- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: ‘Seriously Underwater’ Home Mortgages Tick Up Across the US

Posted on 5/9/24 at 11:26 am to lsufan1971

Posted on 5/9/24 at 11:26 am to lsufan1971

quote:No idea what you're talking about.

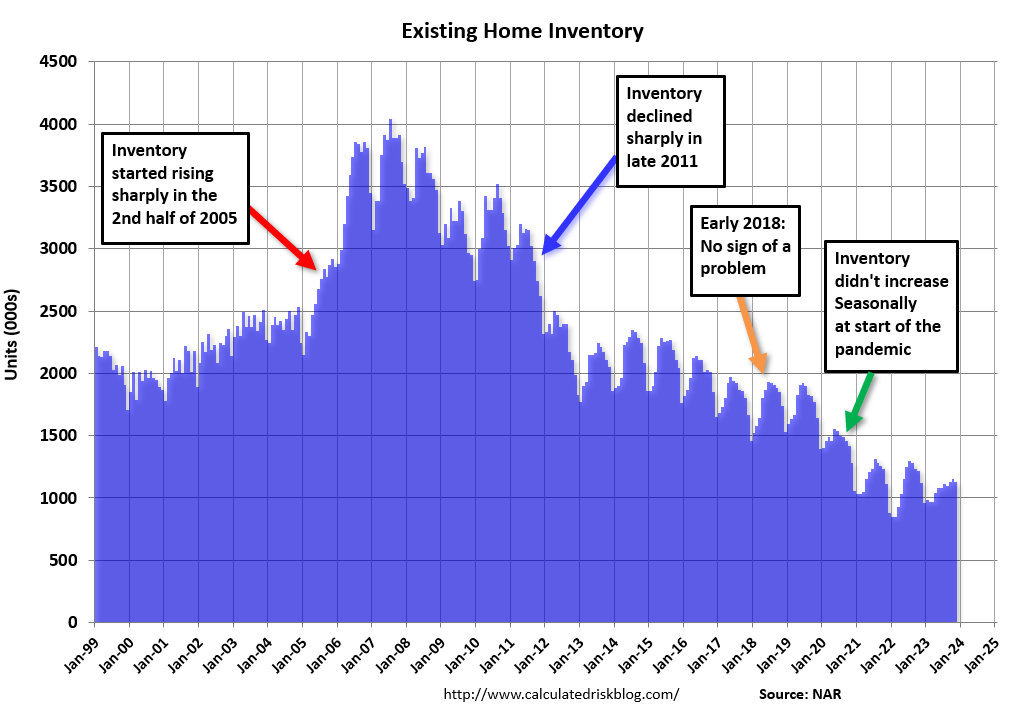

We are getting close to 2007 numbers.

quote:WTF are you talking about?

Big issue with negative equity loans are usually subprime short term with balloon payment.

quote:

Banks never stopped MBS or CDO’s. We are headed there again I’m afraid.

quote:You dumbass.

We are headed there again I’m afraid.

Posted on 5/9/24 at 11:39 am to JohnnyKilroy

quote:

Are you saying people who no longer have a mortgage? If so, hardly any.

Well, presumably that number of underwater mortgages plummeted during COVID because people refinanced to sub-3% interest rates combined with the home values going up by 30%+.

Posted on 5/9/24 at 11:53 am to Big Scrub TX

Idk about 08 since I was a little kid but I’d assume that with stagnant wage growth for people who are in the market to buy a home combined with cost of other goods rising, people will have to make some tough decisions

Posted on 5/9/24 at 12:16 pm to PhilemonThomas

quote:

Used golf carts about to be cheap.

Damn I hope so...we need another one....

Posted on 5/9/24 at 12:30 pm to AwgustaDawg

quote:

Damn I hope so...we need another one....

Add me to that list. We're gonna get one after we buy a place. Would have one now, but for some reason our apartment parking garage doesn't allow them.

This post was edited on 5/9/24 at 12:30 pm

Posted on 5/9/24 at 12:32 pm to Big Scrub TX

quote:

You think a recession necessarily means much lower house prices?

No, nor did I say that a recession necessarily means lower house prices.

In this instance, it may but it's going to depend on how things play out. If the consumer debt bubble pops, if Unemployment goes too high for too long, etc.

Posted on 5/9/24 at 12:35 pm to Big Scrub TX

From what I read, yes. Def won’t go up, may be steady, but likely go down

Posted on 5/9/24 at 12:43 pm to Areddishfish

Mortgage companies should have to eat the upside down amount for being stupid enough to lend more than the homes are worth.

Posted on 5/9/24 at 12:45 pm to Deactived

quote:

If youre in the house you plan on living in forever, does it matter much if you overpaid for it?

We(as in people) overpay for stuff all the time

You know I agree with this if it is a purchase such as a home. The house I currently live in just appraised for over $215 per sq foot and I bought less than a mile away an older home in a bigger neighborhood for almost $100 sq more. But it had a lot of upgrades that I paid for. But I liked them, and I plan to live in this home for a long time and it was the area I wanted so I didn't really care.

Posted on 5/9/24 at 12:46 pm to lsufan1971

quote:

We are getting close to 2007 numbers. 2008 is when the bottom started to fall out.

The big difference from ‘08 is you could walk away from your mortgage and slip into a rental with a substantial savings.

Anybody unable to pay their current mortgage at 3% is also unlikely to find any rental they can remotely afford.

Nobody is vacating their home this time unless physically removed.

Posted on 5/9/24 at 12:48 pm to Areddishfish

quote:

Nationally, 2.7% of homes carried loan balances at least 25% more than their market value in the first few months of the year.

How does it get to this? Are folks just that desperate and banks that reckless?

I mean, I have a big arse mortgage and I didn't bring very much to closing, but almost 3 years and I've got a solid 10% equity.

If I was underwater 25% I would literally not be able to sleep. The stress would shorten my life.

Posted on 5/9/24 at 12:50 pm to Ace Midnight

There was a serious run for homes in the last few years because people assumed location was flexible due to Covid. Now that the dust has settled, places like Nashville Austin etc don’t seem to have as much demand as they thought.

Combined with more development caused house prices to sink

Combined with more development caused house prices to sink

Posted on 5/9/24 at 12:56 pm to Areddishfish

3.5% rate and I owe $110,000 less than market value right now

Posted on 5/9/24 at 1:21 pm to Bard

quote:You said "these statistics would quickly increase" if we went into a recession. The stats in question pertain to LTVs. How would LTVs increase if house prices didn't go down?

No, nor did I say that a recession necessarily means lower house prices.

In this instance, it may but it's going to depend on how things play out. If the consumer debt bubble pops, if Unemployment goes too high for too long, etc.

Posted on 5/9/24 at 1:22 pm to Dire Wolf

quote:

Highest seriously underwater share in Louisiana

Well when some the housing stock sits at or below sea level. It easy to be underwater.

Posted on 5/9/24 at 1:34 pm to fareplay

quote:

There was a serious run for homes in the last few years because people assumed location was flexible due to Covid. Now that the dust has settled, places like Nashville Austin etc don’t seem to have as much demand as they thought.

People had been moving to Austin and Nashville in mass well prior to covid. I can't speak for Nashville but Austin has been building like crazy.

Austin had a ton of new high rises completed in the last few years which has helped ease the market

We didn't build enough housing after 08. Housing cost had been rising pretty steadily for all of the last decade. Between that and the interest rates dropping is why housing went crazy in 2020.

This post was edited on 5/9/24 at 1:51 pm

Posted on 5/9/24 at 2:18 pm to jcaz

quote:

Got lucky with 2.5% in 2020. My home will always be viewed as a home and not an asset. $1100/month when apartments are $1600/month. Yikes

Yep. I'm at 2.25% on a 15 year loan from.2020. My payment is less than post people are paying for 2000sq ft and I have 3x that amount of finished sq ft.

The only way I can move is to be sure I can buy/build for less than I sell for.

Posted on 5/9/24 at 2:52 pm to Areddishfish

That sucks but it shows how shitty our economy or lack of one is

Posted on 5/9/24 at 11:56 pm to USAFTiger42

quote:Must have been really shitty under 4 years ago then when the number was more than double

That sucks but it shows how shitty our economy or lack of one is

Popular

Back to top

1

1