- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

distressed private equity and m&a

Posted on 7/12/17 at 1:55 pm

Posted on 7/12/17 at 1:55 pm

Curious why distressed m&a and pe isn't very common/mainstream? Learning about distressed businesses it seems like a good concept if you are a forward thinker.

Posted on 7/12/17 at 2:24 pm to Statsattack

It's extremely situational. Deals are typically driven by large market forces that remove liquidity and/or credit from the affected industry or business. You can make a ton of money if that window's open, if you have the capital, and if you have the expertise in that field to execute. But that window is not typically open long enough to build a full business around those investments.

Posted on 7/12/17 at 3:25 pm to TheSurge

Thanks and I agree with what you wrote. To have a portfolio of companies that are distressed is an failure waiting to happen.

If a pe firm was searching for companies that have filed chapter 11 you would acquire some of those companies that would allow your portfolio companies to grow

If a pe firm was searching for companies that have filed chapter 11 you would acquire some of those companies that would allow your portfolio companies to grow

Posted on 7/12/17 at 4:37 pm to Statsattack

I'd argue it's very common, just not as "mainstream" because big banks, funds and institutions can't "be seen" to hold distressed assets or securities. There are plenty of funds and firms that target the insolvent. Look at the o&g industry the last 2 years. Private equity money has and will continue to shuffle the deck.

Posted on 7/15/17 at 12:51 pm to Statsattack

quote:

Curious why distressed m&a and pe isn't very common/mainstream?

I'd say because it's usually talked about more in the realm of distressed debt and junk bonds, rather than it terms of equity. Think about it--if a firm is distressed, then almost by definition its equity will be worth very little.

So in the world of "vulture investing" (or more positively, "turnaround management"), investors usually focus on buying the distressed debt, and then work out a deal (for example, a prepackaged bankruptcy) with the remaining equity holders to restructure the company and wipe out the old equity. (It's no coincidence that hedge funds and other firms that invest in distressed companies often have a lot of associates who are bankruptcy lawyers... one of the best fields in finance for lawyers.) A distressed deal doesn't have to involve a declared insolvency of course. Like you indicated, there could be a tender offer for the remaining shares. However, even in those cases, the acquirers had better put most of their attention on controlling the distressed debt situation.

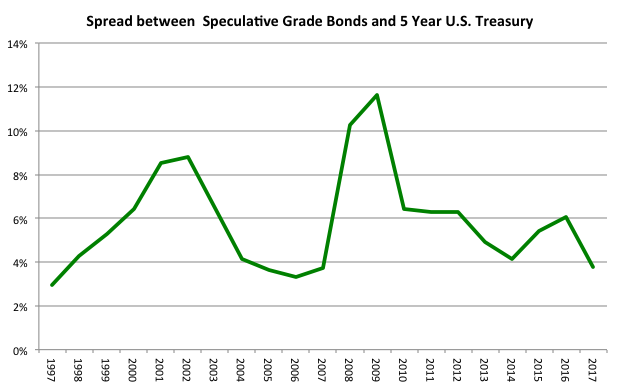

In terms of the market cycle for more passive investors, I find the junk bond market cycle fascinating, and I studied it a good bit some years back. The key take-away I think, is that junk bonds tend to get killed going into recessions, but that coming out of recessions, junk bonds are generally the first place where "green shoots" investors can put their money and make a killing on the benefits of economic recovery.

As for where we are right now, check out this Seeking Alpha snippet from June 18: " Bad Time To Invest In Junk Bonds."

That little snipper doesn't even mention a trend that I've been reading elsewhere recently, which is that corporate bonds (including junk bonds) are setting near-term records for issuing higher and higher percentages of covenant-light bonds. This shows that it's a seller's market, and that bond investors have little power to force companies to put more restrictions into their bond offerings.

In any case, if you are interested in becoming a "vulture investor" one day, I would suggest the following as the best place to start: Turnaround Management Association.

Posted on 7/15/17 at 1:14 pm to Doc Fenton

By the way, I'm still shaking my head at Bill Ackman for losing $500 million on J.C. Penney back in 2013: LINK.

For some reason I though it went bankrupt years ago, but now that I look at it, I guess it has managed to avoid Chapter 11 so far.

For some reason I though it went bankrupt years ago, but now that I look at it, I guess it has managed to avoid Chapter 11 so far.

Posted on 7/17/17 at 3:07 pm to Doc Fenton

Posted on 7/17/17 at 9:37 pm to sneakytiger

That was really short, but a pretty good summary nonetheless. I don't specifically read Gadfly, but I click on Bloomberg more often than I do for any other general news outlet, and I also read RealClearMarkets.com almost every day, so I tend to get diverted to Gadfly articles from time to time.

Popular

Back to top

3

3