- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

How much wealth do you need to join the 1% club in your country?

Posted on 2/29/24 at 10:36 am

Posted on 2/29/24 at 10:36 am

quote:

The entry barriers to the 1% rich club have been getting tougher across the world. Here’s how much you need to join the ranks of the wealthiest people in your country.

Wealth creation, largely fueled by a “robust performance” of the U.S. economy and a rebound in the equity markets, has pushed the minimum requirements for people to qualify as the richest in their respective countries, according to Knight Frank’s wealth report.

The global consultancy notes that Monaco, which has the world’s densest population of millionaires, retains the number one spot for entry into the 1% rich club at $12.9 million, rising 4% from a year ago.

Second in line is Luxembourg, which has an entry requirement of $10.8 million, followed by Switzerland at $8.5 million. The U.S. comes in fourth, with $5.8 million, up 15% from a year earlier.

At $5.2 million, Singapore is fifth globally and leads the Asia-Pacific region in terms of the wealth needed to break into the elite club.

The city-state, alongside Hong Kong, is leading the charge to host Asia’s newly minted wealthy.

The two are offering tax incentives and business-friendly regulations to attract 1,100 family offices that manage over $4 trillion in assets.

As exclusive as the 1% club sounds, it’s still relatively “easier” to break into its ranks than it is to be an Ultra High Networth Individual (UHNWI), which has a global average entry point of $30 million, according to Knight Frank.

quote:

“As Western countries in particular grapple with government deficits and the need to raise tax revenue, expect greater policy focus on where wealth is located,” Bailey added.

He emphasized that governments will have to walk a tightrope between taxing wealth and encouraging its growth as they strive to grow their economies.

The number of wealthy individuals is expected to rise by 28.1% in the five years to 2028, which is much lower compared with the 44% increase seen in the five-year period to 2023, Knight Frank noted.

The latest numbers also underscore the divide between the world’s rich and poor. Since 2020, while the world’s five richest men have more than doubled their fortunes, five billion people have become poorer, according to a report by global organization Oxfam America.

CNBC: How much wealth do you need to join the 1% club in your country?

Posted on 2/29/24 at 10:44 am to fareplay

quote:

Tax the rich

they already do

Posted on 2/29/24 at 10:45 am to saint tiger225

I don't even have enough wealth to join the country club in my city.

Posted on 2/29/24 at 10:49 am to saint tiger225

Bro, I was mad about the Wendy's price bump.

Posted on 2/29/24 at 10:53 am to fareplay

quote:

Tax the rich

That's a groundbreaking idea. Why haven't we done that yet?!?!

Posted on 2/29/24 at 10:57 am to LoneStar23

We do. We just don't tax them as much as 1) we used to or 2) as much as we tax people making much less. Even some of the wealthiest people in our country have noted this inequity.

Posted on 2/29/24 at 10:58 am to Master of Sinanju

Is this number net worth or investable assets?

Posted on 2/29/24 at 11:01 am to nitwit

quote:

1) we used to or 2) as much as we tax people making much less

tell me you have zero idea how taxes work without telling me

you are dumb

Posted on 2/29/24 at 11:09 am to lsu777

quote:

tell me you have zero idea how taxes work without telling me

you are dumb

tell me you have zero idea how percentages work without telling me

you are dumb

Posted on 2/29/24 at 11:13 am to nitwit

quote:You bought into Warren Buffett's PR bullshite?

We do. We just don't tax them as much as 1) we used to or 2) as much as we tax people making much less. Even some of the wealthiest people in our country have noted this inequity.

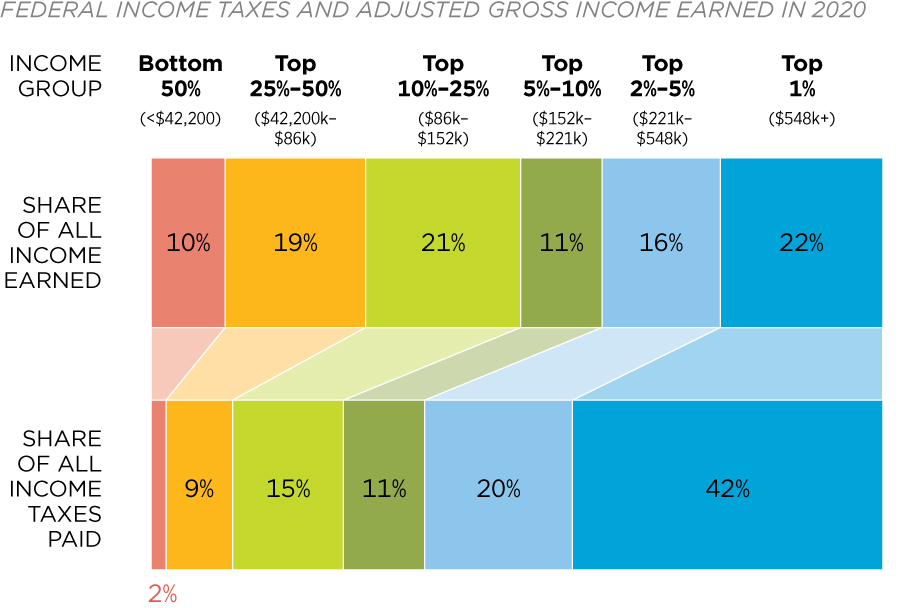

In 2020, the latest year with available data, the top 1 percent of income earners earned 22 percent of all income and paid 42 percent of all federal income taxes – more than the bottom 90 percent combined (37 percent).

Posted on 2/29/24 at 11:14 am to 404 Error

Income isn’t the same as wealth. Elon at one point made no income but was worth billions

Posted on 2/29/24 at 11:16 am to fareplay

quote:

Income isn’t the same as wealth. Elon at one point made no income but was worth billions

This won't make any sense to him, I assure you.

Posted on 2/29/24 at 11:17 am to fareplay

Why is your response "tax the rich"?

Posted on 2/29/24 at 11:19 am to saint tiger225

Because accumulation of wealth via loopholes in taxes and other illicit financial activities is how the 1% generates their wealth. Most likely not a federal tax w2 income and therefore should be taxed in some way to reduce income taxes for rest of us 99%

Posted on 2/29/24 at 11:20 am to Maderan

quote:

investable assets?

Huh? How do you define this?

Posted on 2/29/24 at 11:21 am to fareplay

quote:

Elon at one point made no income but was worth billions

and has still paid more in taxes than anyone in American history

the highest short-term capital gains tax rate is just as high as the highest income tax bracket rate (37 percent)

Posted on 2/29/24 at 11:22 am to fareplay

I guess I'm more of the opinion governments should spend less instead of taxing more.

Posted on 2/29/24 at 11:22 am to Bunsbert Montcroff

He paid the most because he earned the most (in some years) but it wasn’t proportional to his wealth

Also short term cap gains only applies to poorer people. Wealthy would hold

Also short term cap gains only applies to poorer people. Wealthy would hold

This post was edited on 2/29/24 at 11:25 am

Popular

Back to top

15

15