- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Am I the only one who thinks the market's reaction to the coronavirus outbreak is...

Posted on 1/31/20 at 4:32 pm to notiger1997

Posted on 1/31/20 at 4:32 pm to notiger1997

I think the virus makes the losses slightly more. I'm saying if no one ever heard of coronavirus, the markets would still be down because of the Fed's pull back.

Fair enough?

Fair enough?

Posted on 1/31/20 at 4:34 pm to LSURussian

A lot of investors are looking for a reason to get out of the market and take their profits.

The flu excuse?

The flu excuse?

Posted on 1/31/20 at 4:37 pm to BamaAlum02

You posted:

My reply was meant to show the Fed's action reducing its repo balances was meant to maintain the overnight FF rate between the Fed's stated rate target of 1.5-1.75% and had nothing to do with "using" the virus news as cover for reducing repo transactions.

It's a mystery to me why you think the market dropped over 600 points today because of the Fed's repo operations when overnight interest rates have remained virtually unchanged for over a month.

If there were liquidity concerns causing the stock market to pull back then overnight rates would have reflected those concerns by increasing significantly which they haven't done.

Res ipsa loquitur.

quote:

The Fed is using the virus news as an excuse to pull back their cash floats

My reply was meant to show the Fed's action reducing its repo balances was meant to maintain the overnight FF rate between the Fed's stated rate target of 1.5-1.75% and had nothing to do with "using" the virus news as cover for reducing repo transactions.

It's a mystery to me why you think the market dropped over 600 points today because of the Fed's repo operations when overnight interest rates have remained virtually unchanged for over a month.

If there were liquidity concerns causing the stock market to pull back then overnight rates would have reflected those concerns by increasing significantly which they haven't done.

Res ipsa loquitur.

Posted on 1/31/20 at 4:42 pm to Number 9 Fan

I read on wallstreetbets that the Chinese market has been closed all week due to the new year and it could really crash on Monday due to virus scares and nobody being able to trade. Anybody got any speculation on this?

Posted on 1/31/20 at 4:47 pm to Triple Bogey

Guys. I literally just bought a house so yes it will likely crash. Guess I should have told y’all earlier.

Posted on 1/31/20 at 4:48 pm to jimbeam

quote:

Guys. I literally just bought a house so yes it will likely crash. Guess I should have told y’all earlier.

God damn you jb

Posted on 1/31/20 at 4:51 pm to Triple Bogey

The Hong Kong stock market has been open this week. Shanghai has been closed. But in Shanghai's last day of trading, 1/23/20, it was down almost 3%. So there was some selling already there before the holiday began.

I would expect the Shanghai market to react to the virus outbreak in China since China seems to be the epicenter of the outbreak. Its economy and supply chains will most likely be the most affected by travel restrictions inside the country.

So, yeah, a stock market pullback there would not be surprising.

I would expect the Shanghai market to react to the virus outbreak in China since China seems to be the epicenter of the outbreak. Its economy and supply chains will most likely be the most affected by travel restrictions inside the country.

So, yeah, a stock market pullback there would not be surprising.

Posted on 1/31/20 at 5:31 pm to LSURussian

quote:100%.

hospital is doing nothing special for preparing for the corona virus flu.

Sans vaccination, the treatment of corona and influenza is identical.

There is no real basis for a hospital to do anything different at this point. They would be ready, even if there was a sudden US coronavirus pandemic starting tomorrow.

The question is whether CV will spread into the US like flu. I'm seeing little other than very aggressive quarantining to indicate it won't. I'm just not sure how well 2wk quarantining will work if it comes to that.

Put another way, quarantining was effective with ebola. But had ebola maintained a 14 d and asymptomatic transmissible period, we'd have seen far wider spread.

If we can identify every potential entry case, and aggressively quarantine those exposed, we'll be okay. But that is a high mark.

This post was edited on 2/1/20 at 1:26 am

Posted on 1/31/20 at 6:15 pm to NC_Tigah

quote:

The question is whether CV will spread into the US like flu. I'm seeing little other than very aggressive quarantining to indicate it won't.

What is this other worldly respiratory virus that has been going around the last few months? My wife brought this shite home from a trip to NYC on Dec 16 and it was awful. Took 3 weeks to get over major tiredness and most of the coughing, it took her another 3 weeks to get like 95% and she is super fit and never sick. I didn't get it as bad as her but damn it sucked. Compared to the flu friends had gotten this shite was 10x worse, especially the recover time. I don't know any adult that has gotten over this pretty much 100% in less than 5 weeks.

Posted on 1/31/20 at 6:23 pm to NC_Tigah

Patients were treated for Ebola with IV remdesivir (A Gilead product), right? I've also read that confirmed Corona cases were being treated with the same drug.

Are influenza patients treated with remdesvir?

Are influenza patients treated with remdesvir?

Posted on 1/31/20 at 8:15 pm to marchballer

Likely yo have a negative effect on first quarter earnings, and the market is earnings driven.

Posted on 1/31/20 at 8:46 pm to Calvin Coolidge

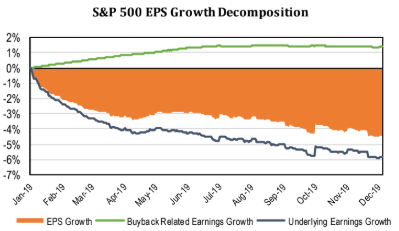

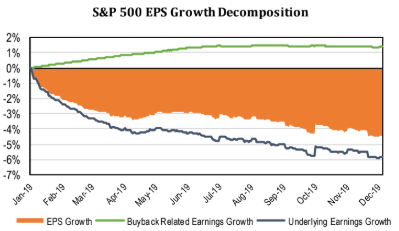

Earnings are negative over the past year and the market was up nearly 30%.

Others have made great points about the Fed, but no one has mentioned the Bern Virus. Bernie taking the lead and probably winning Iowa on Monday night... that’s another big risk I haven’t seen mentioned.

Others have made great points about the Fed, but no one has mentioned the Bern Virus. Bernie taking the lead and probably winning Iowa on Monday night... that’s another big risk I haven’t seen mentioned.

Posted on 1/31/20 at 11:18 pm to LSURussian

The market wasn’t going to go up for ever.

Posted on 2/1/20 at 12:13 am to LSURussian

My perception is warped because I live in Hong Kong, but I definitely see an impact, and not just in HK. My entire Asian supply chain is pretty screwed up right now on both supply and delivery sides. Some issues with customs and clearance and government office being at bare minimum staff are impacting exports.

We always factor in Chinese New year productivity losses every year, but this year that goes from 1 week to maybe 3. That is significant. It might also be compounded that CNY is earlier than usual, which puts it closer to end of previous year where you work down inventories, so you have less buffer at CNY.

My hope is that this will be made up for with a rebound in Q2.

We always factor in Chinese New year productivity losses every year, but this year that goes from 1 week to maybe 3. That is significant. It might also be compounded that CNY is earlier than usual, which puts it closer to end of previous year where you work down inventories, so you have less buffer at CNY.

My hope is that this will be made up for with a rebound in Q2.

Posted on 2/1/20 at 9:30 am to UpstairsComputer

quote:No, they are not. You aren't reading the graph you posted correctly.

Earnings are negative over the past year

Earnings growth was slower in the fourth quarter 2019 compared to the first quarter of 2019 (likely because of the tariffs) but earnings are still positive.

Big difference.

Posted on 2/1/20 at 9:36 am to LSURussian

You keep making this about interest rates and it is about actions of the Fed. The Fed is one of the largest influences on market valuations. I thought that was a pretty accepted principle. You can call it correlation, coincidence, causation or whatever else but generally when the Fed pulls back on repo positions the market reacts in a downturn and vice versa. So regardless of what happens with rates, if the Fed reduces their repo liquidity by 20%, the market is going to downturn. There are years of data to support this.

It was hyperbole on my part to say the virus has 0 impact. Of course it does, everything does because investing also has a psychological aspect that no amount of data can rationalize. So when there are factors like the Fed reducing repo operations, a virus scare, investors looking for a reason to pull profits then all those things snowball and you start to see consecutive days of downturns that maybe turns into a correction.

That is a lot of words on my part to say that I disagree with you that the market would ignore the Fed's actions on repo positions (especially when it is a significant change) just because the overnight rates have been consistent the last few months.

It was hyperbole on my part to say the virus has 0 impact. Of course it does, everything does because investing also has a psychological aspect that no amount of data can rationalize. So when there are factors like the Fed reducing repo operations, a virus scare, investors looking for a reason to pull profits then all those things snowball and you start to see consecutive days of downturns that maybe turns into a correction.

That is a lot of words on my part to say that I disagree with you that the market would ignore the Fed's actions on repo positions (especially when it is a significant change) just because the overnight rates have been consistent the last few months.

Posted on 2/1/20 at 10:20 am to BamaAlum02

quote:Well, yeah. The Fed takes open market actions in order to influence overnight interest rates to meet their stated rate goal. The two are inseparable.

You keep making this about interest rates and it is about actions of the Fed.

quote:The Fed had almost ZERO repo operations from the end of the 2008/2009 financial crisis up until last Fall and the stock market went up considerably during those years.

but generally when the Fed pulls back on repo positions the market reacts in a downturn

Believe what you want.

Posted on 2/1/20 at 10:58 am to LSURussian

quote:

The Fed had almost ZERO repo operations from the end of the 2008/2009 financial crisis up until last Fall and the stock market went up considerably during those years.

But they were taking other action, yes? I've said all along this is about the Fed's actions. They have multiple tools at their disposal and we are just seeing repo action these last few weeks.

quote:

Believe what you want.

Agree. If you believe the Fed's only influence on the market is when they change rates, I don't think we will see eye to eye. We're obviously both successful in our investing despite believing and watching different indicators or else we wouldn't have so much free time to screw around on a message board.

Posted on 2/1/20 at 11:45 am to BamaAlum02

quote:The Fed's repo "action" started last September.

we are just seeing repo action these last few weeks.

quote:I never said that. I said the Fed's recent pull back on its repo program was done to keep rates in its stated rate parameter, 1.5% - 1.75%.

If you believe the Fed's only influence on the market is when they change rates,

Posted on 2/1/20 at 12:01 pm to LSURussian

quote:

The Fed's repo "action" started last September.

I was talking about the recent pullback. You know the topic that has been discussed for 3 pages and includes multiple posts and graphs and analysis. But I think you already knew that.

quote:

I never said that. I said the Fed's recent pull back on its repo program was done to keep rates in its stated rate parameter, 1.5% - 1.75%.

Okay.

Popular

Back to top

0

0