- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Median FICO 8 scores

Posted on 7/9/15 at 7:57 am

Posted on 7/9/15 at 7:57 am

This is the most commonly used FICO credit score:

Millennials average a score of 662, which is lower than Generation X's 680 (understandable) and Baby Boomers' score of 734.

A 2013 study from the government claimed 1 in 5 people had at least 1 mistake on one of their credit reports.

Source is from CNN Money, dated July 6, 2015.

Millennials average a score of 662, which is lower than Generation X's 680 (understandable) and Baby Boomers' score of 734.

A 2013 study from the government claimed 1 in 5 people had at least 1 mistake on one of their credit reports.

Source is from CNN Money, dated July 6, 2015.

Posted on 7/9/15 at 8:00 am to Will Cover

Actually did my yearly check on my reports last week. No issues.

I'm 28. My FICO is 761. My wife's is 801. At least that's what Discover tells me.

I'm 28. My FICO is 761. My wife's is 801. At least that's what Discover tells me.

Posted on 7/9/15 at 8:00 am to Will Cover

Anyone know how accurate the "Your FICO Score" feature is for the Barclaycard Arrival Plus?

Posted on 7/9/15 at 8:01 am to Will Cover

Nothing eye opening... Kind of what I expected.

But damn, I wonder where the millenials score would be if not for my excellent credit propping it up

But damn, I wonder where the millenials score would be if not for my excellent credit propping it up

Posted on 7/9/15 at 8:26 am to Will Cover

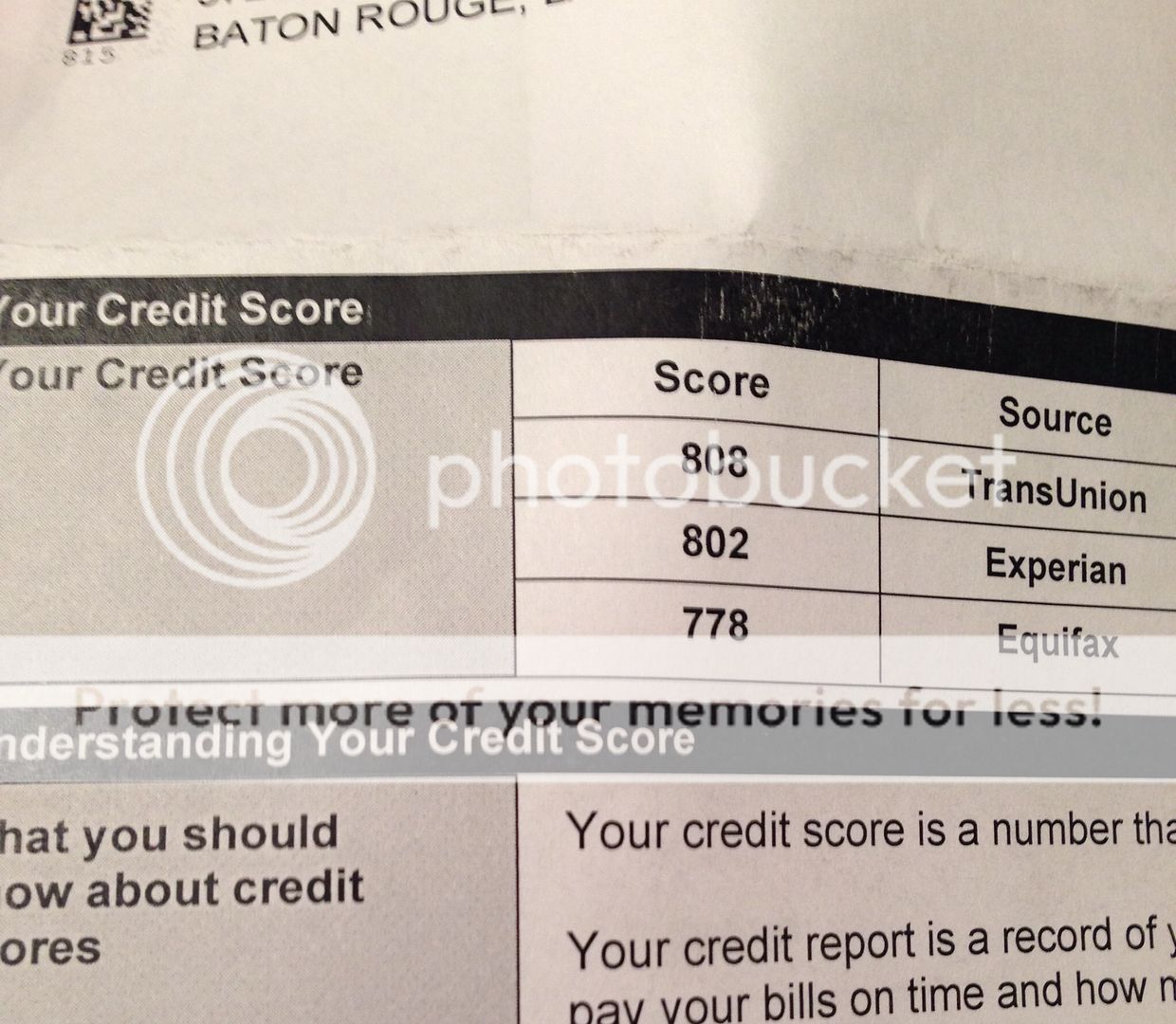

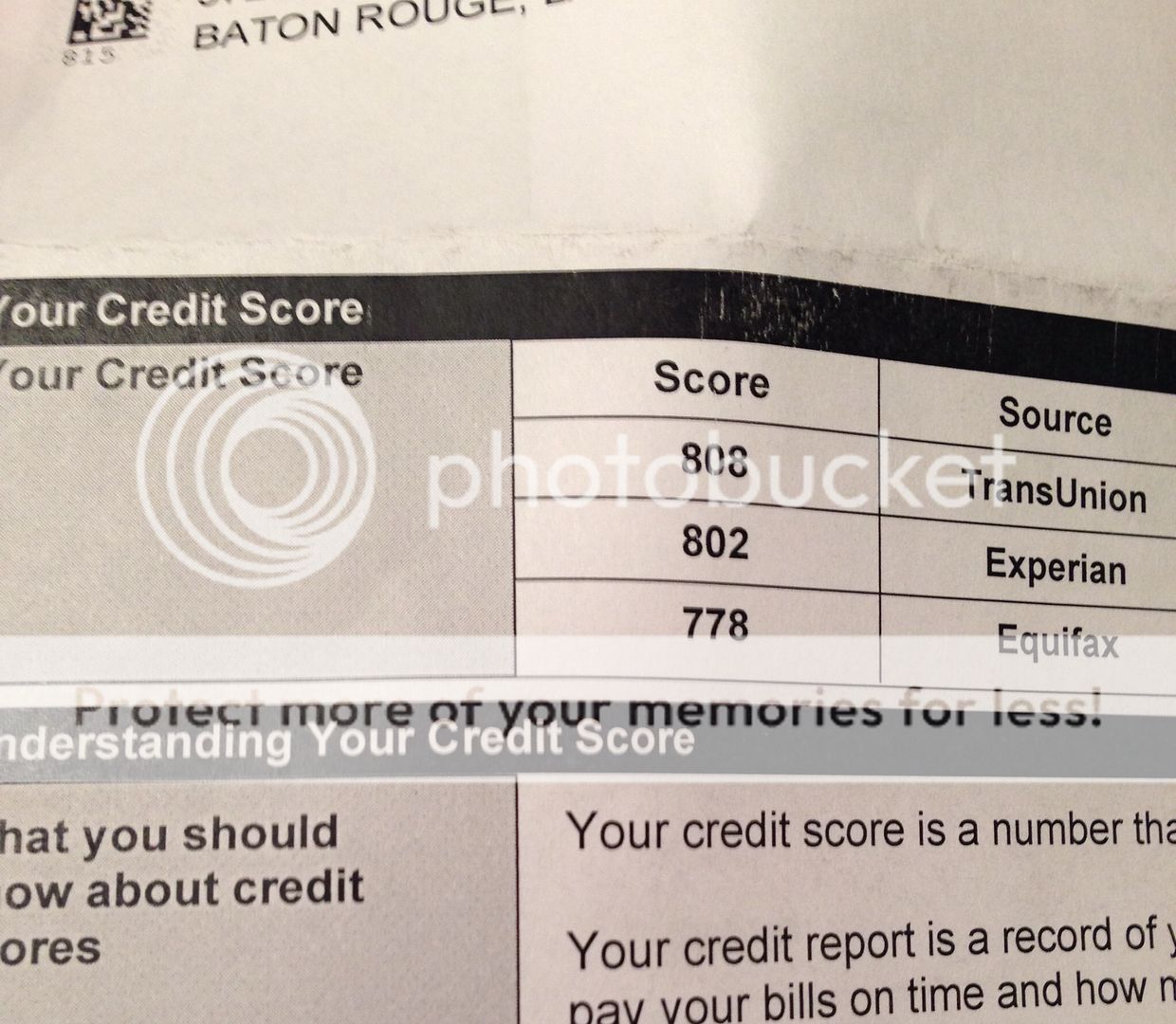

Millennial checking in

This post was edited on 7/9/15 at 8:27 am

Posted on 7/9/15 at 8:52 am to Lsut81

quote:

But damn, I wonder where the millenials score would be if not for my excellent credit propping it up

My wife is a Millenial as well. She has the highest credit score I have ever seen (TransUnion), regardless of age.

For me, I'm Generation X. 820 from Experian.

This post was edited on 7/9/15 at 9:05 am

Posted on 7/9/15 at 9:08 am to Will Cover

What's the highest a credit score gets?

Posted on 7/9/15 at 9:15 am to windshieldman

quote:

What's the highest a credit score gets?

For FICO model, 850.

Posted on 7/9/15 at 9:30 am to Will Cover

My FlexScore is only 726 :(

Posted on 7/9/15 at 9:31 am to Will Cover

Late Gen-X / Early Gen-Y checking in with an 828 (Experian)

Posted on 7/9/15 at 9:44 am to meeple

Mine is around 760-770 as a Millennial. I get dinged on number of lines of credit and length of credit lines.

I also always have credit inquiries because I move apartments every year and they do a credit check each time. The fact that this hurts my credit is ludicrous, BTW.

I also always have credit inquiries because I move apartments every year and they do a credit check each time. The fact that this hurts my credit is ludicrous, BTW.

Posted on 7/9/15 at 9:48 am to Will Cover

Also a Millennial.

I don't know how to get my FICO. I've never missed a payment or had anything big so I guess this should be generally accurate.

Posted on 7/9/15 at 9:52 am to lighter345

quote:

I don't know how to get my FICO.

The easiest way is to pull your FICO score at MyFICO.

Some credit card companies are also offering their customers a free FICO score from one of the credit bureaus. For example, Discover offers TransUnion.

This post was edited on 7/9/15 at 9:52 am

Posted on 7/9/15 at 9:55 am to Will Cover

I mean I get it is good to monitor my score, but if I don't have any big purchases on the horizon and all signs point to me having a good credit score there isn't much of a reason to pay for my FICO correct?

Posted on 7/9/15 at 9:57 am to Will Cover

We're about to take out a new mortgage on our final house. My goal is that this is the last tradeline I ever take.

My middle score when the bank pulled was 749. CreditKarma shows 780. Based on my limited research (one person), you can deduct 30 points off of your CreditKarma.

My middle score when the bank pulled was 749. CreditKarma shows 780. Based on my limited research (one person), you can deduct 30 points off of your CreditKarma.

Posted on 7/9/15 at 10:00 am to lighter345

quote:

I mean I get it is good to monitor my score, but if I don't have any big purchases on the horizon and all signs point to me having a good credit score there isn't much of a reason to pay for my FICO correct?

Your score is a result of your financial behavior. A score is not necessary to "monitor." However, you should always keep a watchful eye on your credit report as errors (or fraud) may be present.

Posted on 7/9/15 at 10:14 am to lynxcat

quote:

I also always have credit inquiries because I move apartments every year and they do a credit check each time. The fact that this hurts my credit is ludicrous, BTW.

Those are only a couple of points, each, though. I agree, though, that a soft pull shouldn't count at all (they're not extending you formal credit, but a utility, apartment, cellphone - whatever - that lets you float month-to-month). Just as applying for a mortgage might generate 3 to 5 (or more) if you're trying to be smart and "get banks to compete" - there is only going to be 1 line of credit advanced.

But - the system is what it is and it should all come out in the wash - and a good credit score is the cumulative result of good credit decisions , not a goal in and of itself (although it should be maximized as much as possible, immediately pior to opening or refinancing a mortgage).

Posted on 7/9/15 at 10:31 am to anc

quote:

My middle score when the bank pulled was 749.

So, what was that - your actual FICO, Transunion, Experian, Equifax?

quote:

CreditKarma shows 780.

CreditKarma was using a "VantageScore 3.0" model and now just gives you your Transunion and Experian. VantageScore 3.0 is a competing product to FICO, developed by the "big 3" credit reporting agencies (Transunion, Experian, Equifax). What you will find is that your "big 3" numbers will all track fairly closely (my Transunion and Equifax are typically within 5 points of each other) - and will depend on how frequent/recently they updated the information - and other variables are caused by some items appearing on 1 bureau's report, while others do not, and so forth.

Some folks FICO is higher than the CreditVantage, and for other folks, it is the reverse.

In particular, car dealerships are adept at getting a range of financing options - their finance folks are probably the experts on all these variables. On the other hand, for big ticket items, particularly mortgages and commercial financing where you're signing a personal guarantee, etc. - the FICO score will be used for the final credit decision the vast majority of the time (although that is changing, slowly).

Back to top

6

6