- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Best Vanguard Index Fund?

Posted on 9/6/21 at 9:53 pm

Posted on 9/6/21 at 9:53 pm

I’m guessing the first one

Vanguard Total Stock Market Index Fund (VTSAX)

Vanguard 500 Index Fund Admiral Shares (VFIAX)

Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX)

Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

Vanguard Real Estate Index Fund Admiral Shares (VGSLX)

Vanguard Growth Index Fund Admiral Shares (VIGAX)

Vanguard Balanced Index Fund Admiral Shares (VBIAX)

Vanguard Dividend Growth Fund (VDIGX

Vanguard Total Stock Market Index Fund (VTSAX)

Vanguard 500 Index Fund Admiral Shares (VFIAX)

Vanguard Total Bond Market Index Fund Admiral Shares (VBTLX)

Vanguard Total International Stock Index Fund Admiral Shares (VTIAX)

Vanguard Real Estate Index Fund Admiral Shares (VGSLX)

Vanguard Growth Index Fund Admiral Shares (VIGAX)

Vanguard Balanced Index Fund Admiral Shares (VBIAX)

Vanguard Dividend Growth Fund (VDIGX

Posted on 9/6/21 at 10:05 pm to xxTIMMYxx

Impossible to answer. There isn’t a “best” fund.

Posted on 9/6/21 at 10:15 pm to xxTIMMYxx

Was questioning whether the 500 was better

Posted on 9/6/21 at 10:16 pm to lynxcat

Yea, but it’s better than mutual funds where you get raped with fees for the “managing”, like a 2050 fund

I originally set it up for a 2050 fund. Almost a 21% return, which is decent

I originally set it up for a 2050 fund. Almost a 21% return, which is decent

This post was edited on 9/6/21 at 10:26 pm

Posted on 9/6/21 at 10:21 pm to xxTIMMYxx

I’m listening to an audio book, Common Sense Investing, and he is shitting all over mutual funds and using money managers. 90% of them are no better than your average, educated retail investor

Posted on 9/6/21 at 10:24 pm to xxTIMMYxx

Found this detailed document about Vanguard returns:

https://institutional.vanguard.com/iam/pdf/total_return_chart.pdf

https://institutional.vanguard.com/iam/pdf/total_return_chart.pdf

This post was edited on 9/6/21 at 10:32 pm

Posted on 9/6/21 at 10:27 pm to xxTIMMYxx

I did the same thing with my fidelity account. Looked at the returns and hand picked much better index funds that had much better returns

Posted on 9/6/21 at 10:28 pm to xxTIMMYxx

Correct, index funds are preferable to actively managed funds for the average investor.

Posted on 9/6/21 at 10:52 pm to xxTIMMYxx

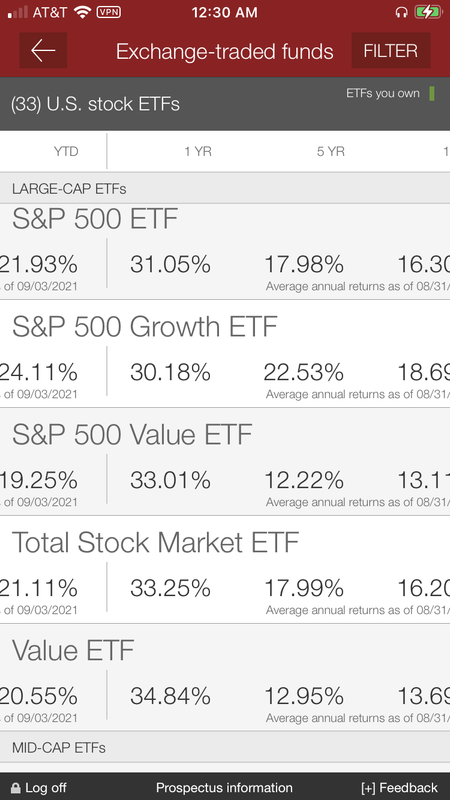

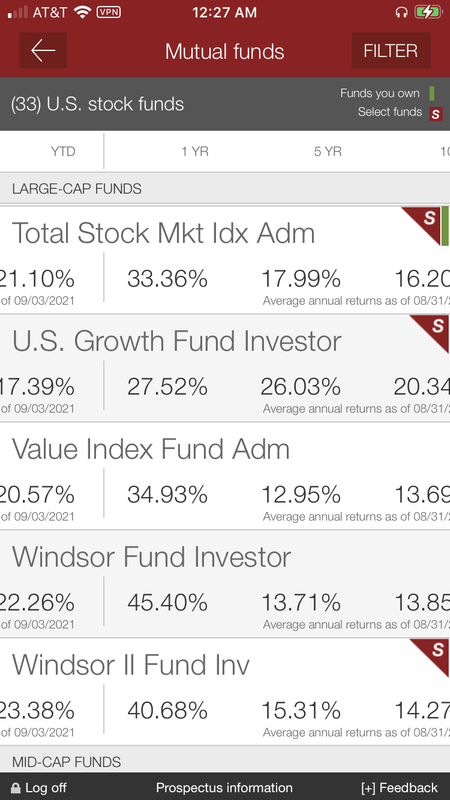

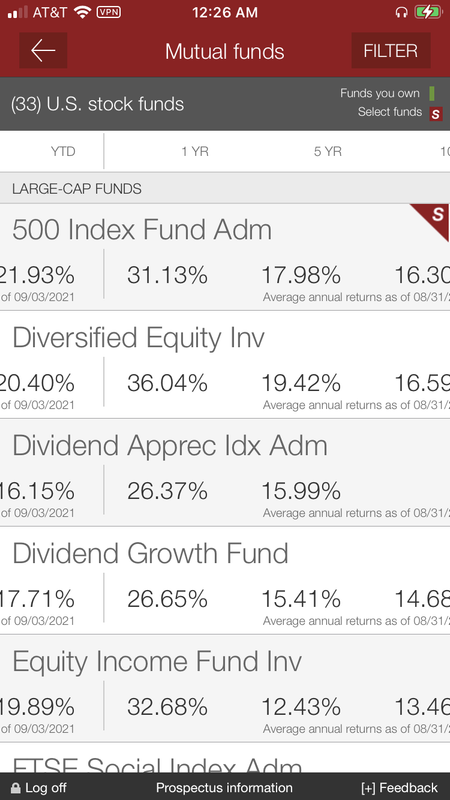

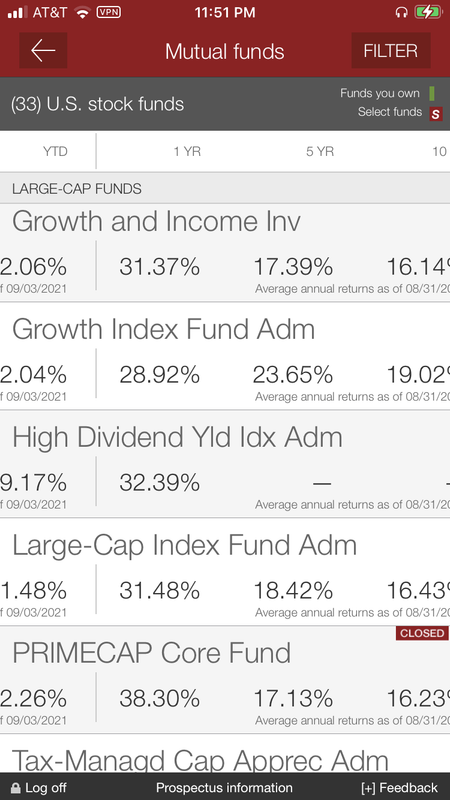

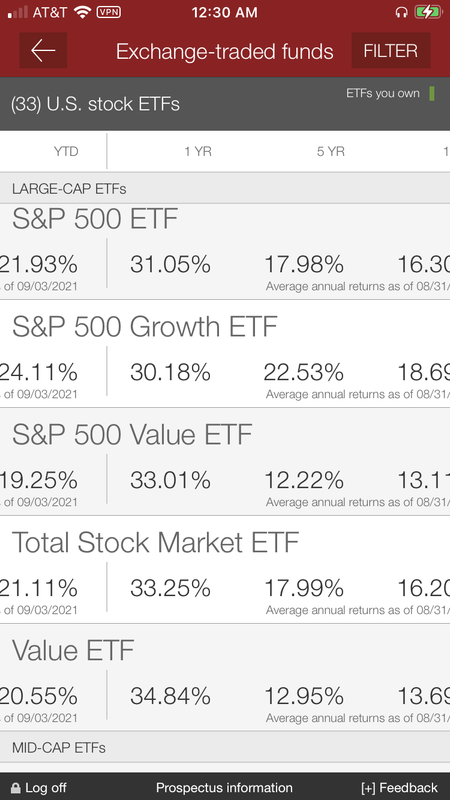

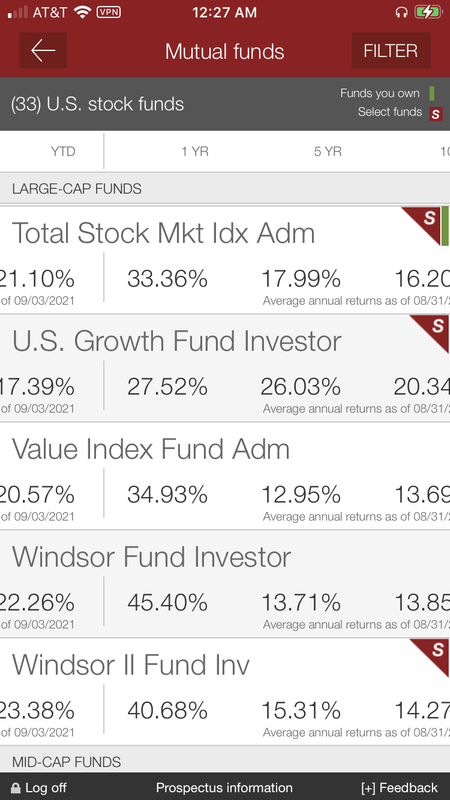

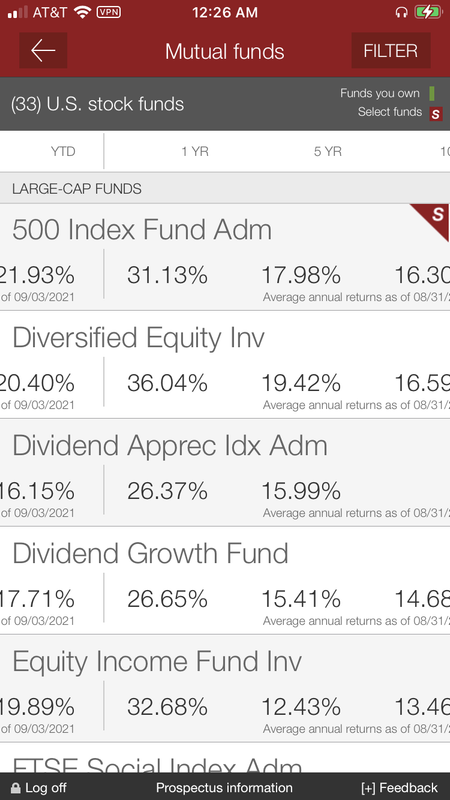

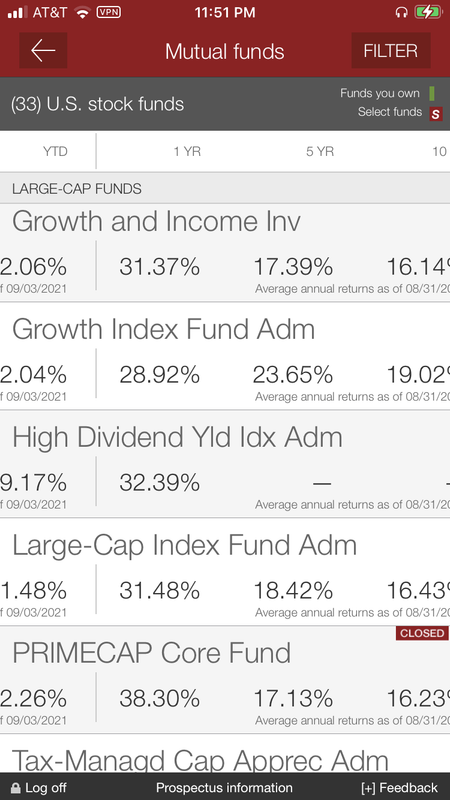

The Growth index funds outperforms the Total Stock Market index. A couple ETF’s do too

Posted on 9/6/21 at 11:54 pm to jimbeam

Some of the ETF options look good as well. Have to be careful because last year returns were absolutely crazy.

I’m 36. I’m starting to lean towards a Growth index fund or etf.

I’m 36. I’m starting to lean towards a Growth index fund or etf.

This post was edited on 9/7/21 at 12:08 am

Posted on 9/6/21 at 11:58 pm to xxTIMMYxx

Focus is really on total mkt, 500, growth, or a combo. They all seem to do well, but the real question is what will be best over the next 4 years. I’ve heard a lot of talk about people returning to value stocks. Far right cut off part is 10 year returns

This post was edited on 9/7/21 at 12:08 am

Posted on 9/7/21 at 5:47 am to xxTIMMYxx

quote:I thought I was doing really well with three hand picked funds in my HSA account.

Was questioning whether the 500 was better

They are getting me 20.1% ytd

Well, the S&P is at 20.75%

Posted on 9/7/21 at 9:03 am to xxTIMMYxx

quote:

I’m listening to an audio book, Common Sense Investing, and he is shitting all over mutual funds and using money managers. 90% of them are no better than your average, educated retail investor

It really depends, but index fund people champion index funds because of the low cost and the fact most active managed funds arent worth the extra expense because long term 8/10, 9/10 or so dont outperform the index. There's also a lot of bad mutual fund products out there, but some really good ones too.

HOWEVER, that doesnt mean if you really do some research and good picking on some higher expense mutual funds you cant beat the market/index over some time, either. I would say it's probably more about being lucky though there than a great picker overall. Some can just be very good (probably lucky) about going to the right funds when the time is right.

I do both low expense index funds and higher fee mutual funds and do have some mutual funds who have crushed the index. One example is WMICX from Wasatch. It has a ridiculous expense ratio (1.66%), but the returns on it the last few years have been extremely high. According to morningstar over 10% higher than the index in 2017, 2018, 2019 and 2020. It's actually not doing great in it's category in 2021, but still above the index. WMICX performance...but then you look at 2011 through 2016 and it was most definitely not worth the extra cost. Even then though, if you look at the 10 year return, it's at 21.16% annualized which the index was at just 15.6% annualized, so the 1.66% expense ratio still was justified over 10 years in that respect.

This post was edited on 9/7/21 at 9:16 am

Posted on 9/8/21 at 4:04 pm to xxTIMMYxx

quote:

Vanguard Growth Index Fund Admiral Shares (VIGAX)

Posted on 9/8/21 at 5:01 pm to xxTIMMYxx

Probably the vanguard 10 million dollars to Hillary’s campaign fund

Oh wait that’s every vanguard

Oh wait that’s every vanguard

Popular

Back to top

11

11