- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: How to get FICO to 800?

Posted on 11/17/17 at 9:21 am to 50_Tiger

Posted on 11/17/17 at 9:21 am to 50_Tiger

I am 804 or something like that.

I have done nothing magical, but I did not cross that barrier until about a year or so after I got a mortgage

I am only 30, decent job, credit limit at like 50k I think, pay off in full.

So I really didnt do anything special. And it only took like 7 years to get to 800

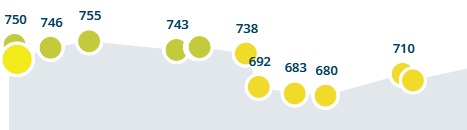

Here is me battling to stay in the 700s right after college

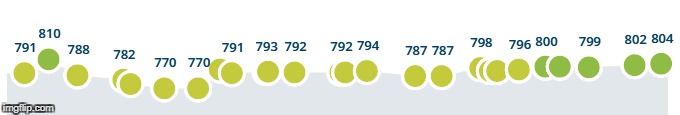

and today

Each dot is like half a month I think

I have done nothing magical, but I did not cross that barrier until about a year or so after I got a mortgage

I am only 30, decent job, credit limit at like 50k I think, pay off in full.

So I really didnt do anything special. And it only took like 7 years to get to 800

Here is me battling to stay in the 700s right after college

and today

Each dot is like half a month I think

This post was edited on 11/17/17 at 9:29 am

Posted on 11/17/17 at 10:00 am to 50_Tiger

Could be worse. I had 775, bank incorrectly reported late payment, score went down to 700, bank corrected false late payment mark, score stayed 700, and they are telling me nothing more can be done since they corrected their mistake. It’s been a real gem to deal with.

Posted on 11/17/17 at 3:34 pm to lsupride87

I was carrying a little bit of debt for a home renovation, but we've been aggressively paying down debt for a little while.

I have no idea how accurate the Chase FICO reporting is, but I've trended upwards since Dec 2016 with a big jump up in March 2017.

I have no idea how accurate the Chase FICO reporting is, but I've trended upwards since Dec 2016 with a big jump up in March 2017.

Posted on 11/17/17 at 3:57 pm to lnomm34

Nice Inomm34. My chase Fico was up to 818 but I got really pissed at Citi and closed $40k in open credit among 2 cards at once, and opened another with BOA. It fell to 788. It may not be finished falling. But it felt good to tell them they could stuff it. That 837 is awesome. I found chase FICO to be lower reporting than CK.

This post was edited on 11/18/17 at 11:16 am

Posted on 11/17/17 at 6:25 pm to CorkSoaker

quote:

they are telling me nothing more can be done since they corrected their mistake. It’s been a real gem to deal with.

Just dispute it with every reporting agency

Posted on 11/18/17 at 12:23 pm to CorkSoaker

My father added me to a high limit bussiness credit card he had for 20 or 30 years. My credit score went from 700 to 800 almost over night and now is 820 to 840

Posted on 11/18/17 at 3:37 pm to Paul Allen

True but the real magic number is actually 760. 760 and above makes everything as simple as it can be

Posted on 11/19/17 at 1:19 am to hawkeye007

quote:

You need to be over 50 to get an 800 with a lifetime of good credit

810 Score. Not close to 50.

Score was 680 5yrs ago.

Didn't have anything negative, but had no car note or mortgage at the time. Just a credit card.

This post was edited on 11/19/17 at 1:25 am

Back to top

1

1