- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

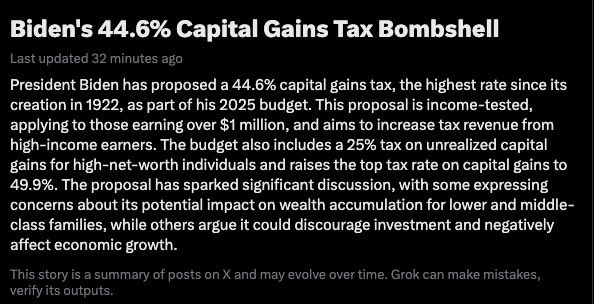

Biden proposed 44.6% Capital Gains tax, 25% tax on Unrealized Gains

Posted on 4/25/24 at 8:24 am

Posted on 4/25/24 at 8:24 am

Probably won’t pass, but this idea of taxing unrealized gains keeps coming back up from Dems, now it’s being presented in a budget from the president of the United States. WTF do these people think the economy would do if they taxed unrealized gains?

Posted on 4/25/24 at 8:39 am to RebelExpress38

Why would it not pass? Who is there to stop it?

Posted on 4/25/24 at 8:40 am to RebelExpress38

While it will never pass, It required an income over 1 million and an invest income over 400K.

That is very very small set of people. There are actually very few people who have standard income that high, and that is by design. Probably professional athletes might be one of the biggest sets of people.

Not sure how there is any discussions for lower and middle class at all.

Once again, this is in a separate proposal from his budget. So even they know it is just political posturing.

That is very very small set of people. There are actually very few people who have standard income that high, and that is by design. Probably professional athletes might be one of the biggest sets of people.

Not sure how there is any discussions for lower and middle class at all.

Once again, this is in a separate proposal from his budget. So even they know it is just political posturing.

This post was edited on 4/25/24 at 8:45 am

Posted on 4/25/24 at 8:47 am to RebelExpress38

Unrealized capital gains.

God I grow to hate this country more and more by the day. How is this even a remote possibility? What the hell have we become?

God I grow to hate this country more and more by the day. How is this even a remote possibility? What the hell have we become?

Posted on 4/25/24 at 8:48 am to RebelExpress38

They could tax us all at 100% and they'd still find a way to print more money. Screw these people. All they are are thieves, nothing more.

Posted on 4/25/24 at 8:51 am to RebelExpress38

Lazy post. Very misleading without the limits. Only applies to income over $1M. Doubt it passes,but expect a watered down version sometime soon.

Posted on 4/25/24 at 9:03 am to RebelExpress38

Can we write off unrealized losses?

Posted on 4/25/24 at 9:26 am to RebelExpress38

Won’t just the possibility of this drive a lot of selling in 2024? What am I missing? This clown president is really trying to tank the country isn’t he?

Posted on 4/25/24 at 9:39 am to RebelExpress38

Will we also be able to claim Unrealized Losses ?

I think we all know the answer to that

I think we all know the answer to that

Posted on 4/25/24 at 9:45 am to RebelExpress38

Moore vs United States will eventually settle this, but if we go off of Eisner v Macomber (which has already been used in previous Moore arguments), then gains aren't considered taxable under the 16th until they become realized. In other words, any talks of or attempts to tax unrealized gains are legally DOA.

Taking Eisner as the precedent, if the federal government actually passed a law taxing unrealized gains, once the case was decided by SCOTUS then the federal government would be on the hook for returning all of that money to the infringed tax payers.

Taking Eisner as the precedent, if the federal government actually passed a law taxing unrealized gains, once the case was decided by SCOTUS then the federal government would be on the hook for returning all of that money to the infringed tax payers.

Posted on 4/25/24 at 10:03 am to RebelExpress38

So, we will tax you at a rate of 25% on your unrealized gains, then when you take out the funds you get to pay us 44.6%?

Posted on 4/25/24 at 11:10 am to RebelExpress38

quote:

tax on Unrealized Gains

I'm not super financially literate but I just can't wrap my head around this. Someone ELI5 and help me out here.

If I buy a stock for $100 at the beginning of the year and at the end of the year it's $200, that $100 gain will be taxed even though I haven't actually seen a penny of it while it's just sitting in my brokerage account? And then what happens when I sell it?

Posted on 4/25/24 at 11:42 am to RebelExpress38

Their are certainly some rationales out there for increasing the capital gains tax in certain situations. You really can't use the "job creation" argument when a very wealthy person is getting all their capital gains from stock trading.

That individual is, to me, very different from the guy who starts his own business, employs a bunch of people he hires, and then sells the business when it's time to retire.

Taxing unrealized capital gains has got to be one of the single dumbest ideas I have ever heard of, not to mention an absolute nightmare to administer.

You can get away with it one time (such as estate taxes) because it is a snapshot.

People will say, oh, well we have mark to market election, this is no different. Mark to market is only used by basically day traders, so the reverse out from unrealized to realized when sold is quick and easy.

Trying to do this with long-term holders would be an absolute disaster.

That individual is, to me, very different from the guy who starts his own business, employs a bunch of people he hires, and then sells the business when it's time to retire.

Taxing unrealized capital gains has got to be one of the single dumbest ideas I have ever heard of, not to mention an absolute nightmare to administer.

You can get away with it one time (such as estate taxes) because it is a snapshot.

People will say, oh, well we have mark to market election, this is no different. Mark to market is only used by basically day traders, so the reverse out from unrealized to realized when sold is quick and easy.

Trying to do this with long-term holders would be an absolute disaster.

Posted on 4/25/24 at 12:35 pm to RebelExpress38

Only the dumbest of the dumb think taxing you on potential earnings is a good idea. There is no way that would ever pass. The rich that donate to congresspeople would not allow it. It would have massive economic impacts.

Posted on 4/25/24 at 2:01 pm to RebelExpress38

Taxing unrealized games has to be unconstitutional.

Posted on 4/25/24 at 2:07 pm to RebelExpress38

And they want to know why people try and hide money so they don’t have to pay taxes because of this stupid bullshite law they trying to pass

Posted on 4/25/24 at 2:22 pm to RebelExpress38

This will be beat back, but it telegraphs the Democrats true desire.... the end of private property rights. That is where wealth taxes ultimately end. The state owning everything, and allowing the populace sustenance.

Posted on 4/25/24 at 2:27 pm to RebelExpress38

They just need to tax all income as ordinary after a certain point. No reason warren buffett and mitt romney etc should have a lower tax rate than someone making $500,000 in salary.

Posted on 4/25/24 at 2:58 pm to RebelExpress38

And if there is a loss, no tax break?

Back to top

31

31