- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Vanguard Roth allocations

Posted on 4/15/15 at 12:48 pm

Posted on 4/15/15 at 12:48 pm

I just opened one with 5500 as last years contribution. I just finally have enough extra cash to start this now. I will be adding to it at a rate to get me 5500 more by the years end. This will be a supplemental to my current jobs plan.

Target retirement date is 2033. So should I go with one of their retirement target date funds or put it in some other fund(s).

Target retirement date is 2033. So should I go with one of their retirement target date funds or put it in some other fund(s).

Posted on 4/15/15 at 12:52 pm to Smirkeaux

If you don't want to ever think about it, it's a good option. Just pick a retirement date that has the allocation and glide path you are comfortable with.

Posted on 4/15/15 at 12:55 pm to Smirkeaux

I'm in the 2045 Retirement Target Fund

...2045....goddamn that's depressing

...2045....goddamn that's depressing

Posted on 4/15/15 at 1:30 pm to Smirkeaux

Target funds usually have higher costs than standard mutual funds. They should have a mutual fund picker that allows you to select some no-fee funds to purchase. I would recommend at least going through that process.

Posted on 4/15/15 at 1:48 pm to jimbeam

2035. Not bad at all.

The REIT and healthcare fund have been great for me.

The REIT and healthcare fund have been great for me.

Posted on 4/15/15 at 2:07 pm to Fat Bastard

Get the large, mid, and small cap growth index funds

Cheap and effective

Cheap and effective

Posted on 4/15/15 at 2:08 pm to white perch

Unless you want some bond exposure, which the TR funds provide.

Posted on 4/15/15 at 2:47 pm to Sigma

quote:

Target retirement date is 2033

Missed this part. Yea, you'll want some bonds in there too.

Look at the life strategy funds or the star fund

Posted on 4/15/15 at 3:13 pm to Smirkeaux

Vanguards target date funds are already appropriately diversified for you depending on your approximate age. They include bond funds already.

Also, their target date funds are very, very cheap. Mine costs 0.18% each year.

Also, their target date funds are very, very cheap. Mine costs 0.18% each year.

Posted on 4/15/15 at 3:49 pm to seawolf06

quote:

Target funds usually have higher costs than standard mutual funds.

.18 for target funds is higher then the admiral shares of a few mutual funds, but that's still pretty damn cheap.

Posted on 4/16/15 at 11:11 am to Oenophile Brah

quote:

.18 for target funds is higher then the admiral shares of a few mutual funds, but that's still pretty damn cheap.

Agreed.

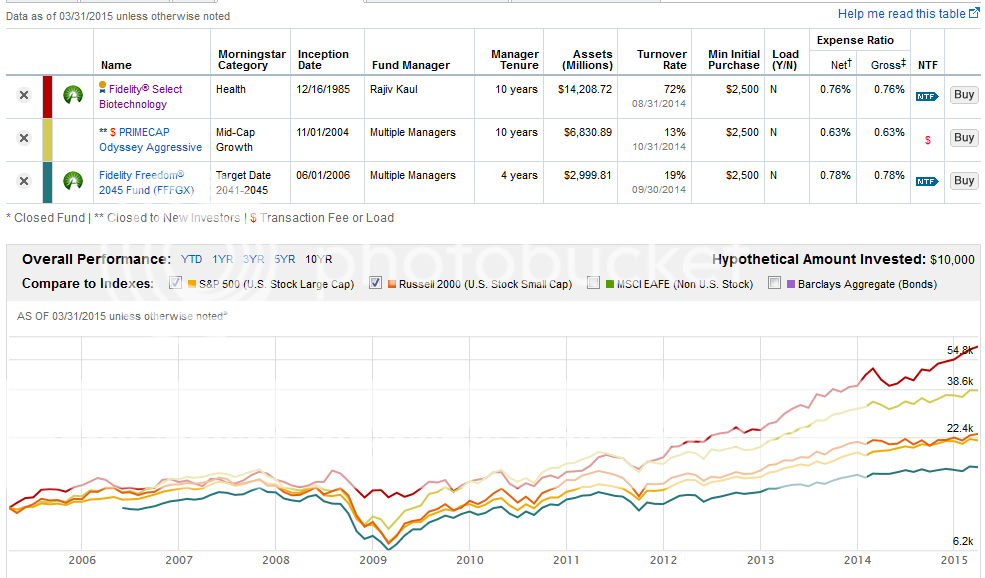

Actually, looking at Fidelity funds, the expense ratios are very close to all of my other mutual funds. The returns, however, are significantly lower.

Ex:

Popular

Back to top

4

4