- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Bosh Jarro is not a fan of the tax plan

Posted on 9/28/17 at 10:19 am to 90proofprofessional

Posted on 9/28/17 at 10:19 am to 90proofprofessional

quote:

once you have navigated all that, the number of brackets don't contribute shite to the overall complexity

Exactly. The number of brackets is completely irrelevant. We could have 1,000 brackets and it wouldn't matter

Posted on 9/28/17 at 10:23 am to 50_Tiger

quote:If we go by what Trump has repeatedly said, then nothing will change in regards to SS/Medicare.

Edit: Can we get rid of FICA too? I am not going to see any of it!

Posted on 9/28/17 at 10:32 am to Iosh

quote:

Bosh Jarro is not a fan of the tax plan

No idea who this is, but from what i've been hearing, the tax plan is a shite show. I'm actually kind of worried that Democrats would support it, because it effectively raises taxes on the middle class.

If the Dems obstruct because "Trump" then it won't have a shot at passing because Senators like Rand Paul and Ted Cruz would never allow it to pass.

Posted on 9/28/17 at 10:48 am to buckeye_vol

quote:

If we go by what Trump has repeatedly said, then nothing will change in regards to SS/Medicare.

BOOO!

I hate how all our policies benefit those with multiple kids, trusts, and/or being broke as frick.

Posted on 9/28/17 at 10:50 am to Iosh

They couldn't even repeal Obamacare.

Taxes ought to be a real hoot.

Taxes ought to be a real hoot.

Posted on 9/28/17 at 10:56 am to Iosh

quote:Based on his own summary, that is a patently stupid statement.

they've decided to take tax benefits away from middle-income people to give them to the rich.

Posted on 9/28/17 at 10:58 am to BugAC

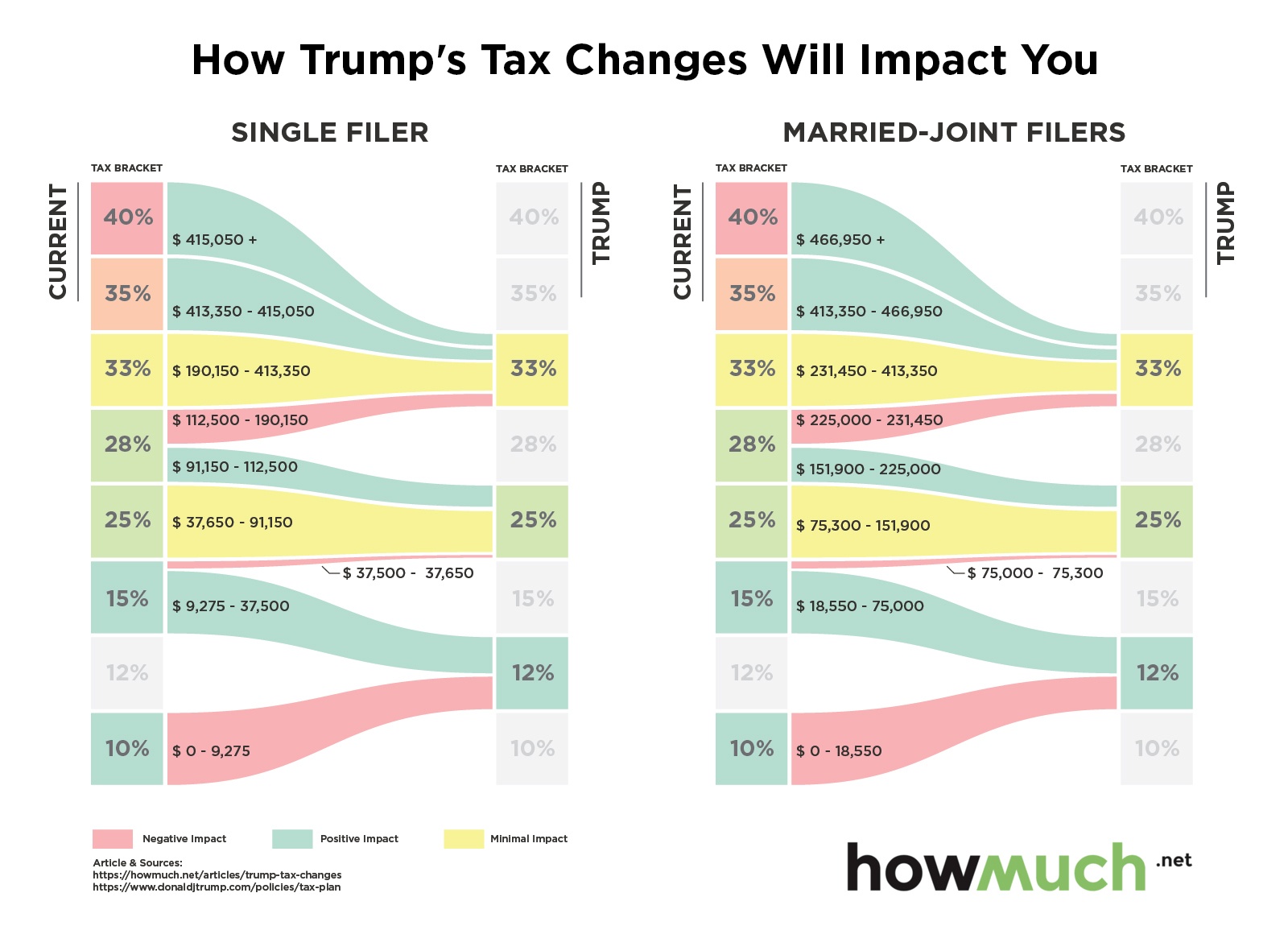

The basic framework of this plan will raise taxes on middle class homeowners. It will benefit the rich (big surprise) and may slightly benefit the poor. This is anything but middle class tax relief.

Posted on 9/28/17 at 11:05 am to Speedy G

quote:What are the income cutoffs for tax brackets?

The basic framework of this plan will raise taxes on middle class homeowners.

Posted on 9/28/17 at 11:16 am to NC_Tigah

quote:

What are the income cutoffs for tax brackets?

I don't know, that is why I referred to the basic framework.

But, it is virtually impossible to adjust the brackets enough to benefit middle class homeowners, on top of everyone else, without ballooning the budget deficit.

The bottom line is that selling this as 'middle class tax relief' is extraordinarily disingenuous. People who itemize their deductions and earn low six figures or less are the least likely beneficiaries. Those people make up the bulk of the middle class.

Posted on 9/28/17 at 11:20 am to Homesick Tiger

quote:

Totally disagree. Little Johnny and Little Mary should not have to hire lawyers and tax consultants today just to save the farm because their dad died yesterday.

Johnny Senior puts his farm into a family Trust, and no lawyers are ever needed again.

It's not expensive.

Posted on 9/28/17 at 11:24 am to Iosh

This new proposal is not what I want for the endgame but it is an improvement for me. $24k/yr deduction is quite a bit more than I deduct right now and I itemize. The most I can ever seem to get deducted is around $13k/yr.

Posted on 9/28/17 at 11:26 am to buckeye_vol

quote:I don't follow your logic. Unless you mean simply stupid.

Isn't one of the main goals to simplify the tax code, which is one if the reasons they are proposing fewer brackets? Maybe I'm alone in this, but given all of the complexities of the tax code, the brackets themsleves are pretty simple so going from 7 to 3 only makes a simple thing a little bit simpler.

So, in this plan, a married couple earning $225,000 pays $56,250 before deductions. Same couple earns one dollar more and they pay $74,250 before deductions, an increase of $18,000. Unless it's 25% on the $225k and 33% on the $1.

This post was edited on 9/28/17 at 11:27 am

Posted on 9/28/17 at 11:37 am to HubbaBubba

quote:

So, in this plan, a married couple earning $225,000 pays $56,250 before deductions. Same couple earns one dollar more and they pay $74,250 before deductions, an increase of $18,000. Unless it's 25% on the $225k and 33% on the $1.

Posted on 9/28/17 at 11:38 am to HubbaBubba

quote:

it's 25% on the $225k and 33% on the $1

Posted on 9/28/17 at 11:39 am to HubbaBubba

quote:I swear to god less than 10% of Americans understand how tax brackets work

So, in this plan, a married couple earning $225,000 pays $56,250 before deductions. Same couple earns one dollar more and they pay $74,250 before deductions, an increase of $18,000. Unless it's 25% on the $225k and 33% on the $1.

Posted on 9/28/17 at 12:00 pm to Iosh

quote:

I swear to god less than 10% of Americans understand how tax brackets work

You shouldn't be able to discuss tax policy if you don't understand how tax brackets work. I've spoken to otherwise intelligent people who didn't understand that your marginal tax rate is not what you pay on ALL of your income.

This post was edited on 9/28/17 at 12:00 pm

Posted on 9/28/17 at 12:03 pm to HubbaBubba

If we're going by that infographic on your post,

It would be 12% on the first $75,000;

25% on the next $150,000 ($75,001-$225,000);

and $33% on the next $1 ($225,001).

It would be 12% on the first $75,000;

25% on the next $150,000 ($75,001-$225,000);

and $33% on the next $1 ($225,001).

This post was edited on 9/28/17 at 12:04 pm

Posted on 9/28/17 at 12:09 pm to Speedy G

quote:

What are the income cutoffs for tax brackets?

I don't know

quote:That simply is not true.

it is virtually impossible to adjust the brackets enough to benefit middle class homeowners

Posted on 9/28/17 at 12:09 pm to Eli Goldfinger

quote:

Anything other than a flat tax will make me Very Disappointed.

Popular

Back to top

0

0