- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Need advice on purching vs renting in my situation

Posted on 5/10/16 at 5:52 pm

Posted on 5/10/16 at 5:52 pm

Moving to Shreveport and starting med school in August. Loans will be my only source of income and real estate prices are relatively cheap up there. I'm looking to live by myself and that means either a 2bd and 1-2 bth home for sub 150k a year or renting a house/apartment for upwards of $1000 a month. Fiance is moving in next year and her first year with me she will be making a small amount of income through and externship before hopfully graduating and making 50-60k in her field.

My main question is, is a better idea to rent the four years I am there, with no way of getting that money back, or just have my parent co sign for a mortgage and try to get a decent starter home that I will hopefully sell post graduation?

I'm doing a lot of research into everything so any constructive criticism/advice is much appreciated.

My main question is, is a better idea to rent the four years I am there, with no way of getting that money back, or just have my parent co sign for a mortgage and try to get a decent starter home that I will hopefully sell post graduation?

I'm doing a lot of research into everything so any constructive criticism/advice is much appreciated.

This post was edited on 5/10/16 at 6:02 pm

Posted on 5/10/16 at 5:56 pm to SundayFunday

quote:

(No message)

Good luck to you

Posted on 5/10/16 at 5:58 pm to SundayFunday

quote:

SundayFunday

Nice try Johnny Manziel.

Posted on 5/10/16 at 5:59 pm to SundayFunday

Slipped in between a double post

Posted on 5/10/16 at 6:00 pm to BACONisMEATcandy

This is starting off lovely. Thanks phone..

This post was edited on 5/10/16 at 6:01 pm

Posted on 5/10/16 at 6:00 pm to SundayFunday

I doubt you would be able to get a mortgage with student loan as your income even with your parents co signing

Posted on 5/10/16 at 6:04 pm to Tigerpaw123

quote:

I doubt you would be able to get a mortgage with student loan as your income even with your parents co signing

This is my feeling as well, but I've been wrong before

Posted on 5/10/16 at 6:14 pm to Tigerpaw123

Well that was my first concern as well but the realtors I've been speaking with were assuring that this is a common thing with the incoming students in the Shreveport area.

So, to educate myself further, assuming I could get a loan, would this be a wise decision to pursue or would spending quite a bit per month in rent for a small apartment be a better decision?

So, to educate myself further, assuming I could get a loan, would this be a wise decision to pursue or would spending quite a bit per month in rent for a small apartment be a better decision?

Posted on 5/10/16 at 6:17 pm to SundayFunday

My wife and I just moved from Shreveport last year after she finished med school. You can easily find a decent place to rent for under $1000/mo. We rented in he south highlands area, and there were many 2 bed/1 bath apartments in the $700-$900 range.

"with no way of getting that money back" - You more than likely will not get your money back if you buy and are only there for 4 years. A majority of your mortgage in the 1st few years will be made up of mostly interest and little principle. Add on top of that the cost of owning a home, taxes, and closing costs when you sell and move for residency, and you'll most likely come out ahead by renting.

and lastly, the short time between your match and moving for your residency are not conducive to selling a house. There's a good chance you don't sell it right away and have to double up on living expenses when you move...and a resident salary aint that great.

"with no way of getting that money back" - You more than likely will not get your money back if you buy and are only there for 4 years. A majority of your mortgage in the 1st few years will be made up of mostly interest and little principle. Add on top of that the cost of owning a home, taxes, and closing costs when you sell and move for residency, and you'll most likely come out ahead by renting.

and lastly, the short time between your match and moving for your residency are not conducive to selling a house. There's a good chance you don't sell it right away and have to double up on living expenses when you move...and a resident salary aint that great.

Posted on 5/10/16 at 6:20 pm to lilsnappa

Well this is good info hear. Ok well from your advice, renting is a good idea. What areas do you recommend looking into relative to campus? I'm not too familiar with the area and I know some parts are shady.

Posted on 5/10/16 at 6:30 pm to SundayFunday

i wouldn't buy during med school or residency personally. You don't want the hassle and expense of yard work, home maintenance at that time during your life and it's a great feeling to just pack up and move to wherever you need to go for residency and after that your first job. Don't become an unintentional landlord by buying and not being able to sell when you do residency somewhere else.

I did med school in Houston and residency in Nashville so my situation was a little different due to higher real estate prices, but I wouldn't do it any other way if I had to do it again.

I did med school in Houston and residency in Nashville so my situation was a little different due to higher real estate prices, but I wouldn't do it any other way if I had to do it again.

Posted on 5/10/16 at 6:33 pm to SundayFunday

Another good thing about renting is that if you get there and don't like the area you're renting in, you can move after the lease ends. I changed apartments once in med school and again once in residency.

Posted on 5/10/16 at 6:46 pm to SundayFunday

I will present the other side. I bought during both med school and residency. At the end of med school, I got a $10,000 check for selling my house (not great, but also a nice start in residency). In residency (5 years), I was able to get a 2.75 interest rate and will likely have 30,000 in equity by the time I am finished.

I enjoy owning a house. I don't mind yard work. I also enjoy minor handy work. On the other hand, my residency isn't that hour intensive (60 hour week average). Just some things to think about.

I enjoy owning a house. I don't mind yard work. I also enjoy minor handy work. On the other hand, my residency isn't that hour intensive (60 hour week average). Just some things to think about.

Posted on 5/10/16 at 6:55 pm to GeauxTigers777

Thanks to everyone for the advice/personal stories. I'll take all that in mind.

Damn GeauxTiger, what residency did you go into?

Damn GeauxTiger, what residency did you go into?

Posted on 5/10/16 at 9:17 pm to SundayFunday

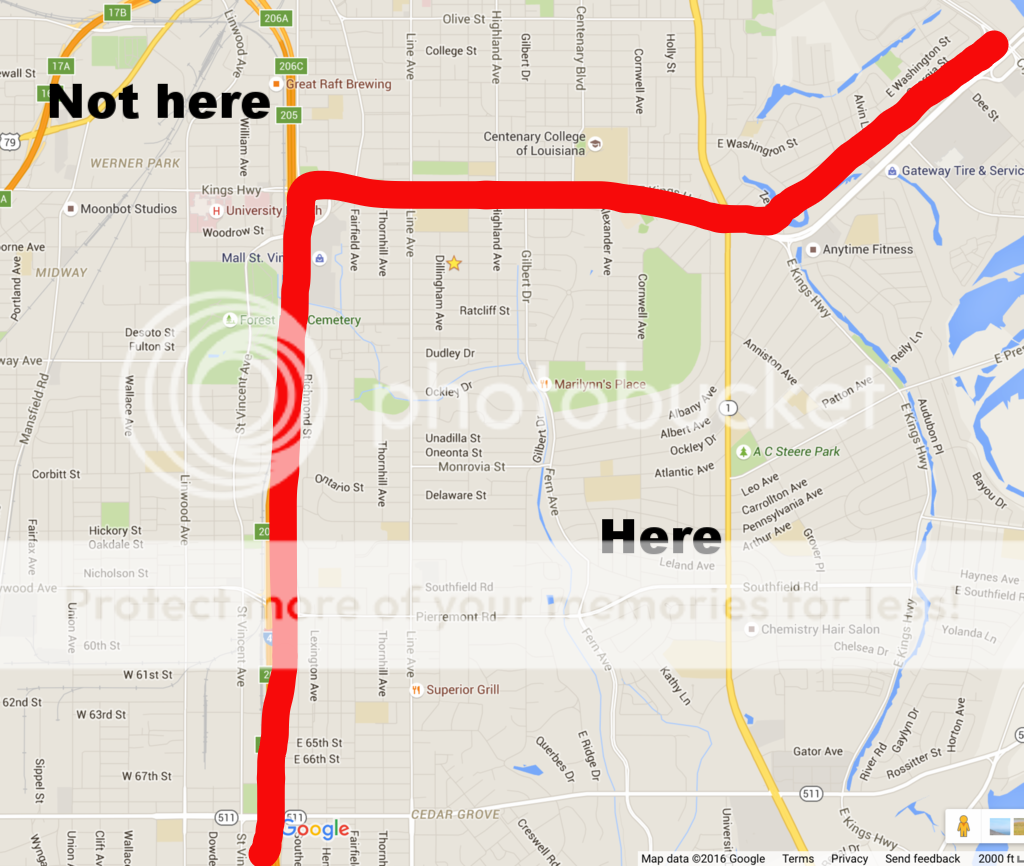

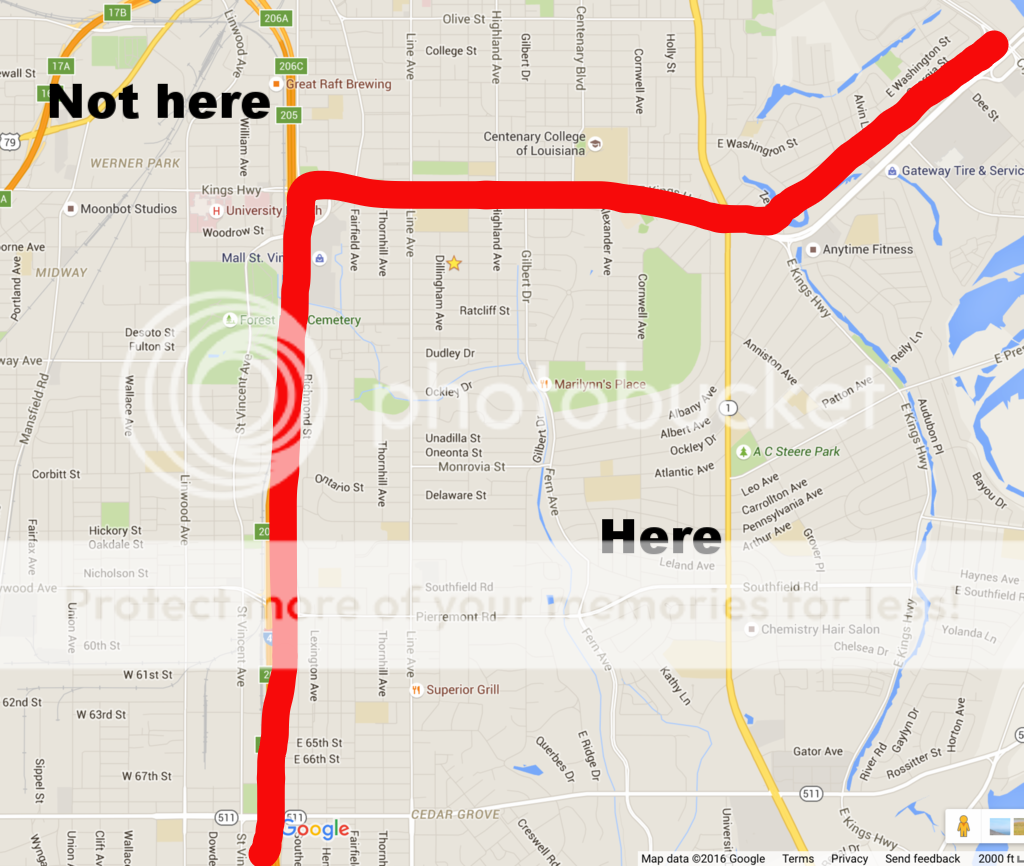

The star is where we lived.. less than a mile from the Hospital/School.

My recommendation is check out craigslist in that area or your best bet is just to drive around the area and look for "For Rent" signs in the yard. Thats how we found our place and it was great for the time we were there.

My recommendation is check out craigslist in that area or your best bet is just to drive around the area and look for "For Rent" signs in the yard. Thats how we found our place and it was great for the time we were there.

This post was edited on 5/10/16 at 9:20 pm

Posted on 5/11/16 at 9:09 am to lilsnappa

Cool. Those are the areas I was looking at so thanks for the advice! I think I've decided to look into the apartment complexes around the broadmore area until she moves up next summer. Then we can look into something bigger.

Posted on 5/11/16 at 9:50 am to SundayFunday

quote:

SundayFunday

Congrats on getting into med school! Wish you guys could have made it to the boil last Tuesday

Posted on 5/11/16 at 10:05 am to SundayFunday

quote:

My main question is, is a better idea to rent the four years I am there, with no way of getting that money back, or just have my parent co sign for a mortgage and try to get a decent starter home that I will hopefully sell post graduation?

either may be viable. what do you think of the ownership market the next few years?

if you are selling in 4, youll be paying a whole lot of tax, and insurance, and probably some repairs, closing costs etc...that you wont be getting back, just like the rent. without building a ton of equity the big question is do you think value is going up. otherwise, id venture it might be easier to just rent and save some troubles.

Popular

Back to top

9

9