- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Expiration of “Trump” tax cuts

Posted on 5/3/24 at 11:15 am to SulphursFinest

Posted on 5/3/24 at 11:15 am to SulphursFinest

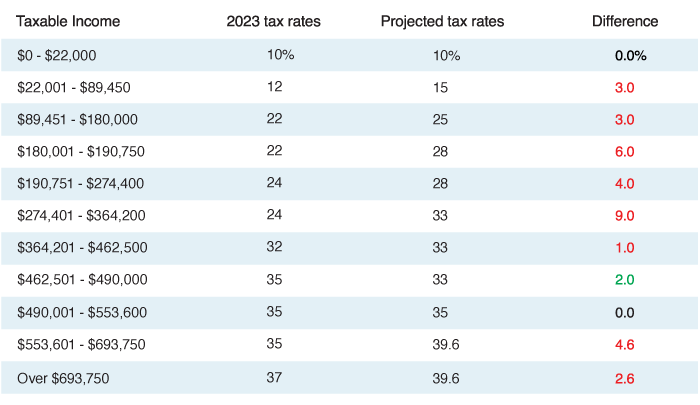

quote:Rates revert to pre-Trump tax cuts. Results in increase in taxes for everyone making $22,000 (married) or higher. I believe this is beginning 2026 so if Biden is re-elected.

Where would you pay the extra $7k. As far as I know it’s the same, and the News is feeding you misinformation

This post was edited on 5/3/24 at 11:16 am

Posted on 5/3/24 at 11:45 am to TigerTatorTots

So given this does it ever make sense to direct 100% of a company 401k into the tax deferred plan vs the Roth if it can drop you into the lower bracket?

I’ve always been of the mindset it’s better to pay today’s rates when I have an income vs some unknown future rate 10 years from now when I need to live off my saved funds.

I’ve always been of the mindset it’s better to pay today’s rates when I have an income vs some unknown future rate 10 years from now when I need to live off my saved funds.

Back to top

1

1