- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

U.S. Economy - No Recovery since 2007 - Gallup

Posted on 12/8/16 at 8:45 am

Posted on 12/8/16 at 8:45 am

LINK

This was posted last night in my thread, figure it needed it's own thread.

The Study

This was posted last night in my thread, figure it needed it's own thread.

quote:

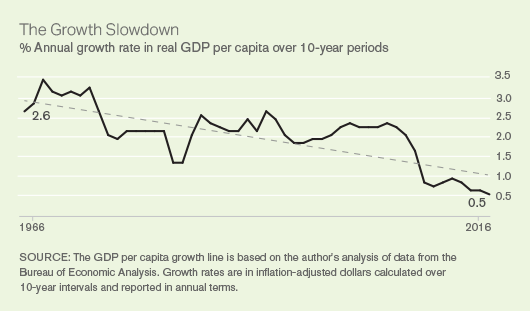

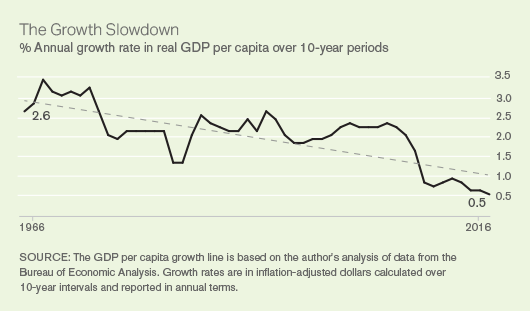

The study, released today, finds there is no recovery. Since 2007, U.S. GDP per capita growth has been 1%.

quote:

Think of our country as a company, America Inc., which has more than 100 million full-time employees, with about $18 trillion in sales and $20 trillion of debt. The most serious problem facing it is no growth. In addition, America Inc. has three soaring expenses threatening to bankrupt the company and its shareholder-citizens: healthcare, housing and education.

quote:

As this report notes, in 1980, these three sectors accounted for 25% of total national spending -- today, they account for more than 36%. They also account for most of the total measured inflation over the same period. And without inflation in these sectors, real annual productivity -- defined as GDP per capita growth -- would have been an estimated 3.9% instead of 1.7%.

quote:

My own opinion is that America Inc. is too big to "turn around" like one would a company or any other organization. There is no quick fix to something this huge and complex. But there is a long-term fix, which is to get GDP increasing to 3% and higher while slowing the increasing costs of healthcare, housing and education.

The Study

quote:

1. The problem is severe.

Since 1980, U.S. GDP per capita growth has been far below its longrun average, and since 2007 it has been almost negligible. From 1929 to 1979, real per capita GDP growth was 2.4% per year. Since then, it has been just 1.7% per year, and the most recent period has been particularly lackluster, both since 2007 (1% per year) and since 2009 (1.4%). These small differences expand into vast gaps in potential living standards. If 1% growth continued for the next 35 years, per capita GDP would increase from $56,000 in 2015 to just $79,000 in 2050. With 1.7% growth, GDP per capita goes up to $101,000 by 2050, and with 2.4% growth it enlarges to $129,000

quote:

3. Changes in living standards are fundamentally linked to changes in how the quality of goods and services relate to their cost. The most important advances in living standards have come from the introduction and development of products that lower the cost of accomplishing important tasks — like producing goods through mechanical power; seeing and communicating via electricity; traveling via trains, cars and planes; and preventing disease through better sanitation — or raise the quality-to-cost ratio, such as recent advancements in computing power and speed. Therefore, when the quality-to-cost ratio falls, living standards do as well.

quote:

4. Deterioration in the quality-to-cost ratio for healthcare, housing and education is dragging down economic growth.

After spiraling price increases, these sectors accounted for 36% of total national spending in 2015, up from 25% in 1980. These sectors account for most of measured inflation over the period, and without inflation in those

sectors, real annual GDP per capita growth would have been an estimated 3.9% instead of 1.7%.

quote:

5. The U.S. population’s health has stagnated or even declined on several measures since 1980, especially for the working-age population.

quote:

6. Housing costs have swallowed up a larger share of income without a corresponding increase in quality

quote:

7. Educational quality is weak and stagnant at all levels.

The U.S. education system has failed to instill any measurable gains in

the cognitive performance of children and young adults for decades, as

U.S. students and adults struggle with poor rates of literacy and numeracy

despite high spending growth.

quote:

8. A number of indirect consequences result from rising inefficiency in healthcare, education and housing

quote:

9. In these sectors, regulations have caused damage, which has accumulated over decades.

General explanations: A number of regulations affect many, if not all, industries and have increased in complexity and cost since 1980. Major regulations passed by the federal government in recent decades have accumulated over time to generate $250 billion in regulatory costs per year, as estimated by the White House’s Office of Management and Budget. These costs are hypothetically outweighed by benefits in terms of public health and other factors, but these benefits may not manifest in GDP accounts. State judicial rulings have increased the risk of firing workers by replacing at-will arrangements with implied contracts.

quote:

Excessive administrative expenses related to billing and claims processing have driven up healthcare costs. These costs are far lower in other countries, suggesting the unusual combination of federal rules and idiosyncratic private sector practices has led to massive inefficiencies. Healthcare costs are also artificially high as a result of state regulations that restrict the practice of non-physicians, forcing them to work under physician supervision, even where their training and expertise do not require it. This inflates the salaries of physicians and has contributed to excess growth in those salaries as demand for healthcare has increased.

quote:

Costs have skyrocketed in higher education without improving quality for two reasons. First, schools are not held accountable for poor performance, because federal subsidies — in the form of loans and aid such as Pell Grants — do not discriminate between schools. Second, across all institutions, colleges employ more workers per student than ever before and have shifted the types of workers they employ toward highly paid professionals, which now outnumber instructors

quote:

Meanwhile, places with a high share of single-family detached housing — the least intensive form of land-use regulation — saw significantly higher increases in housing costs and significantly lower supply growth in recent decades.

Posted on 12/8/16 at 8:47 am to BugAC

But unemployment ratez tho!!!! And the stock market is at ATH!!!

Posted on 12/8/16 at 8:50 am to BugAC

I don't think this will come as a surprise to anyone that is being intellectually honest. Median household income has either flatlined or decreased for about the last 20 years or so.

Posted on 12/8/16 at 8:51 am to BugAC

So, the analysis as a "jobless recovery" turns out to be false.

It wasn't a recovery at all.

"Managing the decline" is what allowed Trump to win, period.

It wasn't a recovery at all.

"Managing the decline" is what allowed Trump to win, period.

Posted on 12/8/16 at 8:53 am to BugAC

End. The. Fed.

Given what Trump inherited, improving the economy should be a fricking layup. If he can get the corporate tax lowered, repeal Obamacare, lessen regulation, and put a hiring freeze on Fed employees, he might go down as the next Ronald Reagan.

Given what Trump inherited, improving the economy should be a fricking layup. If he can get the corporate tax lowered, repeal Obamacare, lessen regulation, and put a hiring freeze on Fed employees, he might go down as the next Ronald Reagan.

Posted on 12/8/16 at 8:53 am to BugAC

quote:

39% - Share of Americans surveyed by Gallup saying that it is a good time to find a “quality job.”

quote:

1% Real per capita GDP growth per year from 2007 to 2015.

quote:

Political forces, not technical or scientific ones, are now the chief restraints on growth.

quote:

A SHIFT IN INDUSTRY COMPOSITION One possible explanation for the slowdown in GDP per capita is that employment growth has shifted from higher-productivity industries (like manufacturing) to lower-productivity industries (like healthcare, retail and other services). A formal way to test this hypothesis is compare average U.S. productivity today to what it would be if previous industry employment shares prevailed. It turns out that productivity would be no different today if industry employment patterns from 2007 or 1998 were still in place. In other words, employment losses in relatively high-productivity industries like computer and chemical manufacturing have been offset by job gains in high-productivity industries like computer systems design and related services, securities trading and other professional services. Indeed, some of the largest job losses in manufacturing have actually been in very low-productivity industries like apparel and leather manufacturing and textile mills. Thus, the recent GDP per capita slowdown is unrelated to employment shifts across industries. The economics literature of earlier periods also confirms this conclusion.11

There's another lib talking point blown out the water.

quote:

While Gordon makes a compelling argument that the prosperity gained from 1920 to 1970 was built upon truly revolutionary progress in science, technology and entrepreneurship, there is no scientific reason why progress cannot be achieved incrementally and in terms of other inventive or entrepreneurial breakthroughs. More fundamentally, it may be possible to achieve stronger growth even without the massive leaps in science and technology that characterized the first or second Industrial Revolution.

quote:

THE ROLE OF POLITICAL BARRIERS In contrast with Gordon, this report makes the case that political barriers are a primary reason for wilting growth. Such barriers may be holding back the efficient diffusion and adaptation of already existing ideas or technologies, such as IT in healthcare administration. The good news is that these are relatively easy to understand and overcome conceptually (unlike advances in, say, fuel cells or artificial intelligence) even if practical barriers to reform present enormous challenges.

quote:

He argued that businesses restrained competition through regulations, driving up prices. He wrote: “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.”16 Olson showed how these efforts can have a cumulative effect over decades, driving down economic progress

quote:

Baily has argued that regulatory inefficiencies and weak competition in education and healthcare have held back productivity gains.

quote:

Political barriers could also explain the relatively weak performance of Europe compared with the United States in recent decades. Analysts within and outside of Europe have long argued that major reforms to regulatory policies are needed there to achieve greater efficiency. The theory laid out by Olson applies to any developed country. The distinct history of the United States may have led to a relatively strong constellation of laws and regulations with respect to agriculture, manufacturing and technology, but a corrosive body of laws governing other sectors like healthcare and education. Housing, meanwhile, is highly regulated across developed countries, though there is little comparative data available to assess where regulations are more or less severe.20

Posted on 12/8/16 at 9:06 am to BugAC

quote:

Raising the quality of goods and services relative to their costs is the fundamental source of growth.

quote:

GDP IS INCOME In fact, the relationship between GDP and household income is more than an analogy. GDP can be defined as “gross domestic income,” which is the summation of worker compensation and the income of business owners (profits, dividends, etc.).21 GDP, therefore, is income. And GDP per capita is average income per person. That’s why its growth is fundamental to the wellbeing of residents, even if well-being includes many aspects of life not directly captured by GDP or household income.22

quote:

The only way to achieve high productivity, or GDP per capita, is through high-productivity growth. Human societies have never achieved sudden bursts of sustainable affluence. Most ancient prosperity, which was still quite low compared with today’s living standards, was achieved through extracting resources from other societies or slaves, not through efficient production.24 Humans were collectively quite poor until the Industrial Revolution ushered in growth that gradually — over centuries — transformed the productive capacity of societies

quote:

n standard macroeconomics, growth comes from positive technological change. Technological change is often described as the production of more things (such as industrial machines or cars) at the same or even cheaper costs, measured by the number of hours worked or other inputs. Yet, technological change is fundamentally an increase in the ratio of product quality to the cost of its production and distribution. If an entrepreneur or inventor implements a cheaper way to produce more goods or services of the same quality, then this results in an increase in the quality-to-cost ratio, and it will raise growth. Likewise, when a product is introduced to the market at high relative quality at similar costs, living standards increase. Smartphones, for example, accomplish many tasks previously performed by other devices, such as personal computers, standalone GPS systems, watches, landline telephone services, video game consoles and televisions. These qualities make the quality-to-cost ratio of a smartphone extremely high, allowing them to raise living standards, even if they lower demand for these other products. Along these lines, the growth of business revenue only increases GDP per capita if its product enhances the quality-to-product ratio. Otherwise, the business is only taking market share, and the product does not make the world richer, but reshuffles income away from other businesses that had been competing for consumer, business or government spending.

quote:

Three huge sectors — housing, healthcare and education — are getting more expensive without a corresponding increase in quality, and these are the focus of this report. Just as product enhancement increases productivity growth and living standards, its opposite — deterioration, meaning cost increases that exceed quality improvements — directly lowers living standards. On balance, the economy has expanded in recent decades, but it has done so much less rapidly than it could have as a result of weakness in these sectors.

quote:

The contribution of healthcare, housing and education to measured inflation since 1980 is OVER 50%

quote:

Here, the focus is on the key period between 1980 and 2015 when the slowdown in GDP growth per capita began. Over this period, private and public spending on housing, healthcare and education soared, and these sectors absorbed a larger share of GDP, going from an already substantial 25% to an enormous 36%. Of these, healthcare saw the largest jump, increasing from 9% to 18%.

quote:

Inflation data show that the spending increases in healthcare, housing and education relate to rising prices and not simply a shift in spending across service categories.

quote:

Education is 8.9 times more expensive in 2015 than in 1980. Within education, higher education specifically is 11.1 times more expensive. Healthcare costs 4.8 times more than it did in 1980, medical insurance costs 8.7 times more and housing 3.5 times more. Thus, the shift in spending toward education, healthcare and housing cannot only reflect increased demand. At a per-unit level, prices have also increased, driving up the share of spending on these products. This suggests that something is holding back supply.

Posted on 12/8/16 at 9:08 am to BugAC

The people intuitively know this.

How do you think Trump won?

It really is the economy, stupid.

How do you think Trump won?

It really is the economy, stupid.

Posted on 12/8/16 at 9:12 am to Aubie Spr96

quote:

End. The. Fed.

I think the question of whether Trump will do anything about the fed deserves its own thread. He railed on Yellen pre-election and called out our current bubble, but I wonder if he does anything about it.

Posted on 12/8/16 at 9:14 am to Aubie Spr96

quote:

If he can get the corporate tax lowered, repeal Obamacare, lessen regulation, and put a hiring freeze on Fed employees, he might go down as the next Ronald Reagan

I think he would surpass Reagan. Accomplishing those things will lead to a job BOOM in America.

The only thing that would make me leery as a major corporation is that the 15% rate s not permanent. You could invest billions in infrastructure over the next 4 year and when you start to operate, a dem comes in and raises it back up.

Posted on 12/8/16 at 9:18 am to CoachChappy

It's always gonna be a possibility. These things ebb and flow.

Posted on 12/8/16 at 9:19 am to BugAC

There is a lot more data i could post, but it would take forever, feel free to peruse. I doubt cruiserhog or the volfan guy will dare to debate what's in the report.

Here's a few more highlights.

Here's a few more highlights.

quote:

Self-reported health status fell for people ages 25 to 59 between 1990 and 2015.

quote:

28% Share of income spent on rent for a typical family in 2014, up from 19% in 1980.

quote:

1971 Year of peak literacy for 17-year-old Americans.

quote:

Health insurance as a share of worker compensation increased from 4.5% to 8.1% from 1980 to 2015.

quote:

DECLINING LABOR FORCE PARTICIPATION From 1962 to its peak in 1998, labor force participation for the working-age population (aged 18 to 64) increased dramatically from 66.3% to 79.0% as social barriers to female labor fell. Over that same period, men gradually started working less, but the gains for women more than offset this. Yet, after 1998, even the positive trend for women reversed itself, and since then, the share of working-age women who were out of the labor force increased from 28% to 31% along with the share of men, which continued to increase from 14% to 19%

quote:

As described previously, one can attribute much of this trend to the declining health status of working-age men and women. In fact, comparing responses to the 1980 Current Population Survey with responses in 2015, the percentage of people who are ill or disabled represents, by far, the single largest categorical increase for why people are not working.

quote:

As described previously, one can attribute much of this trend to the declining health status of working-age men and women. In fact, comparing responses to the 1980 Current Population Survey with responses in 2015, the percentage of people who are ill or disabled represents, by far, the single largest categorical increase for why people are not working.90 But in 1980, the share who were out of the labor force for family reasons was still high and falling. It may be more instructive to see what happens just after peak labor force participation in 2000. Among those out of the labor force during the previous week, from 2000 to 2015, 34% of the increase in nonparticipation among those aged 18 to 64 is explained by health, 29% by more people going to school, 16% from early-retirement, and 5% by people reporting they could not find work. Thus, the dominant reason given for why people are working less is poor health.

quote:

Many companies are devising strategies to minimize or avoid these giant healthcare costs by relying more heavily on part-time workers or contractual workers. The share of workers in temporary, contractual or on-call relationships with employers increased from 10% to 16% from 2005 to 2015.92 Over this same period, the percentage of workers in part-time jobs who would prefer full-time employment increased from 6% to 8.8%. The spike in involuntary part-time work from 2008 to 2009 and 2010 may be related to the Great Recession, but it has remained high even during the recovery. It may be that the Affordable Care Act, passed in early 2010, is playing a role, since it penalizes employers with at least 50 workers for not providing healthcare coverage for full-time employees, giving employers an incentive to reduce full-time opportunities. Less than half of involuntary part-time workers (44%) are covered by their employers, compared with 78% of full-time workers.

quote:

Provisions in the Affordable Care Act were designed to make it easier for the self-employed to purchase health insurance, but even in 2014, 23% of self-employed workers between the ages of 18 and 64 lacked health insurance, compared with 13% of wage and salary workers. For those who are self-employed and have insurance, only about half get it through their businesses.93

quote:

Whatever the reasons, people are much less likely to either be selfemployed or start firms with at least one employee. The number of new firms with at least one worker per capita has fallen by about half since the late 1970s. Although the downward trend has been going on for decades, it accelerated over the Great Recession and has not inched back up.

quote:

Since 1981, the annual costs of federal regulations have increased by an estimated $250 BILLION

Posted on 12/8/16 at 9:20 am to BugAC

I would think that "entitlements" are a bigger problem than those 3 items.

I put entitlements in quotes because nobody is entitled to anything except the opportunity to get a job and do something for a living. There are sorry arse layabouts who are 60 years old and have never had a job.

I am not including SS as an entitlement, since that is paid into by the taxpayer. But there should be STRICT time limits on how long someone can receive benefits.

I put entitlements in quotes because nobody is entitled to anything except the opportunity to get a job and do something for a living. There are sorry arse layabouts who are 60 years old and have never had a job.

I am not including SS as an entitlement, since that is paid into by the taxpayer. But there should be STRICT time limits on how long someone can receive benefits.

Posted on 12/8/16 at 9:22 am to alphaandomega

quote:

I would think that "entitlements" are a bigger problem than those 3 items.

Data suggests it's healthcare spending, education, and housing. There are entitlements included in all 3, but this is the broader scope.

Posted on 12/8/16 at 9:49 am to BugAC

Between the liberal media fake news and Obama administration bullshite data, Obama's 8 years in office have pretty much been smoke and mirrors. But apparently enough of the U.S. electorate saw the man behind the curtain.

Posted on 12/8/16 at 9:50 am to BugAC

Facts don't matter. According to libs and the mainstream media, Trump is about to coast on Obama's success. Any failures of Obama's are because of the mess he inherited from Bush.

It sure would be nice to have a job where I could blame my mistakes on the guy who worked here 8 years ago.

It sure would be nice to have a job where I could blame my mistakes on the guy who worked here 8 years ago.

Posted on 12/8/16 at 9:53 am to Blob Fish

Where are all the liberal fake news lovers? They should be in here defending their hero.

Posted on 12/8/16 at 10:33 am to BugAC

No shite. The largest economic collapse since the Great Depression happened between 2007 and today.

Popular

Back to top

11

11