Deal and Great Society programs is fundamentally broken. Those gaps will get printed.

It was a short lived window, but it was also a golden opportunity to reset our fiscal future. The Bush tax cuts followed by perm-war military spending and nation building started our slide. Then tack on Obamacare and another tax cut under Trump. Then the COVID funding. Now we’re fricked.

We had a chance to actually run surpluses in the 90s and 00s and we blew it.

This post was edited on 9/7/23 at 9:25 pm

Popular

Back to top

0

0