- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Head Of SVB Effectively Lobbied Regulators For Lax Scrutiny….

Posted on 3/12/23 at 11:05 am

Posted on 3/12/23 at 11:05 am

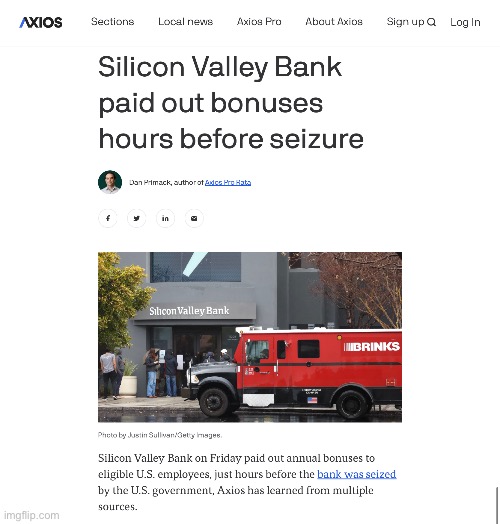

CEO of collapsed Silicon Valley Bank successfully lobbied Congress to avoid imposing extra scrutiny….

The president of Silicon Valley Bank appeared before in 2015 to argue that his bank should not be subject to scrutiny - insisting that 'enhanced prudential standards' should be lifted 'given the low risk profile of our activities'.

Greg Becker, president of SVB, on Friday watched as his bank collapsed and was placed under government control — becoming the second largest bank to fold after Washington Mutual in 2008.

Yet hours later it emerged Becker had convinced Congress to lessen the scrutiny of businesses like his. But anyone with deposits over a quarter of a million dollars with Silicon Valley Bank now faces losing all their money above the $250,000 protected by a federal law.

Becker had also sold $3.57m of stock in a pre-planned, automated sell-off two weeks before the bank collapsed — and the CFO ditched $575,000 the same day.

Becker sold 12,451 shares at an average price of $287.42 each on February 27.

The price plunged to just $39.49 in premarket on Friday before the Federal Deposit Insurance Corporation (FDIC) seized the bank's assets. It closed at $15.

Federal records obtained by The Lever showed that Becker had spent more than half a million dollars on federal lobbying in 2015-18.

The money was well spent: SVB obtained the light-touch regulation it wanted.

Becker told Congress about 'SVB's deep understanding of the markets it serves, our strong risk management practices.'

He argued that his bank would soon reach $50 billion in assets, which under the law would trigger 'enhanced prudential standards,' including more stringent regulations, stress tests, and capital requirements for his and other similarly sized banks.

The financier, who joined the company three decades ago as a loan officer, told Congress that $250 billion was a more appropriate threshold.

'Without such changes, SVB likely will need to divert significant resources from providing financing to job-creating companies in the innovation economy to complying with enhanced prudential standards and other requirements,' said Becker.

'Given the low risk profile of our activities and business model, such a result would stifle our ability to provide credit to our clients without any meaningful corresponding reduction in risk.'

The lobbying paid off in 2019.

The Federal Reserve proposed regulations implementing the deregulatory law - despite warnings from financial watchdogs that its regulations on Category IV institutions — as SVB was later classified due to its size and other risk factors — were far too weak…

This post was edited on 3/12/23 at 11:14 am

Posted on 3/12/23 at 1:57 pm to Toomer Deplorable

Posted on 3/12/23 at 2:06 pm to Toomer Deplorable

The bonuses were scheduled to pay then. They didn’t just decide to randomly pay the bonuses immediately before collapsing

Posted on 3/12/23 at 2:16 pm to Upperdecker

quote:

The bonuses were scheduled to pay then. They didn’t just decide to randomly pay the bonuses immediately before collapsing

Posted on 3/12/23 at 3:14 pm to Toomer Deplorable

Sounds like members and former members of the congressional banking committees need to pay for the bail out. Was Mad Max a part of it? I hope Nancy had a gazillion in the SVB.

Posted on 3/12/23 at 3:19 pm to Toomer Deplorable

I’m sorry your money laundromat got disrupted lieutenant Dan

Posted on 3/12/23 at 3:20 pm to Upperdecker

quote:

The bonuses were scheduled to pay then. They didn’t just decide to randomly pay the bonuses immediately before collapsing

While the FDIC won't ever tell you when a bank is being seized, they do examine them. Banks with deposit insurance required to have audits by third parties.

The executives had to have known they were on the FDIC's shite list. There's a huge difference in attitude when an examiner comes by and you're a shite bank or healthy bank.

Posted on 3/12/23 at 3:21 pm to Toomer Deplorable

After serving on a bank board and going through several audits, I can't believe what larger banks are allowed to get away with. We'd have had our balls nailed to the wall long before it got to this point. No to mention the extreme stupidity of basically going all in on long term treasuries and bonds with shite returns with interest rates at a point that they could only go up.

If they bail them out, they should bail out any other bank that fails. What I've seen looks like gross negligence by both the bank and regulators. Somebody was getting paid to look the other way. Sounds like they were giving too low of rates to a high risk, high volatility clientele as well. frick'em. Let'em sink.

If they bail them out, they should bail out any other bank that fails. What I've seen looks like gross negligence by both the bank and regulators. Somebody was getting paid to look the other way. Sounds like they were giving too low of rates to a high risk, high volatility clientele as well. frick'em. Let'em sink.

Posted on 3/12/23 at 3:22 pm to SmackoverHawg

quote:

After serving on a bank board and going through several audits, I can't believe what larger banks are allowed to get away with. We'd have had our balls nailed to the wall long before it got to this point. No to mention the extreme stupidity of basically going all in on long term treasuries and bonds with shite returns with interest rates at a point that they could only go up

I was an IT manager at a good bank and a bad bank. Big difference when dealing with the FDIC. While I passed audits with flying colors, while working at the bad bank I had to put in more work as there was much more scrutiny.

The good bank happened to be First NBC and we know what happened to them.

Posted on 3/12/23 at 3:23 pm to Pechon

quote:

While the FDIC won't ever tell you when a bank is being seized, they do examine them. Banks with deposit insurance required to have audits by third parties.

The executives had to have known they were on the FDIC's shite list. There's a huge difference in attitude when an examiner comes by and you're a shite bank or healthy bank.

This x 100000. They had to know this was coming.

Posted on 3/12/23 at 3:34 pm to Upperdecker

quote:

The bonuses were scheduled to pay then. They didn’t just decide to randomly pay the bonuses immediately before collapsing

You'd think the "raiders" would know that and seize it prior to at least save that money from going out.

Posted on 3/12/23 at 3:43 pm to SmackoverHawg

quote:

You'd think the "raiders" would know that and seize it prior to at least save that money from going out.

That's the thing. Bank seizures always happen on a Friday evening. Right before the bank and it's branches close, FDIC sends agents in and takes everything over. This way the bank can be converted to the bank who bought the assets in a secret auction without people making a run.

One bank I worked for was certainly on the list. I used to look for cars we didn't recognize around 4 PM on a Friday before going home. They may have not known which Friday it would happen but I'm pretty sure they figured they would pay it out before it happens.

Posted on 3/12/23 at 4:51 pm to Pechon

quote:

The executives had to have known they were on the FDIC's shite list.

Silicon Valley Bank CEO sold $3.5M in shares just two weeks before collapse….

Two of Silicon Valley Bank’s top chiefs dumped millions of dollars worth of stock just two weeks before the firm collapsed Friday, records show.

CEO Greg Becker offloaded over $3.5 million worth of stocks — which amounted to nearly 12,500 shares — in a pre-planned, automated sell-off on Feb. 27, according to a US Securities and Exchange Commission filing.

That same day, the bank’s third-in-command CFO Daniel Beck sold $575,180 in stocks, Newsweek reported….

Posted on 3/12/23 at 5:01 pm to Toomer Deplorable

Everyone is paying bonuses from last year. My bonus paid out Friday for the March 15 payroll.

This is common in the financial industry.

This is common in the financial industry.

This post was edited on 3/12/23 at 5:10 pm

Posted on 3/12/23 at 5:27 pm to bisonduck

quote:

Everyone is paying bonuses from last year. My bonus paid out Friday for the March 15 payroll.

This is common in the financial industry.

And Federal regulators still allowed those bonuses to be dispersed knowing that a takeover was imminent?

Posted on 3/12/23 at 5:29 pm to Toomer Deplorable

Would it make sense to buy shares now, on the premise that they will go up under new management?

Posted on 3/12/23 at 5:32 pm to Toomer Deplorable

quote:

Two of Silicon Valley Bank’s top chiefs dumped millions of dollars worth of stock just two weeks before the firm collapsed Friday, records show.

CEO Greg Becker offloaded over $3.5 million worth of stocks — which amounted to nearly 12,500 shares — in a pre-planned, automated sell-off on Feb. 27, according to a US Securities and Exchange Commission filing.

That same day, the bank’s third-in-command CFO Daniel Beck sold $575,180 in stocks, Newsweek reported….

They need to go to prison. And not white collar resort prison.

Posted on 3/12/23 at 5:42 pm to FightinTigersDammit

How are you going to buy them?

Posted on 3/12/23 at 5:46 pm to Mo Jeaux

No idea. I'm asking a question.

Posted on 3/12/23 at 5:56 pm to Toomer Deplorable

quote:

'enhanced prudential standards' should be lifted 'given the low risk profile of our activities'

In his defense, it was low risk back then when the fed manipulated the markets to the easiest business conditions possible. He was 8 years deep in QE 0% and obviously believed that he'd mastered the market SVB was catering to.

He's just a idiot that would have never been as successful in an actual competitive market environment.

'a fool and his money are soon parted'

. never fails

Back to top

7

7