- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Best retirement investment options if wife and I are already maxing 401k, IRAs?

Posted on 6/17/24 at 7:26 pm

Posted on 6/17/24 at 7:26 pm

My old Manager called me today and wants me to come back (he's tried to get me back before after leaving about a year and half ago, but the company wouldn't offer what I wanted) and offered me an amount I'm willing to consider for sure.

The only thing is the company I work for now matches 401k up to 4% and the old one doesn't really match anything notable. ($500 max a year no matter what you contribute).

But the raise will be about 6 times what that 4% is at my current job. Plus I'll get OT if I want, etc. So definitely makes up for it, but the extra won't be able to go into my 401k.

Any good options, or just invest it in S&P 500 index in a non retirement account and pay taxes on it?

Thanks for any help.

The only thing is the company I work for now matches 401k up to 4% and the old one doesn't really match anything notable. ($500 max a year no matter what you contribute).

But the raise will be about 6 times what that 4% is at my current job. Plus I'll get OT if I want, etc. So definitely makes up for it, but the extra won't be able to go into my 401k.

Any good options, or just invest it in S&P 500 index in a non retirement account and pay taxes on it?

Thanks for any help.

This post was edited on 6/18/24 at 8:14 am

Posted on 6/17/24 at 8:33 pm to NATidefan

I’m confused… couldn’t you still put it in the plan even if you don’t get a match?

Posted on 6/17/24 at 8:41 pm to LSUFanHouston

quote:

I’m confused… couldn’t you still put it in the plan even if you don’t get a match?

We are already maxing mine and my wifes. Max limit is 23k for 401k this year and 7k for IRA. We are putting in 46k in 401k and 14k in IRA already. Unless there is some way I'm unaware of, the only way to put more in is with company match which doesn't count towards your contribution limit.

This post was edited on 6/17/24 at 8:43 pm

Posted on 6/17/24 at 9:07 pm to NATidefan

What about a health savings account? Are you eligible for that?

This post was edited on 6/17/24 at 9:15 pm

Posted on 6/17/24 at 9:40 pm to LoneStar23

They do offer that. I'm 43, and in good health currently. Myself, wife, and kids are covered under my wifes ppo as is. They are both BCBS, and I don't think I can be under both. Her policy is either the price of just her, or her + whole family.

So, I'd really just have to look at that that closer I guess.

So, I'd really just have to look at that that closer I guess.

This post was edited on 6/18/24 at 7:55 am

Posted on 6/17/24 at 9:48 pm to NATidefan

Are after-tax contributions an option? Could be converting these to Roth.

Posted on 6/17/24 at 9:57 pm to UpstairsComputer

quote:

Are after-tax contributions an option? Could be converting these to Roth.

We both have traditional IRAs cause we expect to be in the same tax bracket when we retire as we are now. But we are eligible for roth based on salary. Can you max both to 7k? I was thinking you could do 7k total wither in roth, traditonal, or a mix of both. I guess I could google that. Lol

Eta: yeah, what I thought. You can only contribute the limit (7k) whether it's roth, traditonal, or mix of both.

This post was edited on 6/17/24 at 10:51 pm

Posted on 6/17/24 at 11:23 pm to NATidefan

Do they offer a backdoor roth 401k?

Posted on 6/18/24 at 7:31 am to hob

quote:

Do they offer a backdoor roth 401k?

I'm not sure, but unless I'm misunderstanding, I don't see how that would help me to contribute more. My wife and I combined are under the income limits for Roth, so we could contribute to a Roth directly if we wanted. No need to backdoor it. Backdooring doesn't raise the amount you can contribute right? It justs give you the ability to put it in a Roth instead of a Traditional if you earn more than the limit to contribute to a Roth... if I understand correctly.

We have been contributing to a traditional because I didn't think we would be in a higher tax bracket when we retire. Probably the same or lower than the one we are now. And I still think that is true.

We sit right below the middle of the 22% bracket currently if that helps. This raise would put us right in the middle of it.

Posted on 6/18/24 at 7:53 am to NATidefan

You should be maxing a Roth while in 22% bracket. Money left in a Roth for many years will grow more than you lose on current year taxes.

At the numbers you are saving towards retirement, I wouldn't focus extra savings/investments in retirement funds. You are doing enough there. Build your non-retirement investments. This will give you options in your 50s to use some money without penalty. I did this and was able to retire at 55. Regardless of retirement age, this approach provides good options on funds that are taxed differently.

At the numbers you are saving towards retirement, I wouldn't focus extra savings/investments in retirement funds. You are doing enough there. Build your non-retirement investments. This will give you options in your 50s to use some money without penalty. I did this and was able to retire at 55. Regardless of retirement age, this approach provides good options on funds that are taxed differently.

Posted on 6/18/24 at 8:02 am to NATidefan

a good brokerage account with tax loss harvesting might be the next option.

Posted on 6/18/24 at 8:12 am to KennytheTiger

quote:

You should be maxing a Roth while in 22% bracket.

From this it sounds like it doesn't matter which I choose since I think I'll be in the same tax bracket in retirement. However, they are only putting it 4680 post tax compared to 6000 pretax. But the limits are the same for roth and traditonal. So.. it does seem that I could get more in if I put 7k post tax vs 7k pretax by switching to a Roth now since I would be able to contribute more, right?

quote:

Scenario 1: Tax Brackets Remain the Same

In our first scenario, we examined the difference between a traditional IRA and a Roth account if a person’s tax rate (22%) is the same at age 60 as it was 30 years earlier. Someone who contributed $6,000 to a traditional IRA at age 30 would see her money compound at a greater rate over the next three decades compared to a Roth IRA. That’s because income tax would reduce the Roth contribution to $4,680, while the full $6,000 could grow within the traditional account.

As a result, the traditional IRA would be worth $60,376 after 30 years, while the Roth IRA would be worth $47,093. However, a person with a traditional IRA would pay nearly $13,000 in taxes at the time she withdraws her money, making her post-tax withdrawal exactly the same as the Roth IRA: $47,093.

SmartAsset: How Traditional IRAs and Roth IRAs Stack Up Against Each Other

The bottom line? If your tax rate is the same at the time of withdrawal as it was when you contributed to your IRA, it won’t matter which option you choose.

quote:

At the numbers you are saving towards retirement, I wouldn't focus extra savings/investments in retirement funds. You are doing enough there

It may seem so, but my wife and I didn't put away enough when we were younger, so we are playing catchup right now.

This post was edited on 6/18/24 at 8:24 am

Posted on 6/18/24 at 8:42 am to NATidefan

quote:

7k post tax vs 7k pretax

I hate trying to evaluate that. Your money is more efficient in traditional in your situation because you pay effective tax rates and not marginal but you can save more for retirement with Roth but you pay marginal tax rates on everything you put in.

Posted on 6/18/24 at 10:27 am to NATidefan

quote:

Backdooring doesn't raise the amount you can contribute right?

You can put $23K into a 401k and backdoor another $23k into a roth 401k

I'm not an expert but you need to talk to the employers HR.

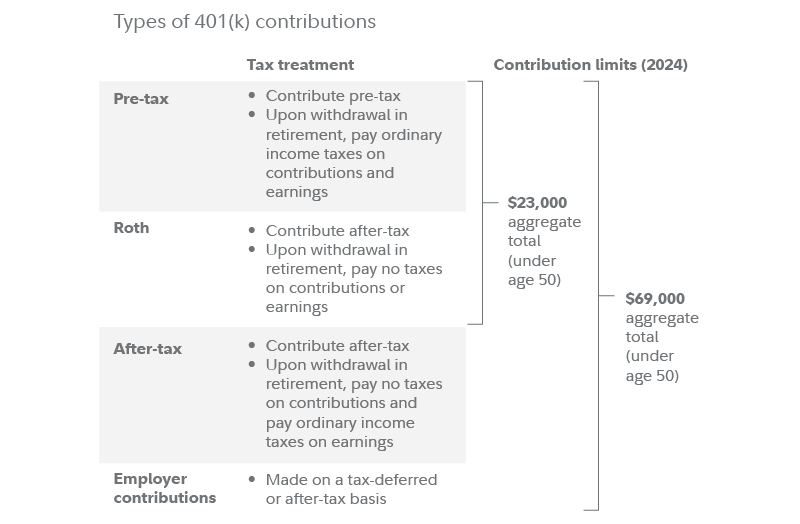

Here's an image from Fidelity

This post was edited on 6/18/24 at 10:31 am

Posted on 6/18/24 at 10:30 am to hob

Oh, sorry, I missed/missread that you said roth 401k. I thought you were meaning roth ira. They don't offer a roth 401k.

Posted on 6/18/24 at 10:32 am to hob

quote:

I'm not an expert but you need to talk to the employers HR.

I'm having them send me the benefits package to go back over today as some things have changed since I left and I'm in a much different postion financially since leaving ( when I left I wasn't able to max 401k, etc). I got a pretty decent raise to leave, and now looking at a pretty decent one to go back.

This post was edited on 6/18/24 at 10:33 am

Posted on 6/18/24 at 11:05 am to NATidefan

Save it outside of a qualified plan. Don't a government program to build wealth.

Posted on 6/18/24 at 12:48 pm to hob

quote:

You can put $23K into a 401k and backdoor another $23k into a roth 401k

No you can't. You've misinterpreted the chart. Look closely it says "aggregate" $23k

You may be getting confused w "mega backdoor Roth" where you contribute the additional post tax 401k contribution and if employer allows in service withdrawals immediately rollover the post tax to a Roth IRA.

Neither backdoor Roth (not applicable since OP is already maxing Roth IRA) or mega backdoor will work seamlessly for OP because they have traditional IRAs and would trigger pro rata rule (may still be worth doing especially if trad IRA balance is low)

This post was edited on 6/18/24 at 12:49 pm

Posted on 6/18/24 at 1:04 pm to hob

Fidelity: What is a Mega Backdoor Roth

Link to the article Hob referenced that chart from in case anyone else wants to read the specifics.

Link to the article Hob referenced that chart from in case anyone else wants to read the specifics.

This post was edited on 6/18/24 at 1:45 pm

Posted on 6/18/24 at 1:17 pm to KennytheTiger

quote:I don't see it that way.

You should be maxing a Roth while in 22% bracket. Money left in a Roth for many years will grow more than you lose on current year taxes.

I think 22% bracket is often better to shift to traditional contributions. Save 22% marginal now and at withdrwal you have to fill deductions, 19% and 12% bracket before first dollar is taxed at 22%. Even in likely event tax rates go up in future there likely will be signifigant room below 22%+ rate. The crux is effective s marginal tax rate and whether you anticipate signifigant other income sources at withdrawal (pension, rental income etc) that would consume deductions and low bracket space.

Even so, unlikely all withdrwals would fall above 22% for most people.

Wish I understood this sooner and made more traditional contributions myself. Even with a pension I have ample room for withdrwals before hitting 22% again.

This post was edited on 6/18/24 at 1:49 pm

Popular

Back to top

6

6