- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Leasing a vehicle; insurance question

Posted on 2/28/17 at 5:25 am

Posted on 2/28/17 at 5:25 am

So we are looking to get the wife a new vehicle. We are planning to purchase, but have realized we've never kept a vehicle as long as planned for some unforseen circumstance. We shuffled vehicles when we got married (sold my 3 year olf truck to make sure we both had a reliable lower cost vehicle). Recently sold our VW due to scandal at around 5 years. Looking to sell our 5 year old Tahoe since it's starting to fall apart.

Never looked at leasing before but starting to research since we are never that 10 year vehicle family. From what I see, you basically pay off the depreciation plus fees. My question comes with insurance. If my car is totalled, does insurance just pay off the lease and since I don't really have equity, I'm just left with no vehicle? In that case, it seems like a net 0 as I would only have been paid depreciated value anyway and would have only gotten an insurance check for my equity. With the lease, I'm paying less, so not building that equity. Am I looking at this correctly? Is there a large negative effect that I'm missing here?

I'm still far from pulling the trigger on a lease, but I think it may work for us.

1)we've averaged around 12k miles per year on my wife's vehicle and that was using it a lot as the primary car. We have a nicer second car that we use often now.

2)we've got about 15k in equity in our current vehicle and that help make a nice Roth IRA contribution this year

3)We don't have the best track record of keeping vehicles over the past 7 years all though it's always the plan.

I'll still never pull the trigger if the cost is a dollar more. But many vehicles are a savings at the 3 year mark when I read up on it. Granted those articles could be using examples that a generous to leasing.

Never looked at leasing before but starting to research since we are never that 10 year vehicle family. From what I see, you basically pay off the depreciation plus fees. My question comes with insurance. If my car is totalled, does insurance just pay off the lease and since I don't really have equity, I'm just left with no vehicle? In that case, it seems like a net 0 as I would only have been paid depreciated value anyway and would have only gotten an insurance check for my equity. With the lease, I'm paying less, so not building that equity. Am I looking at this correctly? Is there a large negative effect that I'm missing here?

I'm still far from pulling the trigger on a lease, but I think it may work for us.

1)we've averaged around 12k miles per year on my wife's vehicle and that was using it a lot as the primary car. We have a nicer second car that we use often now.

2)we've got about 15k in equity in our current vehicle and that help make a nice Roth IRA contribution this year

3)We don't have the best track record of keeping vehicles over the past 7 years all though it's always the plan.

I'll still never pull the trigger if the cost is a dollar more. But many vehicles are a savings at the 3 year mark when I read up on it. Granted those articles could be using examples that a generous to leasing.

Posted on 2/28/17 at 6:34 am to KG6

you made the smart choice, now put down as little as possible, have them roll it all into the lease even bc if you do one of those flex pays and pay the entire amount, yes if you're writing off for work you can write it all off this year, but if you go wreck the car next week you've got a big headache. It also sucks bc you have to have full coverage up to their limits but with that said I still lease all my cars. The headache of trading in cars is ridiculous as dealers will always rip you off and if you try to private party anything over $20-30k good luck with all the people who want to test drive it and kick tires while not even having the financing in place

Posted on 2/28/17 at 8:26 am to dabigfella

quote:

The headache of trading in cars is ridiculous as dealers will always rip you off and if you try to private party anything over $20-30k good luck with all the people who want to test drive it and kick tires while not even having the financing in place

This, selling my BMW private party was a freaking nightmare and the dealer wanted to give me like 7k under blue book. Finally got it sold after 5 months. I had only ever sold cars that were worth 5-7k, didn't realize the market is multiple times smaller.

I leased a Jeep GC and got a great deal, they took off another 6k off the car when i decided to lease instead of finance. Did 0 down, and i will love the idea of just tossing them the keys when the lease is up.

Posted on 2/28/17 at 8:34 am to KG6

Own vs Lease Thread from sticky

From the insurance perspective, most leases include GAP coverage (make sure it does), so if you total the vehicle, you just simply lose the vehicle. You do not gain any equity by leasing. However, the vehicle still has a value and the lease payoff has a value (which is basically the total of all remaining payments + residual).

From the insurance perspective, most leases include GAP coverage (make sure it does), so if you total the vehicle, you just simply lose the vehicle. You do not gain any equity by leasing. However, the vehicle still has a value and the lease payoff has a value (which is basically the total of all remaining payments + residual).

Posted on 2/28/17 at 8:37 am to LSUtigerME

Leasing is the worst. Be careful for hidden fees i.e. Broken windshields that will cost well over $800. Not to mention going over only 1000 miles could be around $300.

Posted on 2/28/17 at 8:44 am to Paul Allen

quote:

Leasing is the worst

Ok Dave Ramsey

Posted on 2/28/17 at 8:50 am to LSUtigerME

I actually read that thread in which prompted the insurance aspect. I'm trying to see if there's any way I'm left worse off in the event of totaling the vehicle.

In the case of owning, say I've had the vehicle for 1.5 years. I've been paying a note on the vehicle and I'm about broken even at this point. Insurance will cut me a check for the depreciated value. Basically enough to pay off what I owe. I come out net 0 since I had no equity in the car.

In the case of a lease, I get in an accident at the same time. I'm assuming the insurance must be such that it pays off the remaining lease terms. Again, I'm left with 0 because I have no equity.

The difference comes when I'd be right side up on payments when owning a vehicle. I'd have that equity and an insurance payment would give me back that equity. But paying less per month for the lease negates that advantage. Just looking to see that I'm not coming across some hidden negative.

Obviously there is an advantage to owning if you keep the vehicle for more than ~3 years.

I guess my other question is if you decide to purchase after the lease is up. What is the negatives there? Is it another set of TTL fees? Do you basically just pay off the residual value, which I'm thinking should all balance out. The lease pays off the depreciation, and you then take on the residual. Overall, you are paying nearly the same price for the vehicle except for a lot of random fees. I'm not saying that's a good approach to purchasing, just thinking out loud that it's another way to protect yourself from things like mileage overages and such.

In the case of owning, say I've had the vehicle for 1.5 years. I've been paying a note on the vehicle and I'm about broken even at this point. Insurance will cut me a check for the depreciated value. Basically enough to pay off what I owe. I come out net 0 since I had no equity in the car.

In the case of a lease, I get in an accident at the same time. I'm assuming the insurance must be such that it pays off the remaining lease terms. Again, I'm left with 0 because I have no equity.

The difference comes when I'd be right side up on payments when owning a vehicle. I'd have that equity and an insurance payment would give me back that equity. But paying less per month for the lease negates that advantage. Just looking to see that I'm not coming across some hidden negative.

Obviously there is an advantage to owning if you keep the vehicle for more than ~3 years.

I guess my other question is if you decide to purchase after the lease is up. What is the negatives there? Is it another set of TTL fees? Do you basically just pay off the residual value, which I'm thinking should all balance out. The lease pays off the depreciation, and you then take on the residual. Overall, you are paying nearly the same price for the vehicle except for a lot of random fees. I'm not saying that's a good approach to purchasing, just thinking out loud that it's another way to protect yourself from things like mileage overages and such.

Posted on 2/28/17 at 8:55 am to barry

It is. I'm no Dave Ramsey stalwart, but had a bad experience with a benign windshield crack that ended up being nearly a grand out of pocket.

Posted on 2/28/17 at 9:13 am to Paul Allen

quote:

but had a bad experience with a benign windshield crack that ended up being nearly a grand out of pocket

Do you not carry windshield coverage on your insurance. I learned my lesson recently on that. Paid for the stupid windshield coverage at the dealership. Later found out that it was full of language that could easily screw me. I wanted to make sure they used OEM glass since there were so many sensors that relied on the windshield. Later found out that I could get a 100 dollar deductible through my insurance and could request the OEM glass. I don't know how a lease would be any different. Repair that issue before returning the vehicle and you are good to go.

Any other major damage would be the same as a regular trade in. Either have additional depreciation due to the body or interior damage, or get it fixed. You are paying (or not receiving the money back, so paying more for your next vehicle) no matter what.

Leasing is a terrible option to keeping a car long term. I'm still not sold on it yet as I need to get to a point where we just set ourselves up better for the long term. We need to buckle down and just keep a vehicle for 7+ years. But I won't say it doesn't intrigue me as the numbers do work out in certain instances.

Posted on 2/28/17 at 9:16 am to KG6

It also depends on what vehicle youre looking at. Some vehicles(Tacomas, Tundras) Youre better off leasing. Some vehicles I would never lease.

Posted on 2/28/17 at 9:25 am to Paul Allen

quote:

Leasing is the worst. Be careful for hidden fees i.e. Broken windshields that will cost well over $800. Not to mention going over only 1000 miles could be around $300.

How the frick is leasing the worst? On normal cars its incredible, on exotics its out of this world value. My daily driver had a sticker of $52k+ I leased it for $3000 down and pay $399/mo for 27 months my total outlay is $13k + tax. It was a special deal bc it was a model that was gonna be replaced in 2 months or so. Anyways if I bought that car for even $47k in 2 years with a new model out, there was no way in hell I was selling it for $34k.

As Barry noted above, good luck selling anything worth a damn back to any dealer, whatever you think its value is, take another big number off bc thats what they will offer you. You can put it on ebay or craigslist, believe me I tried it years ago with a pretty expensive car it was the biggest waste of time ever and then I ended up doing a consignment to sell it. That was the last non exotic car I've ever bought.

Posted on 2/28/17 at 9:38 am to dshort_bruh

Some vehicles do lease much better than others. This can be due to a number of factors, but it requires each case to be evaluated independently. There's not really a blanket statement.

I've leased several personal vehicles and have ran the numbers on a lot of different cases.

I try to encourage viewing leasing as simply an alternative way of financing. The insurance payoff is exactly the same. Insurance value - Loan/Lease Payoff = Equity. Typically, leases do not have any equity as the payment is adjusted to reflect the depreciation. GAP insurance is typically included as well. Same for negotiations, there should not be any difference in negotiated price, unless the manuf has special incentives for leasing vs buying.

I'm not sure why your windshield was "screwing you" unless you were in a bad lease agreement or car was in bad shape. Just like trading a vehicle in, if one dealer isn't taking care of you go to another. I've traded in all of my recent leases, never "turned it in". And in each case I've received more than the Payoff value, allowing that to cover any fees/cap cost reduction on my next.

The potential issue with leasing is that it becomes a difficult cycle to break. However, if you are certain you'll want a new vehicle every 3-5 years, it can keep your cash flow lower.

I'd not recommend any lease to purchase option as it will typically cost you more. However, if you somehow find yourself significantly under mileage or a poor residual value, then it can make sense to purchase the vehicle at payoff value.

I've leased several personal vehicles and have ran the numbers on a lot of different cases.

I try to encourage viewing leasing as simply an alternative way of financing. The insurance payoff is exactly the same. Insurance value - Loan/Lease Payoff = Equity. Typically, leases do not have any equity as the payment is adjusted to reflect the depreciation. GAP insurance is typically included as well. Same for negotiations, there should not be any difference in negotiated price, unless the manuf has special incentives for leasing vs buying.

I'm not sure why your windshield was "screwing you" unless you were in a bad lease agreement or car was in bad shape. Just like trading a vehicle in, if one dealer isn't taking care of you go to another. I've traded in all of my recent leases, never "turned it in". And in each case I've received more than the Payoff value, allowing that to cover any fees/cap cost reduction on my next.

The potential issue with leasing is that it becomes a difficult cycle to break. However, if you are certain you'll want a new vehicle every 3-5 years, it can keep your cash flow lower.

I'd not recommend any lease to purchase option as it will typically cost you more. However, if you somehow find yourself significantly under mileage or a poor residual value, then it can make sense to purchase the vehicle at payoff value.

Posted on 2/28/17 at 10:08 am to LSUtigerME

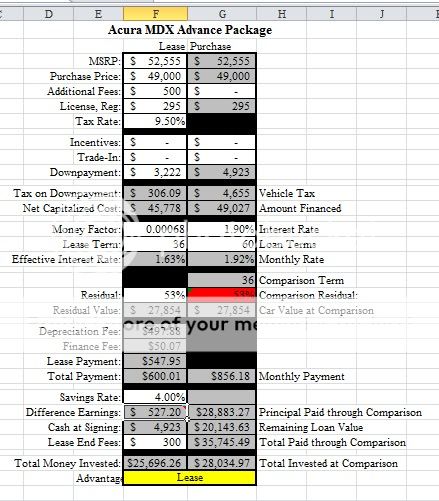

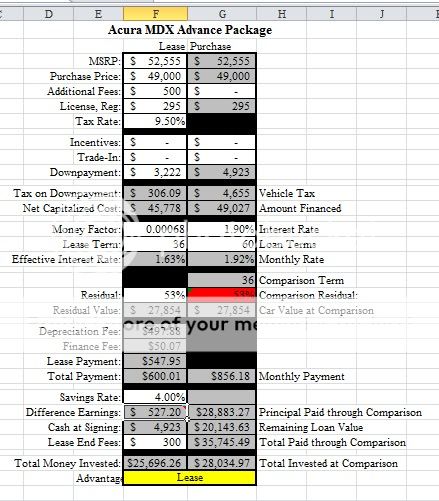

So I saw your excel sheet in the stickied thread. Is there a link or a way to get a copy of that or something similar? Or at least a good breakdown online of all the costs that you used to make that? I started to break it down on my own, but am a little busy at work today. Seems like a very good tool. Everything online is a bit to "simple" and obviously does not capture a lot of the costs.

This is my biggest fear. I have no issue doing the lease from a financial standpoint in the sense that I will only do so if it calculates to be financially advantageous at the 3 year mark. Otherwise, I'll just buy the thing then sell it in 3 years. But I know I'm going to take any leftover cash from this and put it in savings. Next time I go to buy, if we need to put down a payment, it's just harder to pull that cash out of savings as opposed to trading the value in. Plus there's obviously the missed out tax benefits of trading in a vehicle.

quote:

The potential issue with leasing is that it becomes a difficult cycle to break

This is my biggest fear. I have no issue doing the lease from a financial standpoint in the sense that I will only do so if it calculates to be financially advantageous at the 3 year mark. Otherwise, I'll just buy the thing then sell it in 3 years. But I know I'm going to take any leftover cash from this and put it in savings. Next time I go to buy, if we need to put down a payment, it's just harder to pull that cash out of savings as opposed to trading the value in. Plus there's obviously the missed out tax benefits of trading in a vehicle.

Posted on 2/28/17 at 10:49 am to KG6

LINK

That's probably my favorite website that details out the leasing process. A lot of the base lease information comes from there, then some other came from actually going through the process, notably taxes, etc.

I don't have the spreadsheet posted anywhere but I can email it to you if you'd like.

Another thing you'll notice is many dealers/manuf. try to hide the factors used to determine lease payments. Most will give it to you if you request it. If you google well, you can find the factors used (money factor and residual for each make/model/trim), Edmunds car forum is great for this. Advertised lease deals are a good way to back into these numbers if you do the math. In general, the money factor and residual % will apply to the same model regardless of trim (some manuf do reduce residual of certain options differently).

That's probably my favorite website that details out the leasing process. A lot of the base lease information comes from there, then some other came from actually going through the process, notably taxes, etc.

I don't have the spreadsheet posted anywhere but I can email it to you if you'd like.

Another thing you'll notice is many dealers/manuf. try to hide the factors used to determine lease payments. Most will give it to you if you request it. If you google well, you can find the factors used (money factor and residual for each make/model/trim), Edmunds car forum is great for this. Advertised lease deals are a good way to back into these numbers if you do the math. In general, the money factor and residual % will apply to the same model regardless of trim (some manuf do reduce residual of certain options differently).

Posted on 2/28/17 at 12:32 pm to LSUtigerME

quote:

I'd not recommend any lease to purchase option as it will typically cost you more.

Agreed, it is typically a bad deal most of the time. However, check the payoff value against KBB and it may be a good deal. Never hurts to check.

Plus, if you want to break the leasing cycle, at least you have to option of purchasing what is essentially a used car that has only had 1 driver, you. And the payments wouldn't be terribly high on that finance deal.

Posted on 2/28/17 at 8:28 pm to LSUtigerME

So, I think I've derived all of your Excel cells. I'm getting it to spit out the same answers you have when I use your inputs except for one thing.

Only thing I'm not 100% on is the "Difference Earnings" cell in the lease option. I'm having to directly put in what came from your screen shot to get the rest of the cells to calculate. I'm assuming this is the interest gained by keeping the "monthly savings" of leasing vs. buying in an interest bearing account at 4%? I just can't get it to calculate to the exact 527.20 value you show. I keep coming up like 40 bucks different. So I'm not sure if I'm looking at it correctly. In any case, I would think the sheet would be more conservative in estimating the "value" of a lease if that was left as 0 anyway.

Thanks for posting that. Breaking it down and trying to figure it how you calculated each cell lets me get a firm grasp on all the costs that go into each option.

I still have heart burn with the idea of leasing. But I am no longer completely opposed to it. My fear is that it will lead me to buy a vehicle I would otherwise shy away from due to the monthly note being higher than I'd like. Once a note hits 500, I feel like I'm spending too much. I just need to focus on it as if it were a purchase, then look at the lease as an alternative option and only lease if I were willing to buy. Easier said than done when there is a shiny new car in front of you and you are willing to pay 500 a month

Only thing I'm not 100% on is the "Difference Earnings" cell in the lease option. I'm having to directly put in what came from your screen shot to get the rest of the cells to calculate. I'm assuming this is the interest gained by keeping the "monthly savings" of leasing vs. buying in an interest bearing account at 4%? I just can't get it to calculate to the exact 527.20 value you show. I keep coming up like 40 bucks different. So I'm not sure if I'm looking at it correctly. In any case, I would think the sheet would be more conservative in estimating the "value" of a lease if that was left as 0 anyway.

Thanks for posting that. Breaking it down and trying to figure it how you calculated each cell lets me get a firm grasp on all the costs that go into each option.

I still have heart burn with the idea of leasing. But I am no longer completely opposed to it. My fear is that it will lead me to buy a vehicle I would otherwise shy away from due to the monthly note being higher than I'd like. Once a note hits 500, I feel like I'm spending too much. I just need to focus on it as if it were a purchase, then look at the lease as an alternative option and only lease if I were willing to buy. Easier said than done when there is a shiny new car in front of you and you are willing to pay 500 a month

Posted on 3/1/17 at 10:40 am to KG6

The answer to your initial question is gap coverage; it's built in to some leases, and if not, you can add it to your insurance policy. General rule of thumb when leasing is put as little down as possible.

Secondly, those who make blanket statements that "leasing is the worst" are idiots. As a few have mentioned here, some models lease better than others. Manufacturers will push leases by artificially raising the residual or offering incredibly low money factors. Edmunds forums is a good place to start. I was lucky to build a relationship with a salesman at my local mb dealership and he would always advise which models were leasing the best at the time; usually always the base engine c and e classes. BMW is typically very aggressive with their leases as well, Audi not so much.

Secondly, those who make blanket statements that "leasing is the worst" are idiots. As a few have mentioned here, some models lease better than others. Manufacturers will push leases by artificially raising the residual or offering incredibly low money factors. Edmunds forums is a good place to start. I was lucky to build a relationship with a salesman at my local mb dealership and he would always advise which models were leasing the best at the time; usually always the base engine c and e classes. BMW is typically very aggressive with their leases as well, Audi not so much.

Posted on 3/1/17 at 10:44 am to LSUtigerME

quote:

From the insurance perspective, most leases include GAP coverage (make sure it does), so if you total the vehicle, you just simply lose the vehicle. You do not gain any equity by leasing.

dealers gap coverage is a rip off and a money maker, talk to your actual insurance agent first.

Posted on 3/1/17 at 12:42 pm to Chad504boy

quote:

dealers gap coverage is a rip off and a money maker, talk to your actual insurance agent first.

It's free bro

Posted on 3/1/17 at 9:58 pm to dabigfella

Do you know if anyone that does consignments in Baton Rouge area?

Back to top

3

3